In the fast-paced world of investing, the Price to Book (P/B) index emerges as a beacon for savvy investors aiming to outpace the market in 2024. This financial ratio, often overlooked, could be the lynchpin in your investment strategy, unlocking potential in undervalued stocks. Let’s delve into why and how the P/B index can be your ace in the hole in the coming year.

The Essence of P/B Index

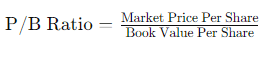

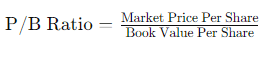

The Price to Book (P/B) index is a financial measurement used by investors to compare a company’s current market price to its book value. Essentially, it provides a ratio that helps investors evaluate whether a stock is undervalued or overvalued compared to its actual net asset value. The formula to calculate the P/B ratio

Book Value Per Share is calculated by subtracting liabilities from assets and then dividing by the number of outstanding shares. This figure represents the intrinsic, tangible value of the company on a per-share basis.

A lower P/B ratio might suggest that the company’s stock is undervalued, implying that the market price is low compared to the company’s book value. This can be a signal to investors that the stock is potentially a good buy, as they are paying less for more asset value.

Conversely, a higher P/B ratio could indicate that the stock is overvalued, meaning the market price is high in relation to the company’s book value. Stocks with high P/B ratios are often associated with investor expectations of high growth rates in the future or they possess significant intangible assets (like brand reputation or patents) not fully captured in the book value.

The P/B index is particularly useful for comparing companies within the same industry, as different sectors can have widely varying typical P/B ratios. For instance, technology companies might consistently exhibit higher P/B ratios due to their growth potential and intangible assets, whereas manufacturing or utility companies might have lower P/B ratios, reflecting their asset-intensive nature and stable, but slower growth expectations.

Investors use the P/B index as part of a broader analysis that includes other financial ratios and metrics to make informed decisions about buying or selling stocks. It’s especially favored for value investing, where the goal is to find companies trading for less than their intrinsic value.

Navigating Through 2024 with P/B Index

Navigating the financial markets in 2024 with the Price to Book (P/B) index involves strategic use of this metric to uncover investment opportunities and manage risks effectively. As the investment landscape evolves, the P/B index remains a crucial tool for investors aiming to identify undervalued stocks with strong fundamentals in a volatile market. Here’s how to make the most of the P/B index in 2024:

Identifying Hidden Gems

In a year characterized by market fluctuations, the P/B index helps investors find companies priced below their intrinsic value but with solid financial health. A lower P/B ratio suggests that a stock may be undervalued, providing a buying opportunity. Investors can use this to their advantage, especially in sectors that are temporarily out of favor but have strong long-term prospects. By focusing on these “hidden gems,” investors can position themselves for substantial gains when the market corrects its undervaluations.

Mitigating Risks in Volatile Times

The P/B index can also serve as a risk management tool. Investing in companies with lower P/B ratios can offer a margin of safety during economic downturns or market corrections. These stocks are often less susceptible to large declines since their market prices are already close to or below their book values. Thus, they can provide a relatively stable foundation for an investment portfolio in uncertain times.

Diversifying Across Sectors

Different industries exhibit varying average P/B ratios due to inherent differences in their business models and asset intensity. In 2024, savvy investors will look beyond the traditional sectors and explore opportunities in industries with historically higher P/B ratios, such as technology and healthcare, for growth potential, and in sectors like utilities and real estate for stability. Understanding these sector-specific nuances allows for strategic portfolio diversification, balancing growth and value investments based on the P/B index.

Forward-Looking Investment Decisions

While the P/B index is rooted in historical financial data, forward-looking investors also consider how future developments might affect a company’s book value and market perception. Factors such as technological advancements, regulatory changes, and economic shifts can significantly impact different sectors. By anticipating these changes, investors can make more informed decisions, selecting companies whose P/B ratios may not fully reflect their future growth potential or resilience.

Continuous Learning and Adaptation

Finally, successful navigation through 2024 with the P/B index requires continuous learning and adaptation. The financial markets are dynamic, and what works today may not work tomorrow. Staying informed about market trends, economic indicators, and company-specific developments is essential. Investors should also be ready to adjust their strategies as new information becomes available and as their investment goals evolve.

By leveraging the P/B index effectively, investors can uncover valuable investment opportunities, mitigate risks, and achieve a well-balanced, resilient portfolio in 2024. It’s about being strategic, informed, and adaptable in an ever-changing market landscape.

FAQs on P/B Index

- What Does a Low P/B Ratio Indicate? A low P/B ratio can suggest that a company is undervalued relative to its book value, potentially offering a good buying opportunity.

- Is a High P/B Ratio Always Bad? Not necessarily. A high P/B ratio might indicate expected growth or intangible assets not reflected in the book value. Context is key.

- How Can the P/B Index Influence My Investment Strategy in 2024? Incorporating the P/B index into your analysis can help you identify undervalued stocks with solid fundamentals, diversify your portfolio, and mitigate risk.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA

– Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 10% off: THANGEA10

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex