The Essential Guide to Understanding the Dead Cat Bounce

In the realm of financial trading, few terms capture the imagination quite like the “Dead Cat Bounce.” This peculiar phrase denotes a specific market phenomenon that every trader, especially those in the Forex market, should be well-versed in. The understanding of this concept not only enriches one’s trading lexicon but also sharpens market analysis skills, aiding in the navigation of the often volatile trading waters.

What Exactly Is a Dead Cat Bounce?

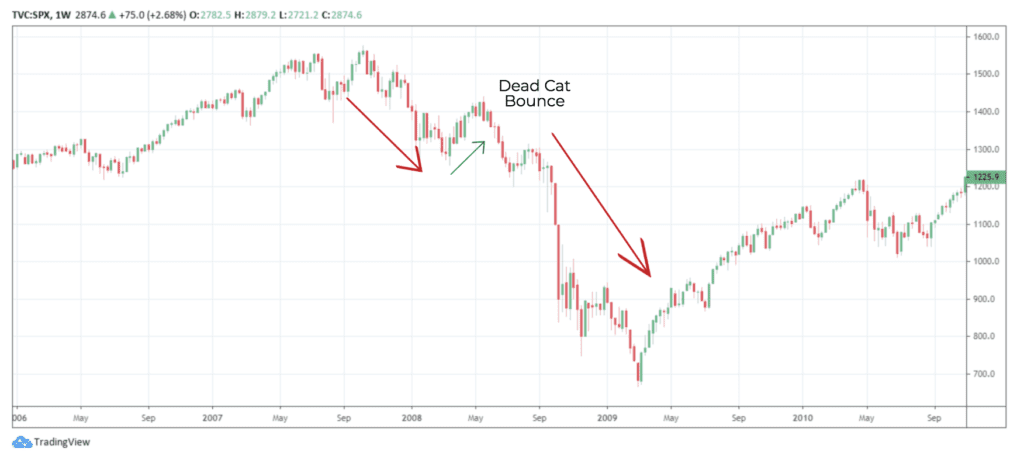

At its core, the Dead Cat Bounce refers to a temporary recovery in the price of an asset, following a substantial fall. This recovery, however, is short-lived and is usually followed by a continuation of the downward trend. The term is metaphorically drawn from the idea that even a dead cat will bounce if it falls from a great height, suggesting that a small recovery doesn’t necessarily mean the asset is no longer in trouble.

Significance for Forex Traders

Forex traders, in particular, need to be adept at identifying a Dead Cat Bounce for several reasons. Firstly, it helps in distinguishing between a genuine market recovery and a temporary price correction. This differentiation is crucial for making informed trading decisions, especially in a market known for its liquidity and volatility. Secondly, understanding this phenomenon assists traders in risk management, preventing them from making premature, potentially loss-inducing trades based on incorrect assumptions of market recovery.

Strategies to Identify a Dead Cat Bounce

Identifying a Dead Cat Bounce requires keen observation and analysis. Here are some strategies that can help:

- Technical Analysis: Utilize charts and indicators to analyze price movements and patterns. Look for declining trends followed by a short-lived upward correction.

- Volume Analysis: Often, a true recovery is accompanied by high trading volumes, while a Dead Cat Bounce may occur on relatively lower volumes.

- News and Events: Stay informed about global events and news that could impact market prices. Sometimes, a Dead Cat Bounce can result from reactive trading to short-term news, without changing the fundamental downward trend.

Navigating the Bounce: Tips for Traders

- Stay Patient: Avoid making hasty decisions based on small recoveries. Analyze the broader market context before concluding a trend reversal.

- Risk Management: Implement stop-loss orders and manage your leverage wisely to mitigate losses if the bounce turns out to be temporary.

- Continuous Learning: The Forex market is dynamic. Keep educating yourself on market patterns, technical analysis, and economic indicators that influence currency values.

Spotting the Bounce: Strategies for Forex Traders

For Forex traders, identifying a Dead Cat Bounce amid the market’s volatility is a skill that, when mastered, can significantly enhance decision-making processes and risk management strategies. This temporary rebound in prices, following a sharp decline, presents both a challenge and an opportunity. Recognizing it requires a blend of technical analysis, keen market observation, and an understanding of underlying economic factors.

1. Employ Technical Analysis

Technical analysis is a trader’s first line of defense in identifying a Dead Cat Bounce. This involves studying chart patterns, price movements, and various indicators to gauge the market’s direction.

- Moving Averages: These can help smooth out price data over a specific period and identify the trend direction. A Dead Cat Bounce may occur below key moving averages, indicating that the bounce is temporary within a longer-term downtrend.

- Momentum Indicators: Tools like the Relative Strength Index (RSI) or the Stochastic Oscillator can signal whether an asset is overbought or oversold. A Dead Cat Bounce might coincide with a short-term move away from oversold conditions without breaking into overbought territory, suggesting the bounce lacks strength.

2. Volume Analysis

Volume plays a crucial role in validating the movements observed on the charts. A genuine recovery often comes with an increase in trading volume, as more participants re-enter the market, convinced of the asset’s upward trajectory. In contrast, a Dead Cat Bounce might occur on low volume, indicating a lack of conviction behind the price increase.

3. Economic Indicators and News

Forex markets are particularly sensitive to economic news and geopolitical events. Traders should:

- Monitor Economic Calendars: Be aware of scheduled releases of economic indicators, such as GDP, employment data, and inflation rates. These can have a substantial impact on currency values.

- Stay Informed on Geopolitical Events: Political instability, trade negotiations, and other geopolitical events can cause market volatility. Understanding the context behind a price movement helps distinguish between a temporary bounce and a sustainable trend reversal.

4. Sentiment Analysis

Sentiment analysis involves gauging the mood of the market participants. This can be done through:

- Market Sentiment Indicators: Tools like the Commitment of Traders (COT) report can provide insight into how different types of traders are positioned in the market.

- Social Media and News Sentiment: Increasingly, traders use algorithms to analyze sentiments expressed in news articles and social media platforms to gauge market mood.

5. Patience and Discipline

Perhaps the most crucial strategy is patience. Waiting for additional confirmation before making a trade can save a trader from jumping in too early on what appears to be a reversal but is, in fact, a Dead Cat Bounce.

FAQs: Your Questions Answered

- What Is a Dead Cat Bounce? A temporary recovery in prices after a significant fall, suggesting mistakenly that a downtrend has reversed.

- Why Is It Important for Forex Traders? It aids in distinguishing false recovery signals from genuine market reversals, crucial for strategic decision-making.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA

– Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 10% off: THANGEA10

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex