What is SL – TP ?Navigating the world of trading involves not only understanding market movements but also mastering the tools that safeguard your investments and lock in profits. Two such critical tools are Stop Loss (SL) and Take Profit (TP). They are essential in risk management and ensuring that traders do not have to constantly monitor their positions. This article will delve into what SL – TP is and how to use it effectively to enhance your trading strategy.

1. Understanding SL – TP

What is SL – TP? SL stands for Stop Loss, and TP stands for Take Profit. Both are orders that traders set on their trading platforms to automatically close an open position at a specific price level, thus securing profits or limiting losses.

- Stop Loss (SL): This is a preset order to sell a security when it reaches a certain price. It is designed to limit an investor’s loss on a trading position. Setting a stop loss is crucial because it helps you prevent emotional decision-making and excessive losses.

- Take Profit (TP): This is a type of limit order that specifies the exact price at which to close out an open position for a profit. When the security reaches the take profit price, the trade is closed automatically, securing your profit.

2. The Importance of SL – TP in Trading

The primary goal of SL – TP is to provide a safety net during trading. They help in managing risks and securing profits without the need to constantly watch the market. Benefits include:

- Risk Management: SL helps in managing the risk by capping potential losses to a level that you are comfortable with.

- Profit Realization: TP enables traders to lock in profits at their target levels without succumbing to greed.

- Emotional Balance: By setting SL and TP, traders can remove the emotional aspect of trading decisions, making their strategy more systematic and less prone to impulsive decisions.

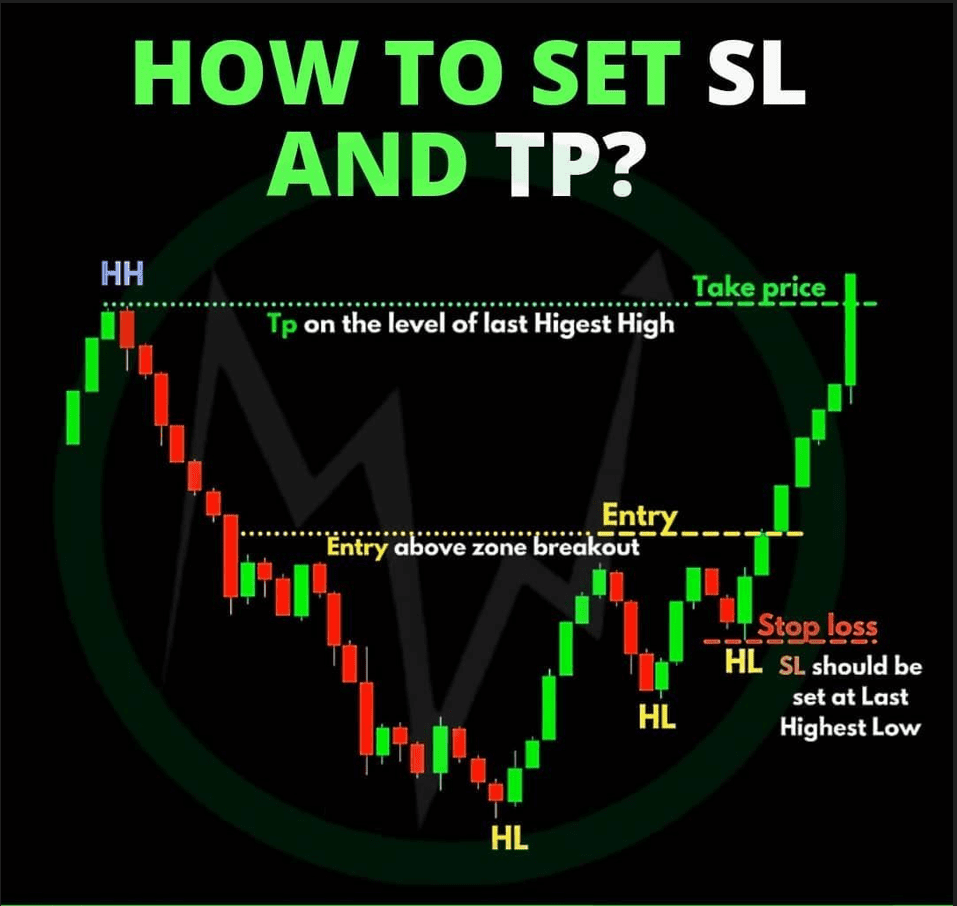

3. How to Set SL – TP Effectively

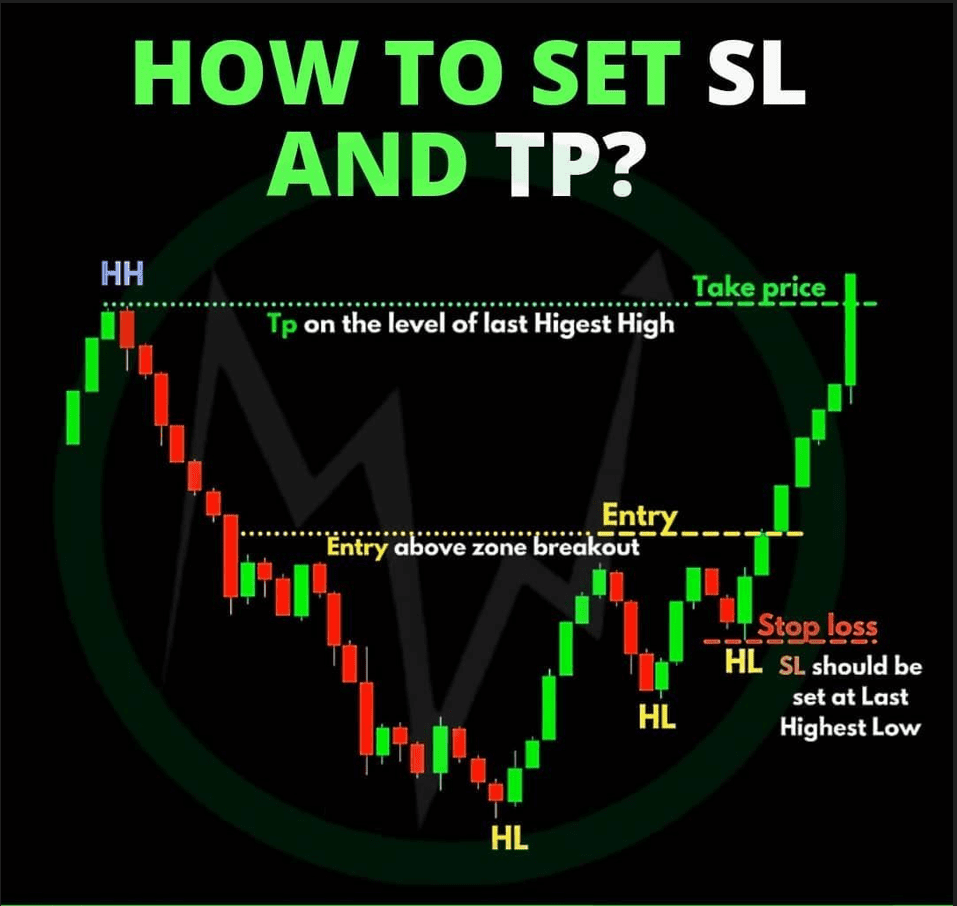

Setting SL and TP effectively requires understanding market behavior and your risk tolerance. Here’s how to approach it:

- Determine Your Risk-Reward Ratio: Before entering a trade, decide how much you are willing to risk in proportion to how much you aim to gain. Common ratios include 1:2 or 1:3.

- Analyze Market Conditions: Consider factors such as volatility, major news events, or economic releases that might impact the currency pair or stock you are trading.

- Use Technical Analysis: Use support and resistance levels, moving averages, or technical indicators to identify strategic levels for setting your SL and TP.

- Consider the Trend: If you’re trading in the direction of the trend, you might set a wider TP. Conversely, if you’re against the trend, it might be wise to have a tighter TP.

4. Tips for Using SL – TP in Different Market Conditions

- In a Highly Volatile Market: Consider setting a wider SL to avoid being stopped out by normal price fluctuations. However, be mindful of your risk tolerance.

- In a Steady Trending Market: You might set your TP further away from the entry price and trail your stop loss behind to capture more profits as the trend progresses.

- In a Range-Bound Market: Set your TP and SL within the range. Buy near the support level and set a TP near the resistance level, with a SL just below the support level.

5. Common Mistakes to Avoid

- Setting Too Tight SL – TP: This can lead to getting stopped out too early or missing profit opportunities.

- Ignoring SL – TP: Not using SL – TP can lead to significant losses or profits turning into losses.

- Emotionally Modifying SL – TP: Stick to your initial analysis unless there’s a valid, analytical reason to adjust.

6. Conclusion

Understanding and effectively implementing SL and TP can significantly enhance your trading strategy, providing a balance between risk management and profit maximization. While they are not a guarantee against losses, they offer a structured approach to closing positions, either to prevent larger losses or to secure profits. Remember, a successful trading strategy involves not only predicting market movements but also managing your risks and knowing when to exit. Master the art of using SL – TP, and you’re on your way to becoming a more disciplined and potentially more profitable trader.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA – Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 5% off: THANGEA5

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex