In the world of trading, understanding market movements is crucial for strategizing and making informed decisions. A common phenomenon every trader encounters is the “pullback.” This article delves into what a pullback is, its significance, and how traders can utilize this knowledge to master their trades.

Understanding Pullback in Trading

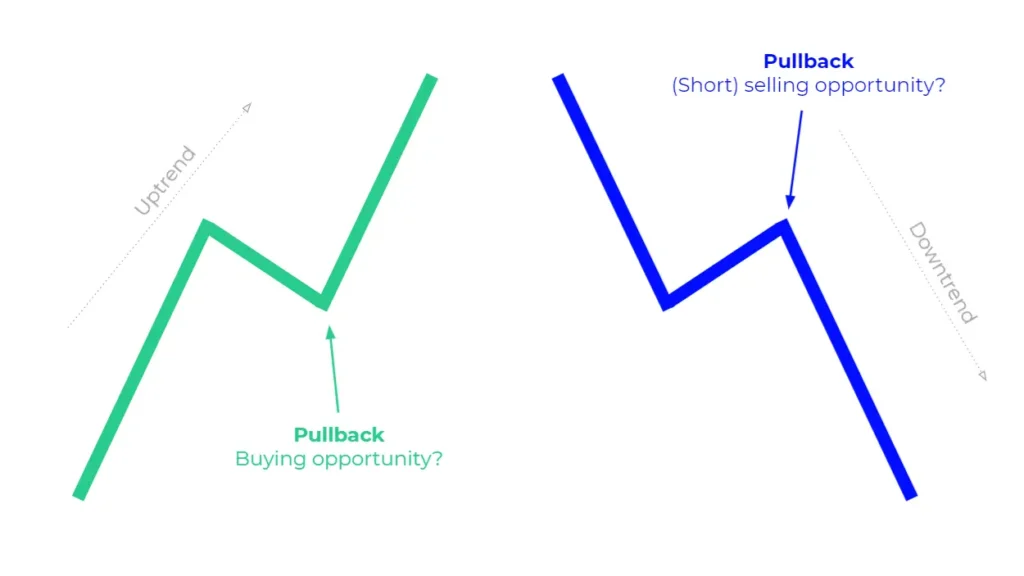

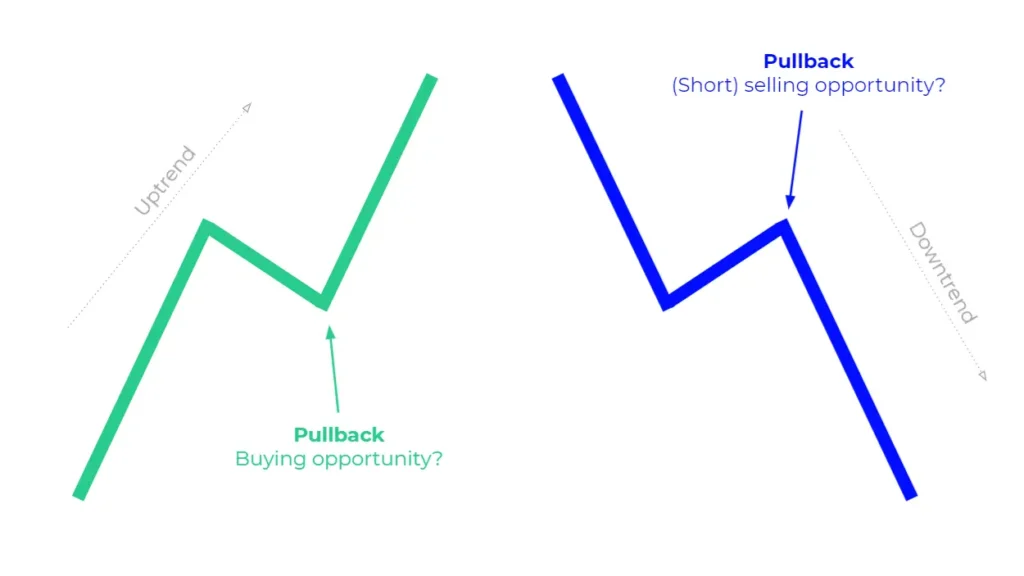

A pullback is a temporary reversal of the prevailing trend in the price of an asset. This movement is seen as a brief dip or decline in the price during an uptrend or a slight increase in price during a downtrend. Recognizing pullbacks is essential for traders looking to enter or exit the market at optimal times.

Why Pullback Happen

Pullbacks occur due to a variety of reasons, including profit-taking, market consolidation, or minor reactions to news events. Understanding the cause of a pullback can provide traders with insights into market sentiment and potential future movements.

Identifying Pullback

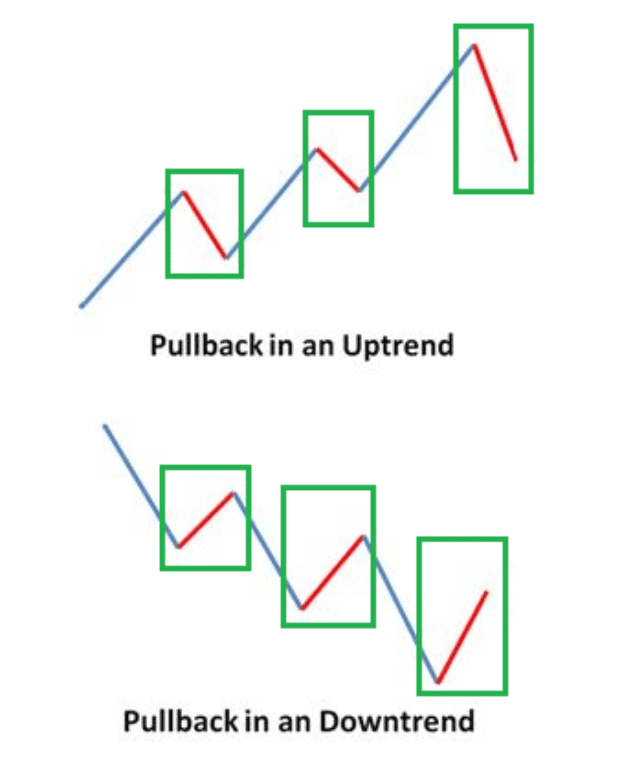

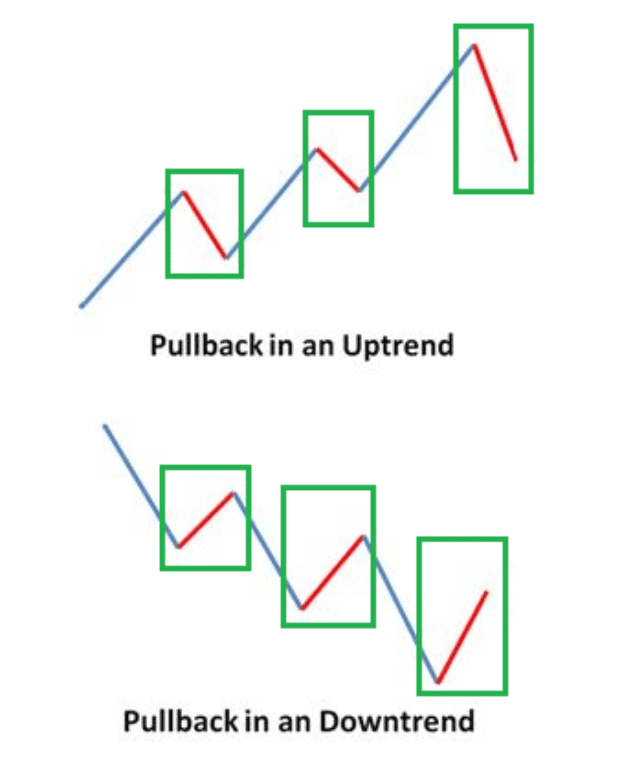

Identifying pullbacks in the financial markets is a crucial skill for traders looking to capitalize on short-term price movements within a larger trend. A pullback, essentially a temporary reversal of the prevailing trend, offers an opportunity to enter the market at a more favorable price before the trend resumes. Here’s how to recognize pullbacks and differentiate them from larger trend reversals.

Understanding the Nature of Pullback

Pullbacks occur in both uptrends and downtrends and are characterized by their temporary nature. In an uptrend, a pullback represents a slight decline in prices, whereas, in a downtrend, it’s seen as a minor price increase. These movements are typically driven by traders taking profits, resulting in a brief shift in supply and demand dynamics.

Key Indicators for Identifying Pullback

- Moving Averages: A common method to spot pullbacks is through moving averages. A price dropping towards a moving average in an uptrend but not breaking below it can indicate a pullback. Similarly, in a downtrend, a price bump towards the moving average without crossing above may suggest a temporary rise.

- Trend Lines: Drawing trend lines along swing highs and lows can help identify potential pullback points. A price that returns to a trend line and bounces off it likely indicates a pullback.

- Volume Analysis: Volume plays a critical role in confirming pullbacks. Typically, pullbacks occur on lower volume compared to the volume seen during the trend movements. A significant drop in volume during the price retracement suggests a lack of strong opposition to the main trend, thus signaling a pullback.

- Fibonacci Retracements: This tool is used to identify potential support or resistance levels during pullbacks. Traders often look for pullbacks to the 38.2%, 50%, or 61.8% Fibonacci levels as potential entry points within a prevailing trend.

- Candlestick Patterns: Certain candlestick patterns can indicate the end of a pullback and the resumption of the main trend. For example, bullish patterns during a pullback in an uptrend or bearish patterns during a pullback in a downtrend can signal entry opportunities.

Differentiating Pullbacks from Trend Reversals

The key challenge in trading pullbacks is distinguishing them from actual trend reversals. Here are a few tips:

- Duration and Depth: Pullbacks are generally short-lived and shallow compared to reversals. If the price movement goes too far against the main trend, it might no longer be a pullback.

- Trend Strength Indicators: Using indicators like the Average Directional Index (ADI) can help assess the strength of the trend. A weakening trend might suggest a higher risk of reversal rather than a simple pullback.

- Market Context: Consider the broader market context and news that might affect the asset. Significant events can lead to trend reversals.

Strategies for Trading Pullbacks

Traders can employ several strategies to take advantage including buying on the dip in an uptrend or selling on a rise during a downtrend. Setting stop-loss orders and identifying potential support and resistance levels can help manage risk and maximize returns.

FAQs

- How do I differentiate between a pullback and a trend reversal?

- A pullback is usually short-term and followed by a return to the original trend, while a trend reversal indicates a significant change in market direction.

- Are pullbacks predictable?

- While pullbacks can be anticipated by analyzing market trends and indicators, predicting their exact timing and magnitude is challenging.

- Can pullbacks occur in any market?

- Yes, pullbacks can occur in any financial market, including stocks, forex, commodities, and cryptocurrencies.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA

– Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 10% off: THANGEA10

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex