In today’s fast-paced financial world, understanding the Weighted Average Cost of Capital (WACC) is crucial for investors aiming to make informed decisions.isn’t just a metric; it’s a compass that guides investment strategies, offering insights into the true cost of financing projects.

What Is WACC?

Weighted Average Cost of Capital, is a critical financial metric used by companies and investors to estimate the average cost a company pays for its capital. Capital, in this context, includes both debt (loans, bonds) and equity (stocks). WACC provides a comprehensive view by weighting the cost of each type of capital by its proportion in the company’s capital structure.

Here’s why WACC is important:

- Investment Decisions: Companies use WACC as a hurdle rate to evaluate the profitability of potential projects. If the expected return on an investment is higher , the project is likely to add value to the company.

- Valuation: Analysts use WACC in discounted cash flow (DCF) analyses to determine the present value of a company’s future cash flows. A lower WACC indicates that a company can fund its operations at a lower cost, potentially increasing its value.

- Financial Strategy: Understanding WACC helps companies optimize their capital structure by balancing the cost and benefits of debt and equity financing. This balance is crucial for minimizing the cost of capital while maximizing financial performance and shareholder value.

Calculating WACC involves several steps:

- Cost of Equity (E/V x Re): This is the return that investors expect on their investment in the company’s equity. It can be estimated using models like the Capital Asset Pricing Model (CAPM).

- Cost of Debt (D/V x Rd) x (1-Tc): This is the effective rate that the company pays on its debt, adjusted for the tax deductibility of interest expenses.

- Capital Structure Weights (E/V and D/V): These are the proportions of equity and debt in the company’s capital structure, based on market values.

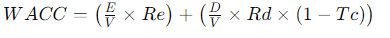

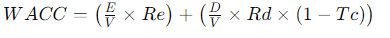

The formula for WACC is:

- E = Market value of the company’s equity

- D = Market value of the company’s debt

- V = Total market value of the company’s financing (Equity + Debt)

- Re = Cost of equity

- Rd = Cost of debt

- Tc = Corporate tax rate

By calculating WACC, businesses and investors can make more informed decisions regarding investments, financing, and valuation, leading to more strategic financial planning and growth.

The Strategic Role of WACC in Investment Decisions

The Weighted Average Cost of Capital serves as a pivotal tool in the realm of investment decision-making, functioning as a benchmark that helps both corporate managers and investors understand the minimum acceptable return on an investment. Its strategic role is multifaceted, influencing various aspects of financial management and investment strategy. Here’s a closer look at the strategic significance of WACC in investment decisions:

Guiding Investment Choices

WACC is crucial for assessing the viability of potential projects or investments. By comparing the expected return on investment (ROI) against, decision-makers can gauge whether an investment is likely to generate sufficient returns to justify the risks and costs associated with using capital. Projects with returns exceeding the WACC can potentially add value to the company, making them favorable choices.

Capital Budgeting

In capital budgeting, WACC is used as the discount rate to evaluate the present value of future cash flows from a project. This process, often conducted through discounted cash flow (DCF) analysis, helps determine whether the net present value (NPV) of an investment is positive. A positive NPV indicates that the project is expected to generate returns above the cost of capital, marking it as a financially sound decision.

Optimizing Capital Structure

WACC provides insights into how different financing options (debt vs. equity) affect the company’s overall cost of capital. By understanding how various capital structures impact WACC, companies can strategically balance debt and equity to minimize their WACC. A lower WACC not only reduces the hurdle rate for investment but also can lead to a higher valuation of the company, as it indicates a lower risk and cost of financing.

Performance Evaluation

For investors, WACC offers a baseline for evaluating a company’s performance. By analyzing how well a company generates returns in excess of its WACC, investors can assess the efficiency of its capital utilization and management’s ability to create value. Companies that consistently earn returns above their WACC are often seen as better investment opportunities.

Strategic Planning

Instrumental in strategic planning, helping companies align their investment strategies with their financial objectives. It aids in prioritizing projects, allocating resources efficiently, and making strategic decisions that align with the company’s goal of maximizing shareholder value. By keeping investments focused on opportunities that exceed, companies can ensure sustainable growth and profitability.

Mergers and Acquisitions (M&A)

In the context of M&A, WACC is used to value target companies and determine the feasibility of the acquisition. A thorough analysis of WACC helps in setting the maximum price that can be paid for a target company without diluting the acquirer’s shareholder value. It serves as a critical factor in negotiations, influencing the final decision on whether to proceed with the merger or acquisition.

Risk Assessment

Finally,plays a vital role in risk assessment. The cost components, particularly the cost of equity, are influenced by the company’s risk profile. Changes in WACC can signal shifts in the company’s risk, impacting investment decisions. A higher WACC might indicate increased operational or financial risk, prompting a more cautious approach to new investments.

In essence, the strategic role of WACC extends beyond a mere financial metric; it is a comprehensive gauge of investment attractiveness, financial health, and strategic direction. Its application in investment decision-making underscores the importance of achieving an optimal balance between risk and return, guiding companies in their quest for value creation.

FAQs

- What influences changes in WACC?

- How does WACC affect company valuation?

- Can WACC be too high or too low?

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA

– Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 10% off: THANGEA10

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex