In the complex world of business finance, EBITDA stands out as a crucial metric that often serves as the backbone of financial analysis and decision-making. But what exactly is EBITDA, and why is it considered the secret language of successful businesses? This article delves into the essence , offering insights into its significance and practical applications.

What is EBITDA ?

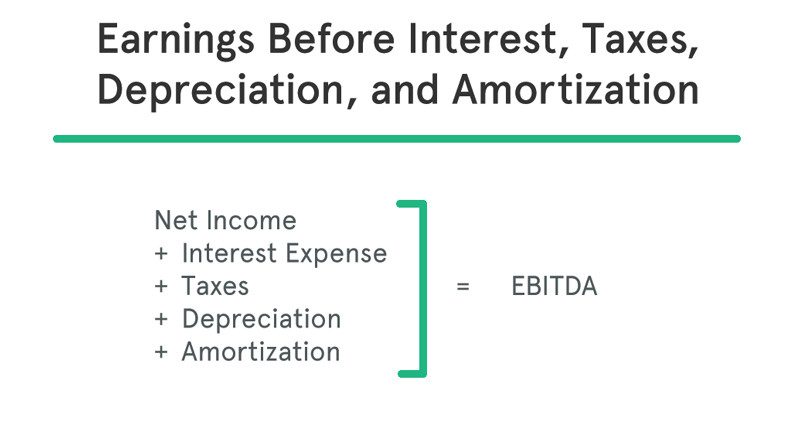

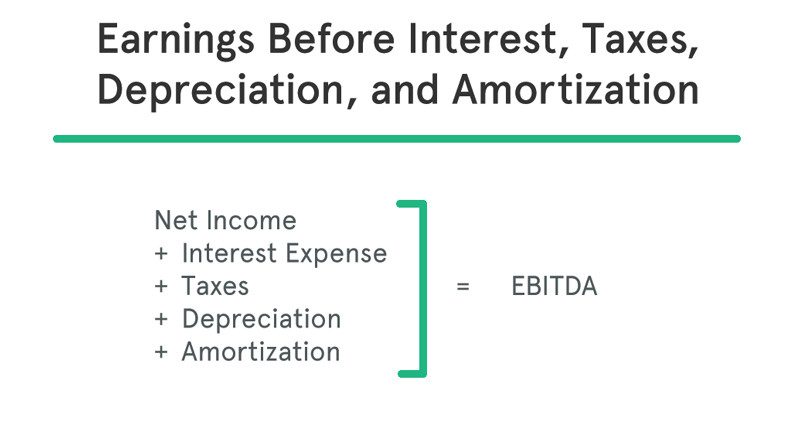

Stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a financial metric used to evaluate a company’s operating performance without the need to factor in financial decisions, accounting decisions, or tax environments. EBITDA provides a clear view of the profitability from the company’s core operations, making it a preferred measure for comparing the financial health across companies and industries.

Understanding the Components of EBITDA

- Earnings: The net profit or loss of the company.

- Interest: Costs associated with debt.

- Taxes: Corporate income taxes.

- Depreciation: The reduction in value of physical assets over time.

- Amortization: The spread of the cost of intangible assets over their useful life.

By excluding these elements, EBITDA focuses purely on the operational effectiveness of a business, offering a cleaner, albeit simplified, picture of its operational profitability.

Why EBITDA is a Key Metric for Success

often hailed as the secret language of successful businesses for several reasons:

- Comparability: It allows for an apples-to-apples comparison between companies by eliminating the effects of financing and accounting decisions.

- Investment Decisions: Investors rely on EBITDA to assess potential investments, as it provides a proxy for the company’s cash flow from operations.

- Operational Efficiency: It highlights the efficiency of a company’s core operations, serving as a benchmark for operational improvement and scalability.

Calculating

The formula to calculate EBITDA is relatively straightforward:

EBITDA=Net Income+Interest+Taxes+Depreciation+AmortizationEBITDA=Net Income+Interest+Taxes+Depreciation+Amortization

This calculation strips away the factors that can cloud the core operational performance, providing a more consistent measure of profitability and operational success.

EBITDA in Action: A Practical Example

Consider a technology startup that has invested heavily in developing its software platform. The significant upfront costs associated with software development (amortization) and the purchase of computer equipment (depreciation) can make the company appear unprofitable in its early years if judging solely by net income. However, by analyzing EBITDA, investors and stakeholders can better understand the company’s underlying operational performance and potential for future profitability.

Limitations

While EBITDA is a valuable tool, it is not without its limitations. It does not account for capital expenditures needed to maintain or expand the business, nor does it reflect changes in working capital. Consequently, it should be used in conjunction with other financial metrics for a comprehensive analysis.

FAQs

Q: Is EBITDA the same as cash flow? A: No, EBITDA is an earnings metric that excludes non-cash expenses, but it does not account for capital expenditures or changes in working capital, which are included in cash flow calculations.

Q: Why do companies use EBITDA? A: Companies use EBITDA to provide a clearer picture of their operational performance and profitability, especially when comparing themselves to peers in the same industry.

Q: Can EBITDA be manipulated? A: Like any financial metric, can be subject to manipulation through aggressive accounting practices. It’s important for analysts and investors to scrutinize the components of EBITDA calculations.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA

– Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 10% off: THANGEA10

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex