Introduction forex moving average strategy :

In the dynamic world of Forex trading, mastering effective strategies is key to unlocking profitable trades. Among the plethora of tools available to traders, the “forex moving average strategy” stands out as a fundamental and versatile technique. This comprehensive guide delves into the nuances of this strategy, helping both novice and experienced traders harness its potential for market analysis and decision-making.

Understanding the Forex Moving Average Strategy:

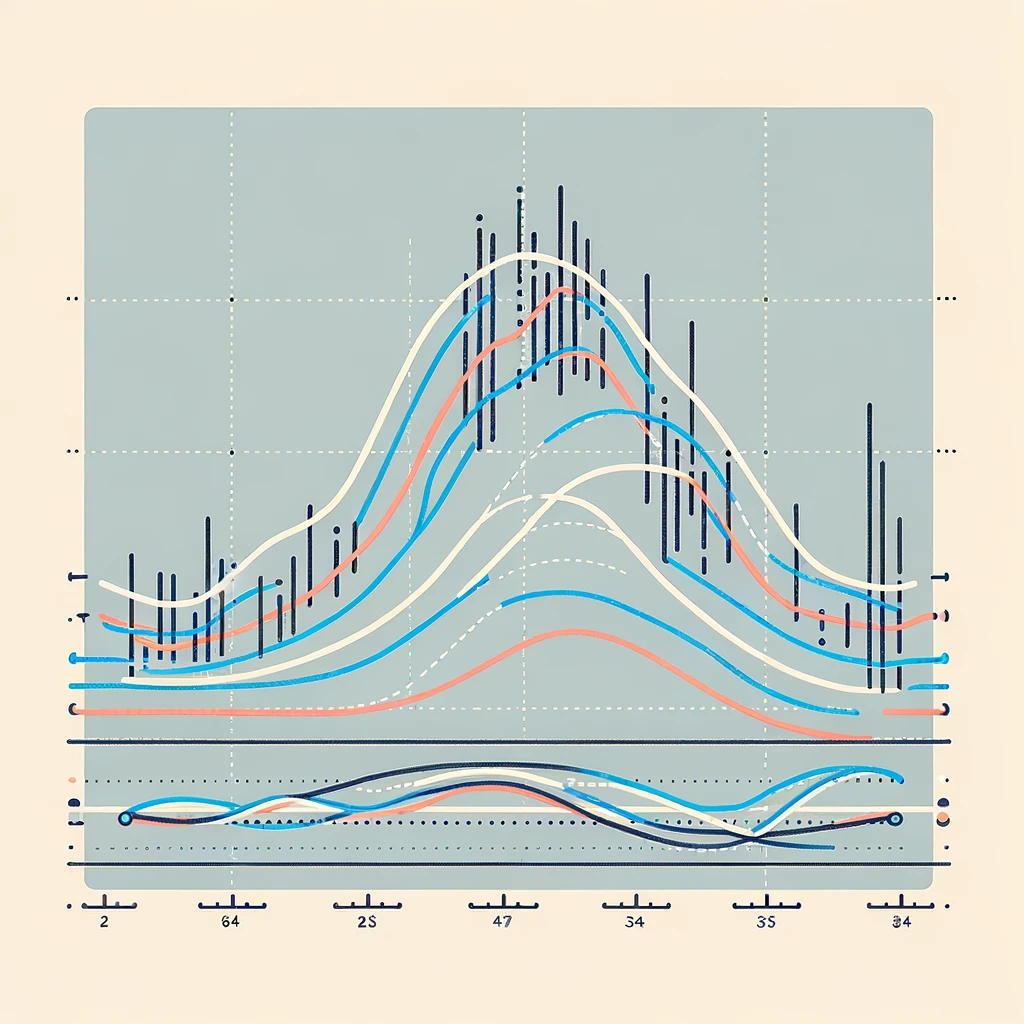

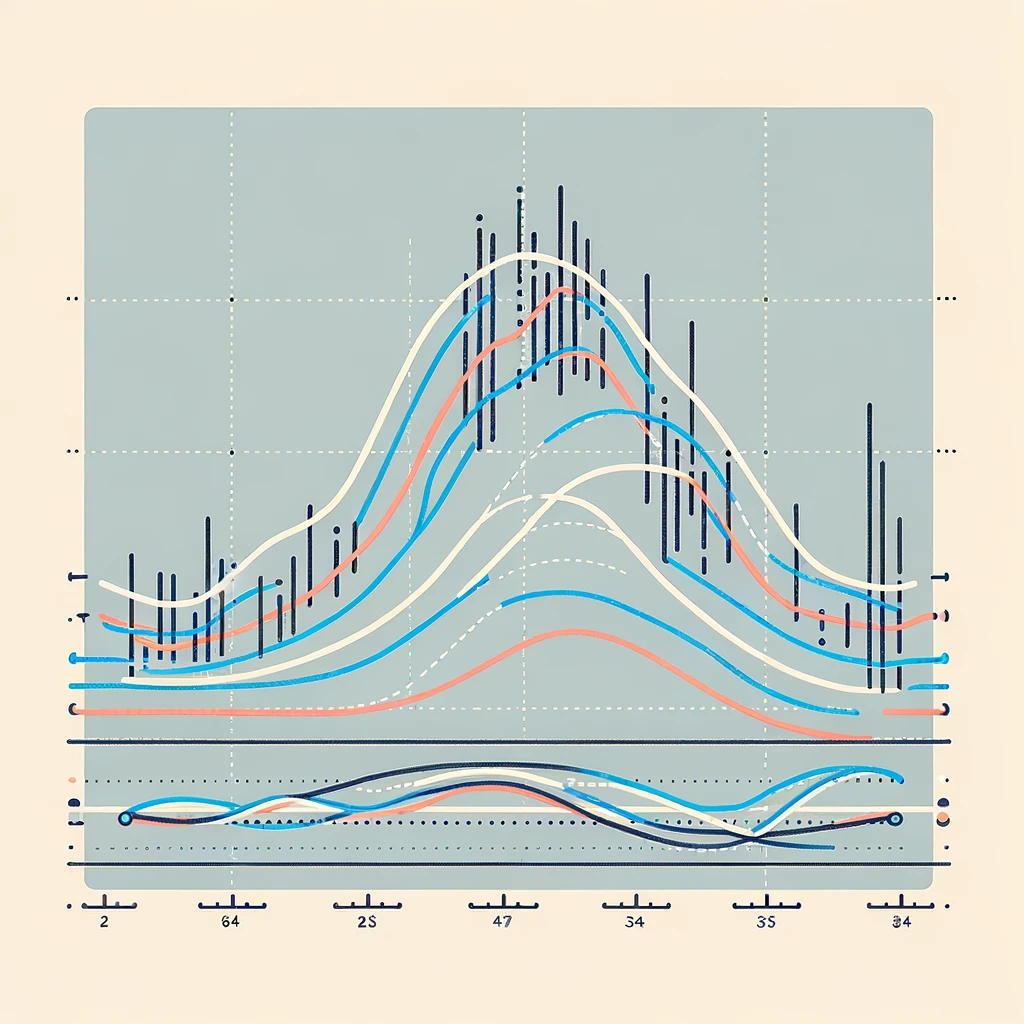

At its core, the forex moving average strategy involves plotting the average price of a currency pair over a specific period. This helps smooth out price fluctuations and provides a clearer view of the overall trend. The strategy is used not only to identify the trend direction but also to gauge momentum and potential entry and exit points.

Types of Moving Averages in Forex:

- Simple Moving Average (SMA): The SMA is calculated by taking the average price of a currency pair over a set number of periods. It’s straightforward and gives equal weight to all prices in the period.

- Exponential Moving Average (EMA): The EMA gives more weight to recent prices, making it more sensitive to new information. This can be beneficial in fast-moving markets.

Developing a Trading Strategy with Moving Averages:

The key to a successful forex moving average strategy lies in understanding how to interpret these averages:

- Trend Identification: A rising moving average indicates an uptrend, while a falling moving average suggests a downtrend.

- Trade Signals: Traders often look for the currency price to cross the moving average. A price crossing above may signal a buy, and crossing below may indicate a sell.

- Support and Resistance Levels: Moving averages can act as dynamic support and resistance levels. The price often bounces off these averages, providing trading opportunities.

Advanced Moving Average Strategies:

For those looking to enhance their trading strategies, consider the following advanced techniques:

- Moving Average Crossover: This involves using two moving averages of different lengths (e.g., a 50-period and a 200-period). A crossover of these lines can signal a potential change in trend.

- Combining with Other Indicators: Integrating moving averages with other indicators like RSI or MACD can provide more robust trading signals.

Common Pitfalls and How to Avoid Them:

While the forex moving average strategy is powerful, it’s not foolproof. Common pitfalls include:

- Overreliance on Moving Averages: Solely relying on this strategy without considering other market factors can lead to misleading signals.

- Ignoring Market Context: The effectiveness of moving averages can vary in different market conditions, such as trending versus range-bound markets.

Real-World Examples and Case Studies:

To illustrate the forex moving average strategy in action, let’s examine a few case studies:

- Case Study 1: Analysis of a major currency pair during a trending period, showcasing how moving averages provided entry and exit points.

- Case Study 2: Examination of a range-bound market where moving averages were less effective, highlighting the need for adaptive strategies.

Tools and Resources for Moving Average Trading:

Several tools can enhance your application of the forex moving average strategy:

- Charting Software: Platforms like MetaTrader or TradingView offer advanced charting tools to plot and analyze moving averages.

- Educational Resources: Books, courses, and webinars can provide deeper insights into using moving averages effectively.

Conclusion:

The forex moving average strategy is a vital tool in a trader’s arsenal. By understanding and correctly applying this strategy, traders can better navigate the complexities of the Forex market. Remember, success in trading comes from a blend of sound strategy, continuous learning, and disciplined risk management.

FAQ Section:

- Q: Is the forex moving average strategy suitable for all types of traders? A: Yes, both beginners and experienced traders can benefit from this strategy, though it should be adapted to fit individual trading styles and goals.

- Q: How do I choose the right period for a moving average? A: The choice of period depends on your trading style. Shorter periods are better for short-term trading, while longer periods are suited for long-term trend analysis.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA – Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 5% off: THANGEA5

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex