The Double Bottom Pattern is a chart formation that technical analysts and traders watch closely. This pattern signifies a potential reversal of a prevailing downtrend, hinting at a bullish market turn. Recognizing and understanding the Double Bottom Pattern can be crucial for those looking to make strategic trading decisions.

The Basics of the Double Bottom Pattern

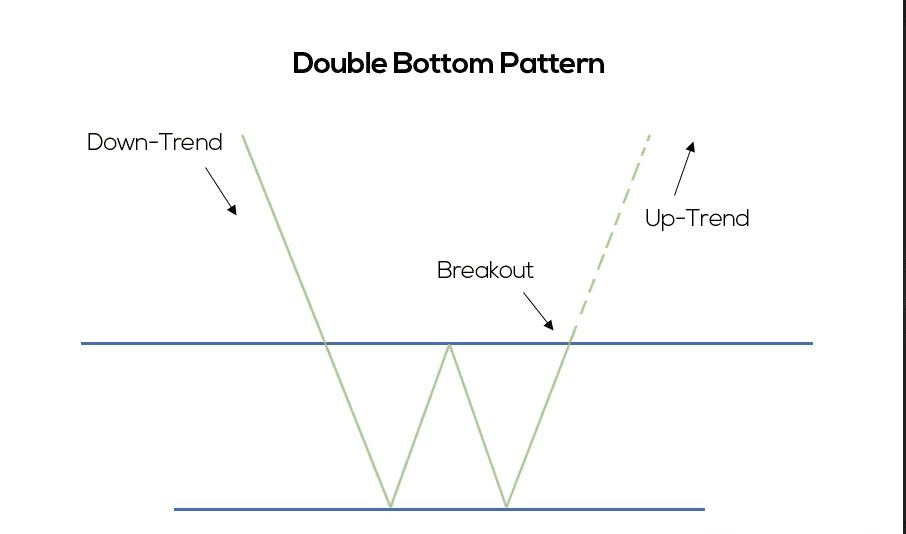

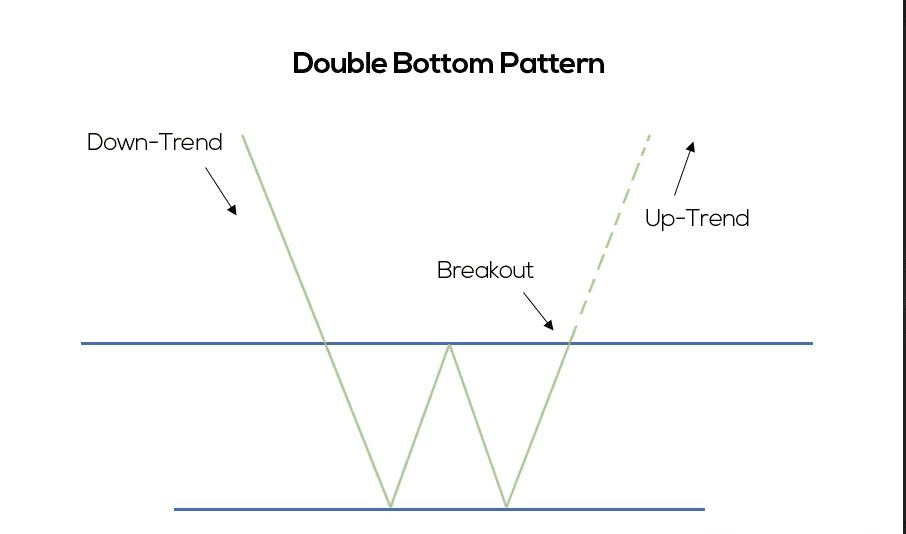

The Double Bottom Pattern emerges on a chart after a significant downtrend, forming two distinct troughs at a similar price level. These troughs are separated by a peak, creating a “W” shape. The pattern is confirmed when the price breaks above the resistance level formed by the peak between the two troughs.

Trading the Double Bottom Pattern

Once the Double Bottom Pattern is identified and confirmed, traders often consider it a signal to enter a long position. The entry point is typically as the price breaks above the resistance level, with a stop loss placed below the second trough to manage risk.

Key Considerations

When incorporating the Double Bottom Pattern into your trading strategy, several key considerations should guide your decisions to maximize effectiveness and manage risk. Understanding these aspects can help you refine your approach and potentially increase your trading success.

1. Pattern Confirmation

- Breakout Confirmation: A crucial step in trading the Double Bottom Pattern is waiting for a price breakout above the resistance level (the peak between the two troughs). This breakout is a strong signal that the downtrend has reversed.

- Volume Confirmation: Volume should increase as the price breaks above the resistance level. Higher volume during the breakout provides additional confirmation that the reversal is backed by strong buying interest.

2. Entry and Exit Strategies

- Entry Point: A common strategy is to enter a trade just after the price breaks above the resistance level. This timing aims to capitalize on the momentum of the trend reversal.

- Stop-Loss Orders: Placing stop-loss orders below the second bottom can help manage risk if the market does not move as anticipated.

- Profit Targets: Setting clear profit targets based on the pattern’s height (the distance from the resistance level to the bottoms) can help in locking in gains.

3. Risk Management

- Position Sizing: Adjust the size of your position based on the risk associated with the trade. Consider the distance to your stop-loss order to manage the potential loss size.

- Diversification: Avoid concentrating too much capital in a single trade or market. Diversification can help manage overall portfolio risk.

4. Technical and Fundamental Analysis

- Complementary Indicators: Use other technical indicators and analysis tools in conjunction with the Double Bottom Pattern for a more comprehensive market analysis. Tools like moving averages, RSI, and MACD can provide additional insights.

- Market Conditions: Be aware of overall market conditions and economic indicators that might affect the strength and reliability of the pattern.

5. Patience and Discipline

- Patience in Formation: The Double Bottom Pattern takes time to form. Exercise patience and wait for the pattern to fully develop before making trading decisions.

- Discipline: Stick to your trading plan and resist the temptation to make impulsive decisions based on short-term market movements or emotions.

6. Continuous Learning

- Review and Reflect: Regularly review your trades to identify what worked and what didn’t. Reflection can lead to improved strategies and decision-making.

- Stay Informed: The financial markets are constantly evolving. Keeping abreast of the latest market trends, news, and analysis can inform your trading decisions and strategies.

FAQs

- How reliable is the Double Bottom Pattern?

While no pattern guarantees success,is a well-regarded indicator of potential market reversals. - Can the Double Bottom Pattern appear in any timeframe?

Yes, this pattern can manifest across various timeframes, offering insights for both short-term traders and long-term investors.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA

– Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 10% off: THANGEA10

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex