In the quest for financial freedom, many turn to the stock market, seeking strategies that promise not just returns but the kind of wealth that changes lives. Among these strategies, swing trading has emerged as a beacon for traders looking to navigate the volatile seas of the market. This article delves into the essence of swing trading, illustrating its potential to unlock financial freedom for those willing to learn its rhythms and adhere to its principles.

Swing Trading: A Brief Overview

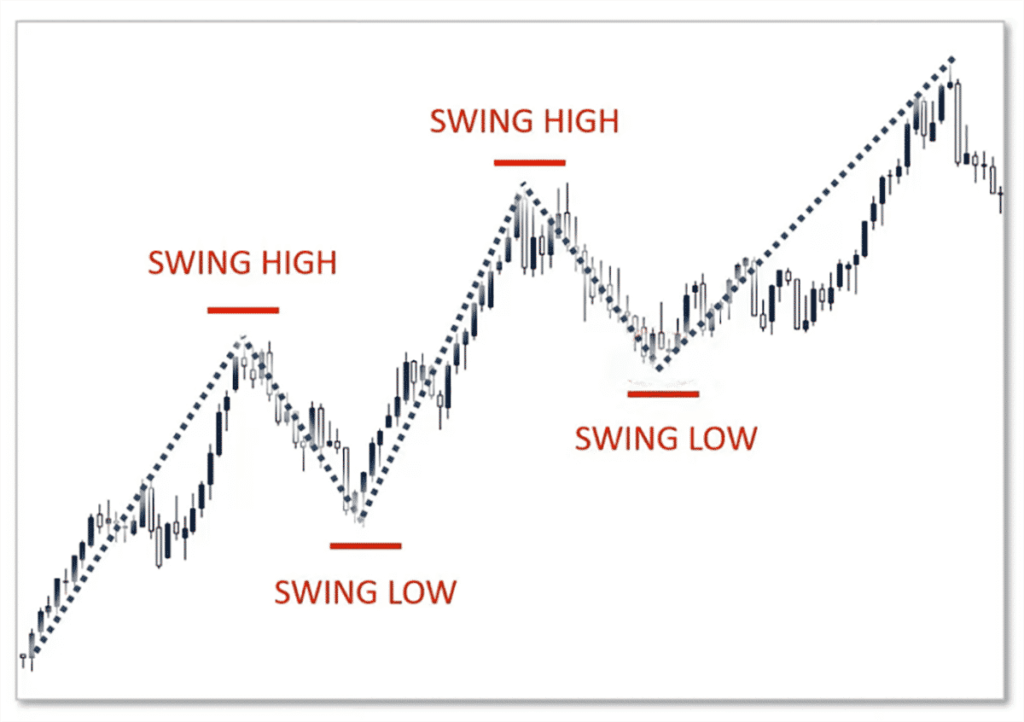

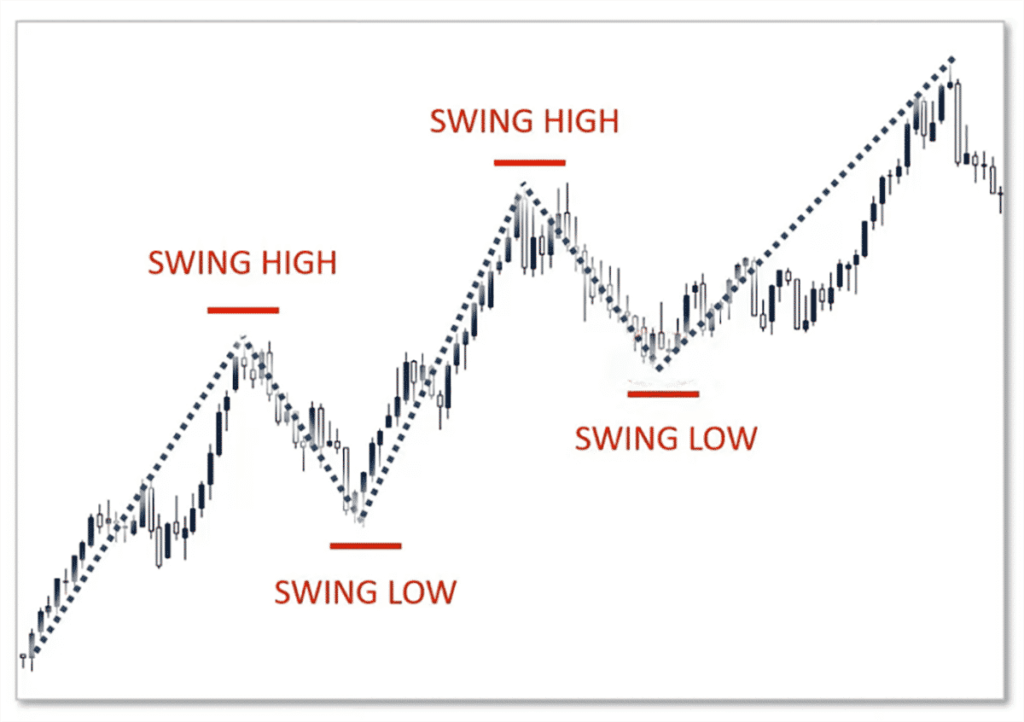

Swing trading stands out for its moderate pace, positioned between the rapid-fire trades of day traders and the long waits of buy-and-hold investors. This strategy focuses on capturing short- to medium-term gains in a stock (or any financial instrument) over a period from a few days to several weeks. Swing traders utilize a combination of technical analysis and fundamental analysis to make their trading decisions, seeking to profit from price “swings” within a relatively short timeframe.

Advantage

The core advantage of swing trading lies in its flexibility and efficiency. This strategy does not demand the constant market watch that day trading does, allowing traders to maintain a more balanced lifestyle while still actively participating in the markets. Moreover, it capitalizes on the natural ebb and flow of stock prices, targeting gains that, while smaller than those sought by long-term investors, can accumulate rapidly to substantial returns.

Key Components of a Successful Swing Trading Strategy

- Market Analysis: Successful swing traders are adept at reading market trends and signals. They rely heavily on technical analysis tools like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) to identify potential entry and exit points.

- Risk Management: Perhaps the most critical aspect of any trading strategy, effective risk management involves setting strict stop-loss orders and only allocating a small percentage of the portfolio to any single trade.

- Patience and Discipline: Swing trading requires patience to wait for the right trading opportunities and discipline to stick to the strategy, even when emotions run high.

Success Stories

Many traders have found significant success, turning modest investments into impressive portfolios. These stories often share common themes: a deep understanding of market mechanisms, a well-defined trading plan, and an unwavering commitment to risk management.

Frequently Asked Questions (FAQs)

- What makes swing trading different from day trading? Swing trading involves holding positions for several days to weeks, unlike day trading, where positions are entered and exited within the same trading day.

- How much time do I need to dedicate? While less time-consuming than day trading, swing trading still requires regular market analysis and monitoring, especially for identifying entry and exit points. A few hours per week can be sufficient for experienced traders.

- Can swing trading lead to financial freedom? Yes, with disciplined execution, adequate capital, and effective risk management, swing trading can be a pathway to building substantial wealth.

Offers a compelling blend of active engagement with the markets and the potential for significant returns. It strikes a balance, appealing to those who cannot commit to the desk-bound life of a day trader but wish to be more hands-on than the typical long-term investor. With the right approach, informed by diligent study and disciplined practice, swing trading can indeed be a key to unlocking financial freedom. This strategy, with its focus on flexibility, efficiency, and strategic acumen, represents a viable path for many seeking to enhance their financial standing and secure their economic future.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA

– Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 10% off: THANGEA10

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex