Understanding Forex Drawdown

In the realm of Forex trading, the journey of a trader is fraught with highs and lows, profits, and losses. Among these challenges, the concept of drawdown plays a pivotal role in assessing risk and managing a trading strategy effectively. This guide aims to demystify the term “drawdown” in Forex trading, offering insights into its significance, calculation, and strategies to mitigate its impact. By understanding and managing drawdowns, traders can navigate the volatile Forex markets more confidently and sustainably.

What is a Forex Drawdown?

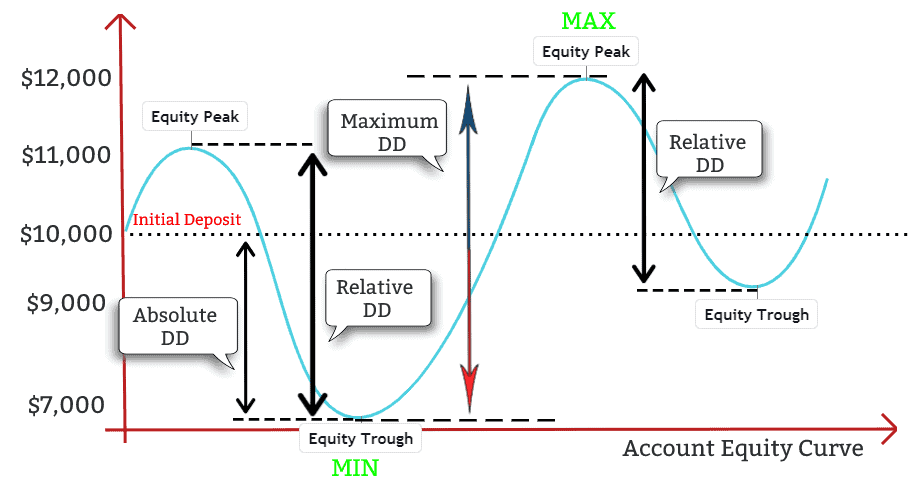

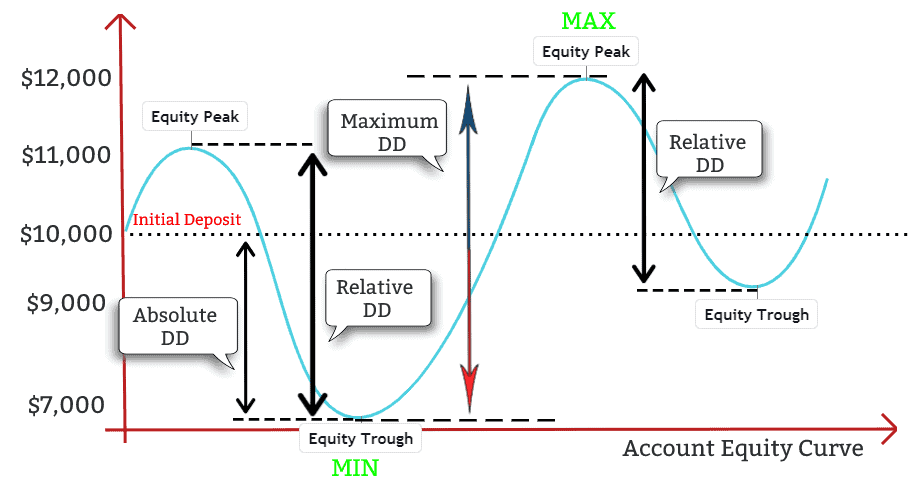

A drawdown in Forex trading refers to the reduction in your trading account balance from a peak to a trough, before a new peak is reached. It is essentially the measure of a decline from a high point in your trading balance to a low point, usually expressed as a percentage. Drawdowns are a natural part of trading; they indicate the risk involved in a trading strategy and help traders understand the volatility and potential losses that may occur over time.

Why is Drawdown Important?

Drawdown is a critical metric for traders for several reasons:

- Risk Assessment: It helps in evaluating the risk level of a trading strategy. A strategy with frequent and deep drawdowns might be considered riskier than one with fewer and shallower drawdowns.

- Strategy Evaluation: Traders can use drawdowns to assess the effectiveness of their trading strategies. High drawdowns may indicate that a strategy is too aggressive or not aligned with current market conditions.

- Emotional Resilience: Understanding potential drawdowns can prepare traders emotionally and financially for the ups and downs of trading, reducing the likelihood of rash decisions during periods of loss.

How to Calculate Drawdown

The calculation of drawdown involves three key points:

- Peak: The highest point (in terms of account balance) before a decline.

- Trough: The lowest point reached after the peak, before a new peak is achieved.

- Drawdown Percentage: The percentage difference between the peak and the trough.

The formula to calculate the drawdown percentage is:

Drawdown Percentage=(Peak−TroughPeak)×100

Strategies to Overcome Forex Drawdown

Mitigating the impact of drawdowns is crucial for long-term success in Forex trading. Here are several strategies employed by seasoned traders:

- Risk Management: Implement strict risk management rules, such as setting stop-loss orders and only risking a small percentage of your account balance on a single trade.

- Diversification: Spread your investments across different currency pairs and trading strategies to reduce the risk of a significant drawdown.

- Regular Review: Continuously monitor and review your trading strategies to ensure they are in line with current market conditions and your risk tolerance.

- Psychological Preparedness: Mental resilience is key. Accept that drawdowns are part of trading and focus on long-term goals rather than short-term losses.

- Education and Continuous Learning: The more you understand the market and your own trading strategy, the better you can adapt and minimize drawdowns.

Strategies for Overcoming Forex Drawdown

1. Risk Management

Implement Strict Risk Management Rules: The cornerstone of overcoming drawdowns is effective risk management. This includes setting stop-loss orders, only risking a small percentage of your capital per trade (typically 1-2%), and avoiding overleveraging.

Diversification: Don’t put all your eggs in one currency pair basket. Trading multiple currency pairs or diversifying into other asset classes can spread risk.

2. Psychological Resilience

Maintaining Discipline: Sticking to your trading plan, especially in the face of losses, is crucial. Emotional trading often leads to bigger drawdowns.

Psychological Preparation: Be mentally prepared for the inevitability of losses. Building psychological resilience can help you stay focused and clear-headed during drawdown periods.

3. Use of Stop-Loss Orders

Strategic Placement: Learn to place stop-loss orders effectively to minimize losses. This could be based on technical analysis or a set percentage of your trading capital.

4. Continuous Education and Backtesting

Stay Informed: The forex market is constantly evolving. Stay informed about global economic indicators, news, and trends that can affect currency movements.

Backtesting: Regularly backtest your strategies against historical data to ensure they remain effective under current market conditions.

5. Seeking Professional Advice

Mentorship: Consider seeking a mentor who has experience in forex trading. Their insights can provide valuable guidance on how to navigate drawdowns effectively.

Join Trading Communities: Being part of a trading community can provide support, share strategies, and offer advice on managing drawdowns.

Success Stories: Overcoming Drawdown

Many successful traders have faced significant drawdowns and emerged stronger. These stories often highlight the importance of resilience, adaptability, and strict adherence to risk management principles. By learning from these experiences, traders can gain insights and motivation to overcome their own drawdown periods.

FAQ

Q: How long does it take to recover from a forex drawdown?

A: The recovery time from a forex drawdown varies depending on the severity of the loss, the trader’s strategy, and market conditions. With disciplined risk management and strategy adjustment, recovery can be expedited.

Q: Can drawdown be completely avoided?

A: While it’s impossible to entirely avoid drawdowns in forex trading, effective risk management and trading discipline can significantly reduce their frequency and severity.

Q: Should I change my trading strategy during a drawdown?

A: While minor adjustments based on market analysis are normal, completely overhauling your strategy during a drawdown might not be advisable. Instead, focus on risk management and backtesting your strategy for improvements.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA

– Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 10% off: THANGEA10

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex