In the world of trading, success hinges on the ability to anticipate market movements before they happen. Among the plethora of strategies and patterns traders use to forecast these movements, one stands out for its reliability and predictive power: the Head and Shoulders pattern. This pattern, a cornerstone of technical analysis, offers traders a competitive edge by signaling potential market reversals. Understanding and applying the Head and Shoulders pattern can transform your trading strategy, providing clarity amidst the market’s inherent volatility.

Understanding the Head and Shoulders Pattern

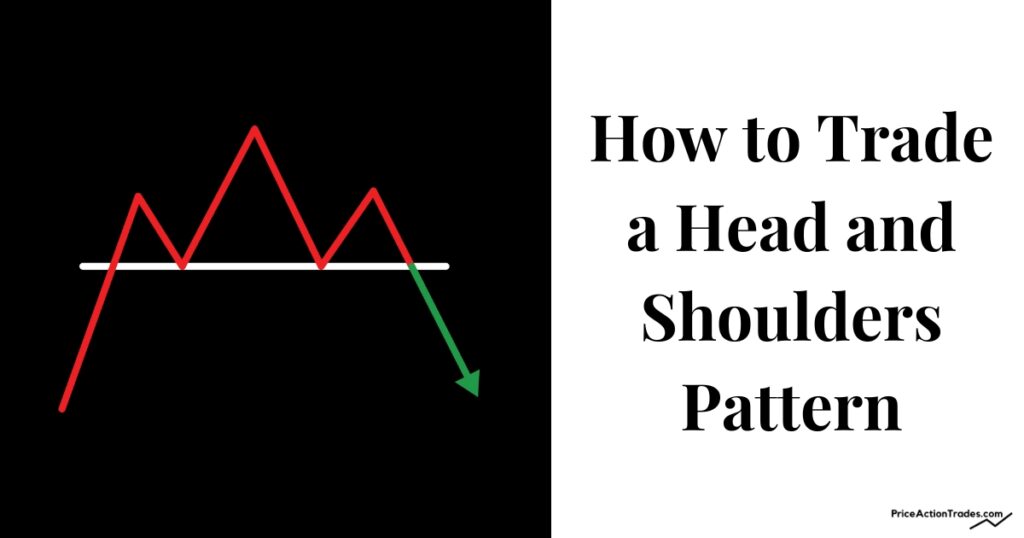

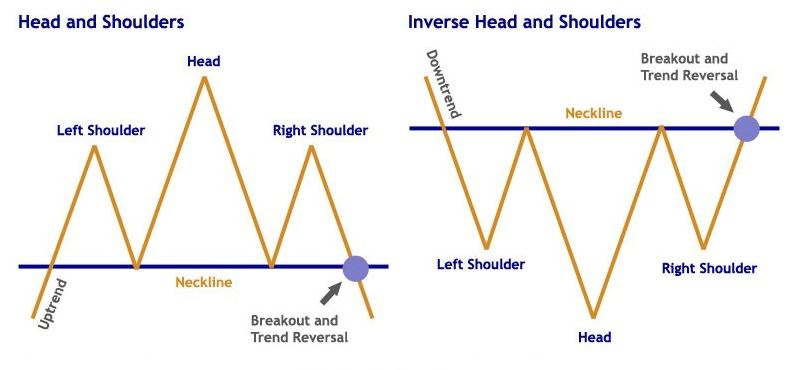

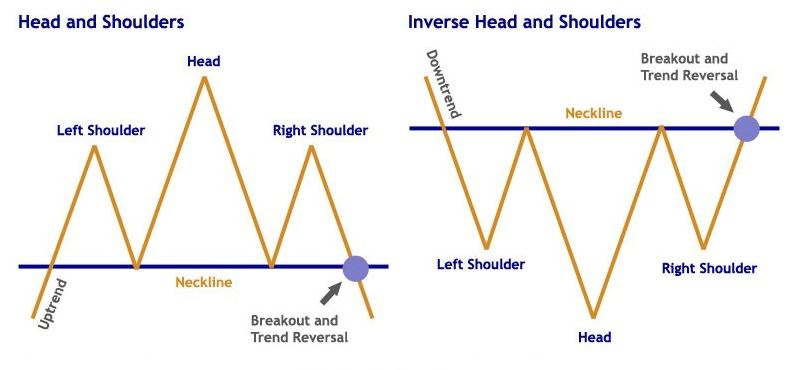

The Head and Shoulders pattern is a chart formation that predicts a bullish-to-bearish trend reversal. It is identified by three peaks: the left shoulder, the head, and the right shoulder. The left shoulder forms during an uptrend, followed by a retracement. The head is created when prices rise again but then fall back to a similar level of the first retracement. Finally, the right shoulder forms as prices rise and fall once more, mirroring the left shoulder. This pattern is completed and confirmed when the price falls below the neckline, a support line drawn through the lowest points of the two troughs.

Key Features of the Head and Shoulders Pattern

- Symmetry: The right and left shoulders should be of similar heights and widths, providing the pattern with its distinctive look.

- Volume: Typically, volume is highest on the left shoulder, decreases on the head, and is lowest on the right shoulder. This decrease in volume confirms the pattern’s validity.

- Neckline: The neckline can be horizontal or sloped and is a critical factor in confirming the pattern’s breakout direction.

Trading Strategies and Considerations

Trading effectively requires a solid understanding of various strategies and considerations that can adapt to the dynamic nature of financial markets. Here are some key trading strategies and considerations to help navigate the complexities of buying and selling assets:

1. Understand Market Trends

- Identify the trend: Use technical analysis tools like moving averages, trendlines, and price action to determine the market’s direction. Knowing whether the market is in an uptrend, downtrend, or sideways movement can guide your trading decisions.

- Follow the trend: Once a trend is identified, align your trades in the same direction. “The trend is your friend” is a common saying among traders for a good reason.

2. Use Technical Analysis

- Chart patterns: Familiarize yourself with chart patterns such as the Head and Shoulders, Double Tops and Bottoms, and Triangles. These patterns can signal potential market moves.

- Technical indicators: Indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands can help identify potential entry and exit points.

3. Manage Risk of the Head and Shoulders Pattern

- Stop-loss orders: Always use stop-loss orders to limit potential losses. Determine your risk tolerance before entering a trade and set your stop-loss accordingly.

- Position sizing: Adjust the size of your positions based on the risk level of the trade. This helps manage overall portfolio risk.

4. Psychological Discipline

- Stay disciplined: Follow your trading plan and resist the temptation to overtrade or deviate from your strategy based on emotions.

- Keep emotions in check: Fear and greed are powerful emotions that can lead to poor trading decisions. Recognize these feelings and make decisions based on logic and strategy.

5. Diversification of the Head and Shoulders Pattern

- Spread your risk: Don’t put all your capital into a single trade or market. Diversifying your trades can reduce risk and smooth out your overall performance.

6. Continuous Learning

- Stay informed: Keep up-to-date with financial news, market trends, and economic indicators that can affect your trading decisions.

- Learn from experience: Review your trades regularly to understand what worked and what didn’t. This reflection can improve your strategy over time.

7. Leverage and Margin Trading

- Understand leverage: Trading on margin allows you to control larger positions with a smaller amount of capital. However, leverage also amplifies losses, so it’s crucial to use it judiciously.

- Margin requirements: Be aware of the margin requirements for your trades and ensure you have enough capital to cover potential margin calls.

8. Paper Trading

- Practice with paper trading: Before committing real capital, practice your strategies through paper trading. This can help you gain experience without the risk of actual losses.

FAQs

- Q: How reliable is the Head and Shoulders pattern for predicting market reversals? A: While no pattern is foolproof, the Head and Shoulders pattern is considered one of the most reliable indicators for signaling reversals when confirmed by volume and a neckline breakout.

- Q: Can the Head and Shoulders pattern be found in all time frames? A: Yes, this pattern can emerge in any time frame, making it versatile for both short-term day traders and long-term investors.

- Q: Is there an inverse Head and Shoulders pattern? A: Absolutely. The Inverse Head and Shoulders pattern signals a bearish-to-bullish trend reversal, featuring a similar structure but flipped upside down.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA

– Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 10% off: THANGEA10

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex