In the volatile world of stock trading, where most investors focus on identifying stocks that will rise in value, there exists a contrarian strategy that thrives on market pessimism: short selling. This approach, often viewed as betting against the market, involves selling stocks that the trader does not own, with the expectation that their price will fall, allowing them to be bought back at a lower price. The difference between the selling price and the buyback price is the trader’s profit. “The Short Seller’s Playbook: Making Big Profits from Falling Stocks” is your guide to understanding and executing this complex strategy successfully.

Understanding Short Selling

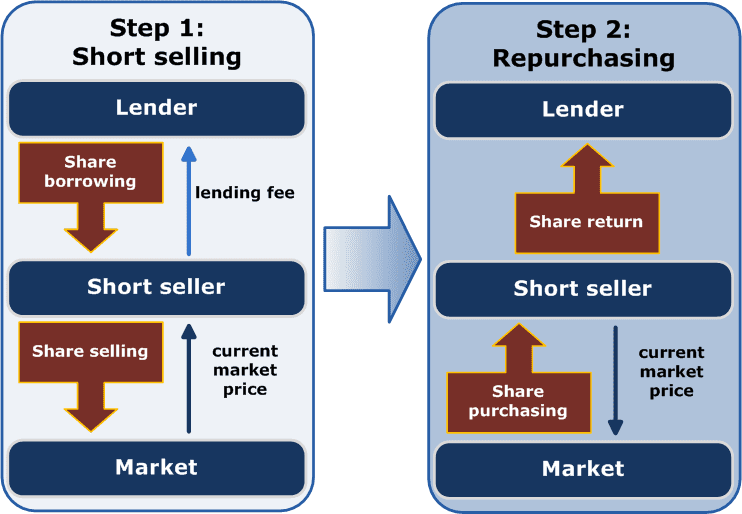

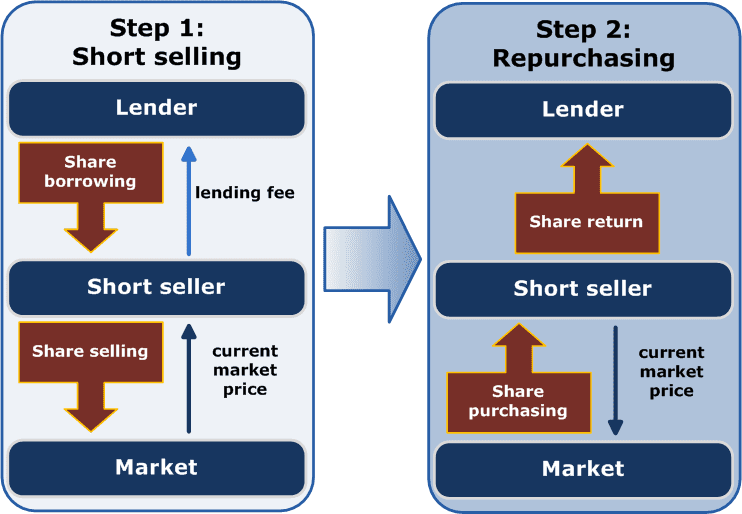

Short selling starts with borrowing shares from a broker and selling them on the open market at their current price. The short seller then aims to purchase these shares back at a lower price in the future. If successful, they return the borrowed shares to the lender, pocketing the difference minus any fees or interest charged. However, if the shares increase in value, the short seller must buy them back at a higher price, incurring a loss.

The Mechanics of Short Selling

Short selling, often seen as a sophisticated investment strategy, involves betting against a stock or security, anticipating its value will decrease over time. This approach allows investors to profit from falling stock prices, which contrasts with the traditional investment goal of buying low and selling high. Understanding the mechanics of short selling is crucial for anyone considering this strategy, as it involves several steps and inherent risks.

1. Identifying a Target

The first step in short selling is to identify a stock or security that the investor believes will decrease in value. This decision is typically based on extensive research and analysis, considering factors such as overvaluation, poor financial health, or external market conditions that could negatively impact the stock.

2. Borrowing the Stock

Once a target is identified, the investor needs to borrow the shares from a brokerage firm. This process involves the investor agreeing to return the shares at a later date. The ability to borrow shares depends on the brokerage’s policies and the availability of the stock. Some stocks are heavily shorted, making them hard to borrow.

3. Selling the Borrowed Shares

After borrowing the shares, the investor sells them on the open market at the current price. This step is executed in the same manner as selling any other stock, with the transaction occurring through a brokerage account. The proceeds from the sale are held in the investor’s account, but they do not belong to the investor since the shares must eventually be returned.

4. Waiting for the Stock to Decline

The short seller then waits for the stock price to fall, as anticipated. During this period, the market can move in any direction, and the investor closely monitors the stock’s performance and market conditions that might affect its price.

5. Buying Back the Shares

If the stock price falls as expected, the short seller buys back the same number of shares sold at the beginning of the process, but at the lower price. This action is known as covering the short position. Ideally, the cost of buying back the shares is less than the proceeds from the initial sale, resulting in a profit for the short seller.

6. Returning the Shares

Once the shares are bought back, they are returned to the brokerage or the original lender, completing the short selling cycle. The difference between the sale price and the buyback price, minus any fees or interest charged by the brokerage for borrowing the shares, constitutes the short seller’s profit or loss.

The Risks of Short Selling

While short selling can offer significant profits, especially during economic downturns or market crashes, it comes with high risks. The potential loss is theoretically unlimited, as the price of stocks can rise indefinitely. Additionally, short selling involves borrowing costs and requires precise market timing, making it a strategy more suited to experienced investors.

Strategies for Successful Short Selling

- Thorough Research and Analysis: Successful short sellers conduct extensive research to identify stocks that are overvalued or face potential downturns due to economic, sector-specific, or company-specific factors.

- Timing: Timing is critical in short selling. Recognizing when to enter and exit a position can mean the difference between profit and loss.

- Risk Management: Employing stop-loss orders and monitoring positions closely can help manage the risks associated with short selling.

The Ethical Debate Surrounding Short Selling

Short selling is often criticized for its potential to accelerate market declines. Critics argue that it can lead to excessive speculation and manipulation. However, proponents believe that short selling provides liquidity, aids in price discovery, and can act as a counterbalance to unfounded market optimism.

FAQs

Q: Can anyone engage in short selling? A: While technically anyone with a brokerage account can attempt to short sell, it is best suited for experienced investors due to its high risk and complexity.

Q: Is short selling legal? A: Yes, short selling is legal but regulated. Certain rules, such as the uptick rule in some markets, are designed to prevent market manipulation.

Q: How much money can I make from short selling? A: The profit potential from short selling is significant, especially during market downturns. However, losses can also be substantial. There is no upper limit to the potential loss, as stock prices can theoretically rise infinitely.

Q: How long can I hold a short position? A: There is no set limit on how long a short position can be held. However, interest and fees accumulate over time, and the lender can request the return of their shares.

Q: What triggers a short squeeze? A: A short squeeze occurs when a stock’s price unexpectedly rises, forcing short sellers to buy back shares to close their positions, further driving up the stock price. This can result in significant losses for short sellers.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA

– Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 10% off: THANGEA10

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex