In the vast universe of technical analysis, the morning star candle pattern shines brightly as a harbinger of potential reversals from bearish to bullish markets. This formation, revered by both forex and stock traders, serves as a guiding light, indicating that the dawn of an uptrend may be on the horizon. Understanding the morning star candle is crucial for traders aiming to navigate the turbulent waters of financial markets with more confidence and strategy.

What is a Morning Star Candle?

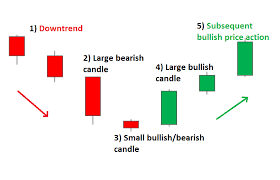

The morning star candle pattern is a three-candle formation that typically occurs at the bottom of a downtrend. It starts with a long bearish candle, followed by a small-bodied candle or a doji, which represents market indecision. The third day is marked by a long bullish candle, closing at least halfway up the body of the first day’s candle. This pattern signals a shift in momentum from sellers to buyers, suggesting that a bullish reversal is imminent.

Identifying the Morning Star in Forex and Stock Markets

Spotting a morning star pattern requires keen observation. The key lies in looking for a downtrend leading to the formation of this three-candle pattern. The contrast between the bearish sentiment of the first candle and the bullish surge of the third candle is a critical indicator of market sentiment shifting in favor of the bulls.

Strategies for Trading the Morning Star Candle

- Confirmation is Key: Traders should wait for additional confirmation before acting on a morning star pattern. This could come in the form of a higher close on the following day or other technical indicators aligning with the reversal signal.

- Setting Stop-Loss Orders: To manage risk effectively, setting a stop-loss order just below the lowest point of the morning star pattern can help protect against false signals.

- Volume Analysis: An increase in volume on the third candle of the pattern can provide further confirmation that buyers are taking control of the market.

The Psychological Underpinnings

The morning star candle pattern is more than just a formation; it’s a narrative of changing market psychology. The initial bearish candle signifies continued selling pressure. The small-bodied second candle indicates that the sellers are losing steam, and the decisive bullish candle confirms that the bulls have taken over, setting the stage for potential upward momentum.

FAQs about Morning Star Candle Pattern

- Q: Can the morning star pattern be used in all time frames?

- A: Yes, the morning star pattern can be effective in various time frames, but it may be more reliable on longer time frames such as daily or weekly charts.

- Q: Do I need to use other indicators with the morning star pattern?

- A: While the morning star pattern can be a strong signal on its own, many traders use it in conjunction with other indicators, such as moving averages or the RSI, for additional confirmation.

- Q: How often does the morning star pattern occur?

- A: The frequency of the morning star pattern depends on market conditions and the time frame being observed. It is less common than some other patterns but is highly regarded for its reliability when it does appear.

The morning star candle pattern is a potent tool in the arsenal of forex and stock traders, signaling the potential end of a downtrend and the beginning of an uptrend. By understanding and accurately identifying this pattern, traders can enhance their ability to make informed decisions, manage risk effectively, and seize opportunities in the financial markets. As with any trading strategy, success with the morning star candle pattern requires patience, discipline, and continuous learning.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA – Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 5% off: THANGEA5

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex