In the world of Forex trading, mastering the art of candlestick patterns is crucial for success. Among these patterns, the hammer candle stands out as a powerful indicator of potential market reversals. This beginner’s guide will demystify the hammer candle strategy, showing you how to leverage it for significant gains in the Forex markets.

Understanding the Hammer Candle

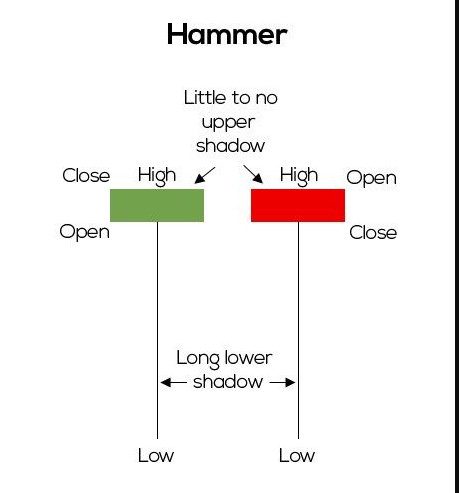

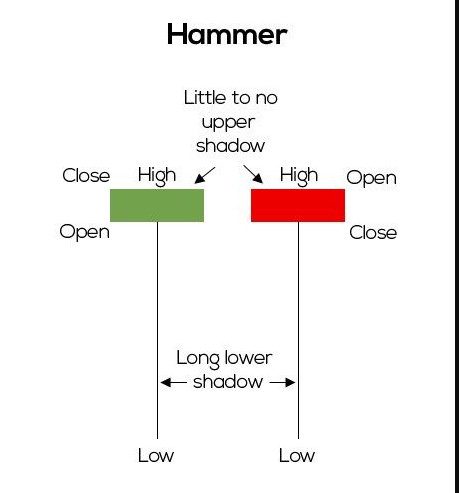

The hammer candle is a candlestick pattern that signals a reversal in the market trend. It is characterized by a small body at the top with a long lower wick and little to no upper wick. This pattern indicates that even though the market experienced selling pressure during the period, by the close, buyers were able to push the prices back up, showcasing potential strength in the market.

Why the Hammer Candle Matters in Forex Trading

- Signal of Potential Reversal: The appearance of a hammer candle after a downtrend is a bullish signal, indicating that the market could be bottoming out and ready to reverse.

- Confirmation of Market Sentiment: The long lower wick of the hammer demonstrates that there is buying interest at lower price levels, suggesting an upcoming change in market direction.

How to Trade the Hammer Candle

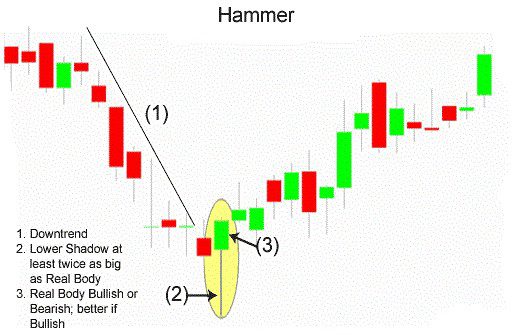

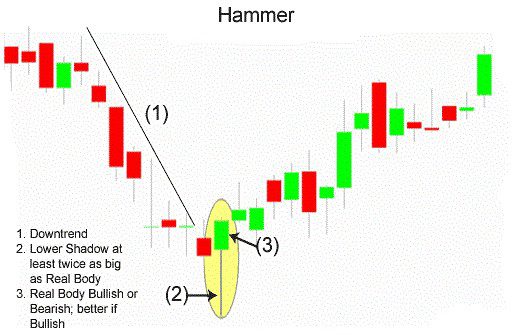

1. Identify in a Downtrend

The first step is to spot a hammer candlestick during a downtrend. The downtrend indicates that the market sentiment has been bearish, but the presence of a hammer suggests a possible exhaustion of the downtrend and the beginning of buyers stepping in.

2. Confirm

Confirmation is crucial before considering a trade based on a hammer candle. Look for confirmation in the form of the next candle closing above the hammer’s closing price. This indicates that the market is accepting higher prices and that the reversal signal given by the hammer might be valid.

3. Plan Your Entry

Once confirmation is observed, plan your entry. A common approach is to enter a long position (buy) when the price moves above the high of the hammer candlestick. This entry strategy helps ensure that you’re catching the momentum as the market starts to reverse upwards.

4. Set a Stop Loss

Setting a stop loss is essential to manage risk. A sensible place for a stop loss is below the low. This positioning protects against the possibility that the market does not reverse as anticipated and continues the downtrend instead.

5. Determine Your Exit Strategy

Having an exit strategy is as important as the entry. You can set a profit target based on key resistance levels above your entry point or use a trailing stop loss to let your profits run while still protecting gains. Another method is to exit the position if you see a bearish reversal pattern developing, indicating the potential end of the bullish momentum.

6. Use Additional Indicators for Confirmation

While the hammer candle can be a strong signal on its own, using additional technical indicators can provide further confirmation and increase the trade’s probability of success. Indicators such as moving averages, Relative Strength Index (RSI), or MACD can help confirm the change in market sentiment.

FAQs

- Q: What time frames work best with the hammer candle strategy?

- A: The hammer candle can be effective on various time frames, but it’s commonly used on daily charts for clearer signals and higher reliability.

- Q: Can the hammer candle be used in isolation?

- A: While the hammer candle is a strong indicator, it’s best used in conjunction with other technical analysis tools for confirmation.

- Q: Is the hammer candle a bullish signal in all market conditions?

- A: The hammer candle is primarily considered a bullish reversal signal when it appears after a downtrend. Its effectiveness can vary based on market conditions and should be validated by other analyses.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA – Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 5% off: THANGEA5

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex