In the world of investment, strategies that stand the test of time are as valuable as gold. Among these, the Dow Theory shines brightly, offering insights that have guided investors for over a century. This theory isn’t just historical trivia; it’s a beacon for modern investment strategies, illuminating paths through the volatile terrains of stock markets.

Unveiling the Dow Theory

The Dow Theory, developed by Charles H. Dow, co-founder of The Wall Street Journal, is a cornerstone of technical analysis. It’s based on the observation of the Dow Jones Industrial and Transportation averages, proposing that market trends can be predicted through their movements.

Core Principles of Dow Theory

The Dow Theory, an enduring cornerstone of technical market analysis, was conceived by Charles H. Dow, co-founder of The Wall Street Journal. It’s a framework that has informed investment strategies for over a century, offering insights into market trends and movements. Here are its core principles distilled into a modern context:

1. The Market Discounts Everything

This principle posits that all current prices reflect every piece of available information. Whether it’s news, economic indicators, or political events, the market’s current state is an aggregate representation of all known factors, making it the ultimate barometer of public sentiment and valuation.

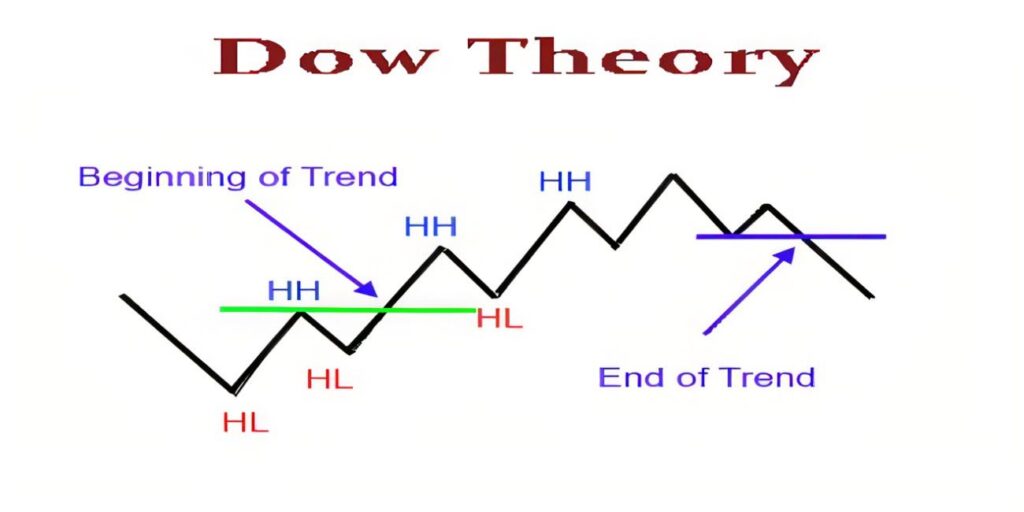

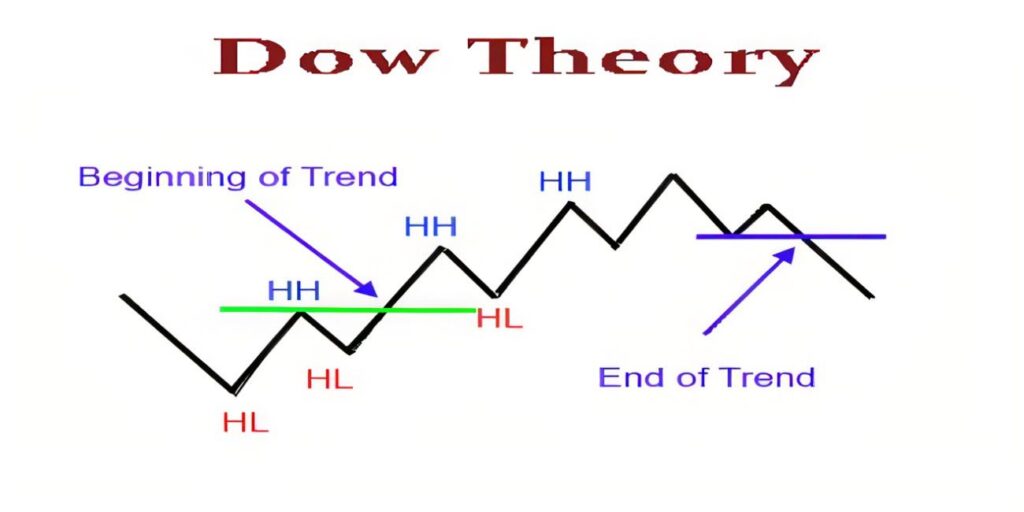

2. The Existence of Three Market Trends

Dow identified three types of trends within the market: primary, secondary, and minor. Primary trends represent the overarching direction of the market, lasting a year or more. Secondary trends are corrective movements within primary trends, lasting from a few weeks to a few months. Minor trends are short-term fluctuations, often noise within the broader market movement.

3. Primary Trends Have Three Phases

Each primary trend is composed of three phases. The accumulation phase is where knowledgeable investors start to buy or sell, anticipating the next movement. The public participation phase sees the broader market catch on, driving prices significantly. Finally, the distribution phase occurs when savvy investors begin to exit their positions, leading to the trend’s reversal.

4. Indexes Must Confirm Each Other

For a trend to be considered valid, it must be confirmed by both the Dow Jones Industrial Average and the Dow Jones Transportation Average. This principle is based on the idea that industrial companies’ production and transportation companies’ shipments should rise and fall together, reinforcing the trend’s validity.

5. Volume Confirms the Trend

Trading volume should increase in the direction of the primary trend. A rising trend accompanied by increasing volume is seen as strong and likely to continue. Conversely, if volume decreases while the price continues to rise (or fall), it might suggest the trend is weakening and could soon reverse.

6. Trends Persist Until a Clear Reversal Occurs

A trend remains in effect until definitive signals indicate its reversal. This principle underscores the importance of not prematurely predicting reversals without clear, confirming evidence. Market trends, once established, have inertia and tend to continue until significant factors compel a change

Applying Dow Theory to Modern Investing

Incorporating Dow Theory into your investment strategy can significantly enhance decision-making processes. It aids in identifying potential bullish or bearish markets, helping investors to adjust their strategies accordingly.

Advantages of Dow Theory

- Time-Tested Reliability: The Dow Theory has been relevant for over a century, proving its endurance and reliability.

- Simplicity and Applicability: Its principles are straightforward and can be applied to any market condition.

- Risk Management: By understanding market trends, investors can better manage risks associated with volatile markets.

Challenges of Dow Theory

- Subjectivity in Interpretation: The application of Dow Theory principles can be subjective, requiring experience and judgment.

- Delayed Signals: Sometimes, the theory may provide signals after a trend has begun, potentially reducing profitability.

FAQs

Q: Can Dow Theory be applied to markets other than stocks?

A: Yes, while it was originally developed for the stock market, its principles can be applied to any financial market.

Q: How does Dow Theory help in investment decision-making?

A: Dow Theory helps investors identify market trends and potential reversals, aiding in more informed decision-making.

Q: Is Dow Theory suitable for short-term traders? A: While it’s primarily used for understanding long-term market trends, short-term traders can also benefit from its insights on market movements.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA

– Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 10% off: THANGEA10

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex