In the world of trading, understanding chart patterns is crucial for success. One such pattern, the bullish megaphone pattern, stands out as a unique opportunity for traders. This article delves into how to identify and leverage this pattern for significant gains.

Understanding the Bullish Megaphone Pattern

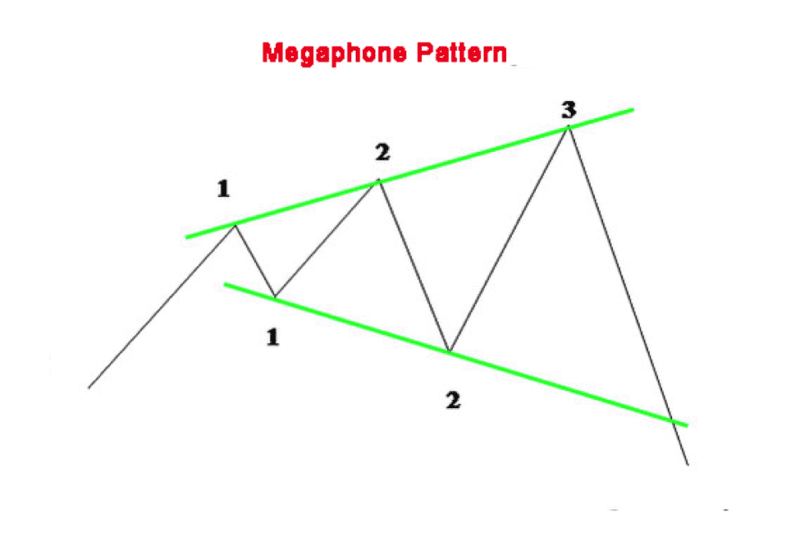

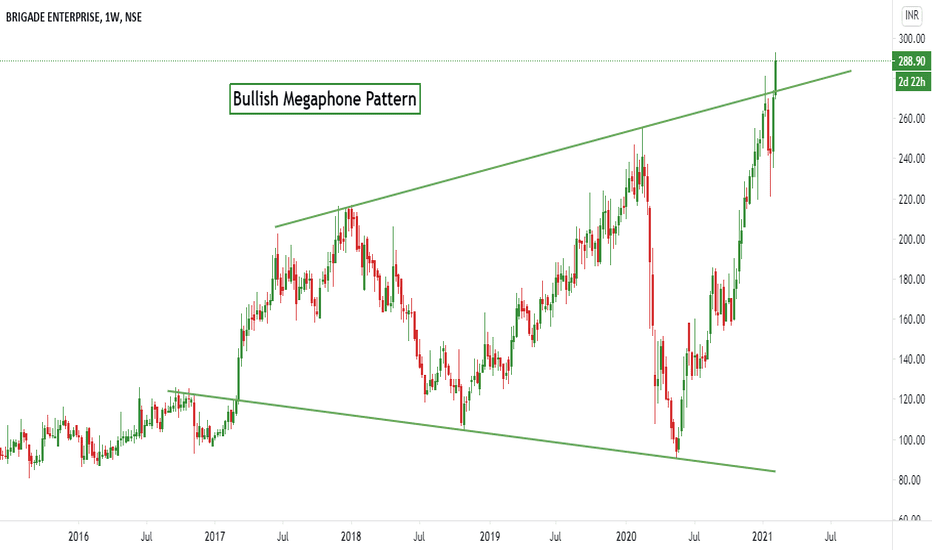

The Bullish Megaphone Pattern is a distinctive chart formation that traders and investors observe in the stock, commodities, and forex markets to predict potential price movements. It is characterized by a series of progressively higher highs and lower lows, expanding outward in a shape that resembles a megaphone, hence the name. This pattern indicates increasing volatility and can be a signal of bullish sentiment in the market, suggesting that prices may continue to rise.

Key Features of the Bullish Megaphone Pattern

- Expanding Range: Unlike most patterns that tend to narrow over time, the bullish megaphone pattern expands, showing a broadening range between support and resistance levels.

- Higher Highs and Lower Lows: The pattern is marked by a sequence of higher highs and lower lows. Each peak is higher than the previous peak, and each trough is lower than the previous trough, creating a diverging pattern on the chart.

- Volume Trends: Volume may increase as the pattern develops, reflecting growing interest and activity in the stock or asset as it makes more dramatic swings in price.

- Potential Reversal Signal: While primarily seen as a continuation pattern, indicating that an existing bullish trend is likely to continue, the bullish megaphone pattern can sometimes signal a potential reversal if it forms after a long downtrend.

How to Trade

Trading based on the bullish megaphone pattern involves several strategic steps:

- Pattern Identification: The first step is to identify the pattern early by spotting the series of expanding highs and lows on the chart.

- Confirmation: Wait for the pattern to develop fully and for the price to bounce off the pattern’s lower trendline, confirming that the pattern is in effect.

- Entry Point: Traders often consider entering a position after the price bounces off the lower trendline, anticipating a move towards the upper trendline of the pattern.

- Stop-Loss Orders: To manage risk, setting a stop-loss order just below the most recent swing low within the pattern is advisable.

- Profit Targets: The upper trendline serves as an initial profit target. Traders may look to sell their position as the price approaches this line, expecting resistance and a potential reversal or pullback.

- Monitoring Volume: Paying attention to volume can provide additional clues. An increase in volume as the price moves towards the upper trendline can reinforce the strength of the bullish signal.

Risks and Considerations

While the bullish megaphone pattern can signal significant opportunities for profit, it also comes with risks, primarily due to the increased volatility it signifies. Traders should be cautious and consider the overall market context, other technical indicators, and their risk tolerance when trading based on this pattern. It’s also important to remember that no pattern can predict market movements with absolute certainty, and using stop-loss orders can help manage potential losses.

Spotting the Pattern in the Market

Identifying a bullish megaphone pattern requires keen observation. Look for a series of expanding swing highs and lows. The key is to notice the widening nature of the pattern, which differentiates it from other formations.

Strategies for Trading

Trading this pattern effectively involves entering a position as the price bounces off the pattern’s lower trendline, aiming for profits near the upper trendline. Setting stop-loss orders below the recent swing low minimizes risk.

FAQs

- What is the bullish megaphone pattern?

The bullish megaphone pattern is a chart formation indicating potential bullish momentum due to increasing volatility. - How can I spot this pattern?

Look for a pattern of expanding swing highs and lows on the chart. - What trading strategy works best with this pattern?

Enter a trade at the bounce off the lower trendline, targeting profits near the upper trendline, with a stop-loss below the recent swing low.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA – Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 5% off: THANGEA5

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex