In the world of Forex trading, the Evening Star Candle pattern is a crucial technical analysis tool that signals a potential bearish reversal after an uptrend. Recognizing this pattern can be a game-changer for traders, providing insights into when to enter or exit trades to maximize profits and minimize losses. Here’s a detailed guide on how to spot the Evening Star Candle pattern and what it signifies.

Understanding the Evening Star Candle Pattern

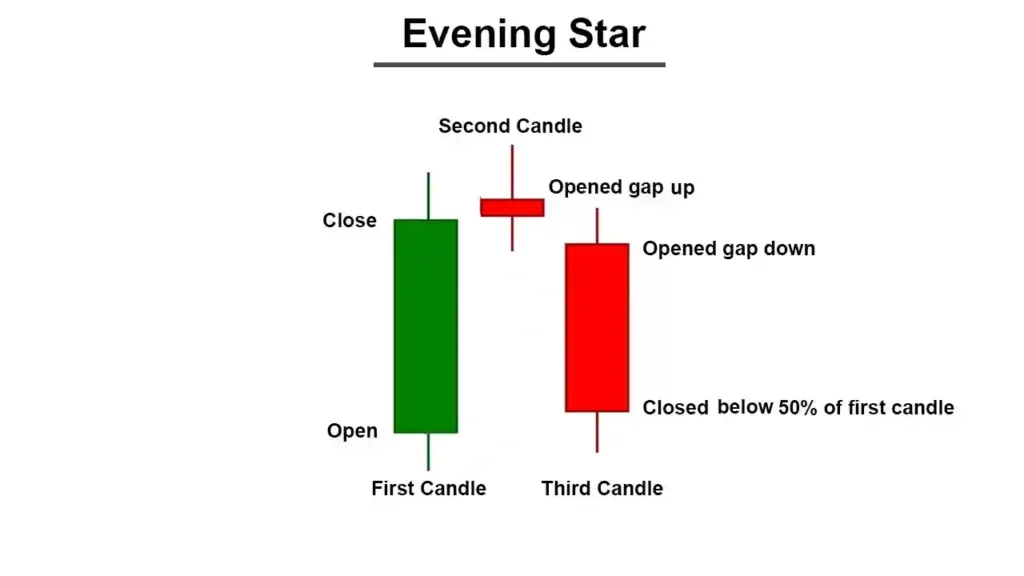

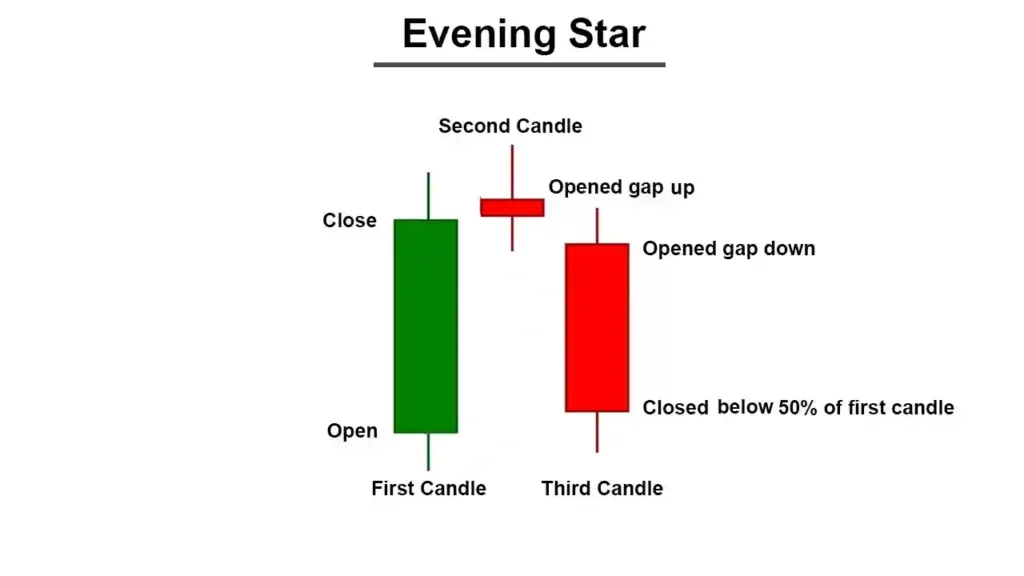

The Evening Star Candle pattern is a three-candle formation that occurs at the peak of an uptrend, heralding a shift in momentum from buyers to sellers. It is composed of:

- A large bullish candle: This first candle represents the continuation of the existing uptrend, with prices closing at highs.

- A small-bodied candle or a Doji: The second candle opens higher than the previous close but does not advance much further, indicating indecision in the market. This candle can be either bullish or bearish and is usually distinct by a gap up from the first candle.

- A large bearish candle: The third candle signifies the reversal, opening below the second candle and closing well into the body of the first candle, covering at least half of it. This indicates that sellers have taken control.

Step-by-Step Guide to Spotting the Evening Star

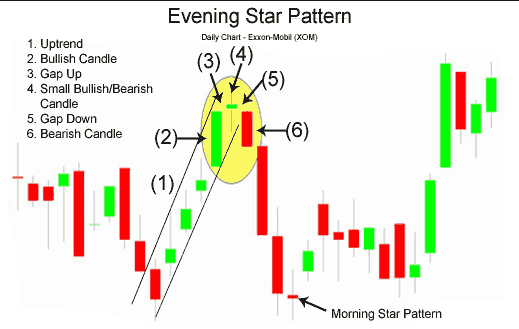

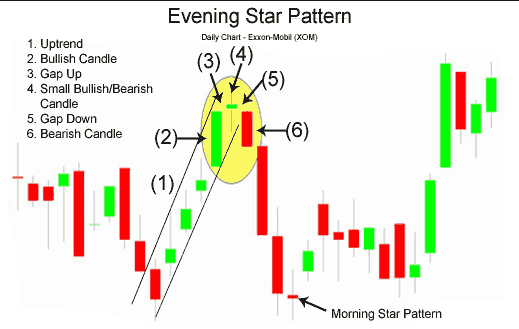

1. Identify an Uptrend: The Evening Star pattern is meaningful only when it appears after a significant uptrend. Look for a steady increase in prices over a period.

2. Watch for a Large Bullish Candle: The presence of a large bullish candle at the end of an uptrend indicates strong buying pressure but also sets the stage for potential exhaustion.

3. Spot the Small-bodied Second Candle: This candle is key to the pattern. It may gap up from the first candle, showing a continuation of buying sentiment initially, but the small body indicates a slowdown and potential change in direction.

4. Confirm with a Large Bearish Candle: The third candle should open below the second and close significantly into the first candle’s body. This is the confirmation of the bearish reversal.

5. Volume and Confirmation: While not always necessary, increased volume on the third candle can reinforce the pattern’s validity. Additionally, waiting for a few candles after the pattern to confirm the downtrend can be prudent.

Practical Tips

- Context Matters: Always consider the larger market context when spotting the Evening Star pattern. The pattern is more reliable when it confirms other bearish signals or occurs at key resistance levels.

- Use with Other Indicators: For greater accuracy, use the Evening Star pattern in conjunction with other technical indicators, such as moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence).

- Patience is Key: Avoid rushing into trades immediately after spotting the pattern. Wait for additional confirmation to reduce the risk of false signals.

1. What is an Evening Star Candle pattern in Forex trading? The Evening Star Candle pattern is a bearish reversal signal seen at the end of an uptrend. It consists of three candles: a large bullish candle, followed by a small-bodied candle or a Doji, and completed by a large bearish candle. This pattern indicates a shift from buying to selling pressure.

2. How can I identify an Evening Star Candle pattern? To identify an Evening Star pattern, look for a bullish candle in an uptrend, followed by a small-bodied candle that gaps above the previous close, showing indecision. The pattern is confirmed by a third, bearish candle that opens below the second candle and closes at least halfway down the body of the first candle.

3. Why is the Evening Star Candle pattern important? The Evening Star Candle pattern is important because it signals a potential reversal from an uptrend to a downtrend. Spotting this pattern early can help traders make informed decisions to exit long positions or consider entering short positions to capitalize on the anticipated downward movement.

4. How reliable is the Evening Star Candle pattern? While the Evening Star Candle pattern is considered a reliable indicator of a potential bearish reversal, no pattern is infallible. It’s most reliable when confirmed by other technical analysis tools or indicators, such as volume increases, or when it occurs at significant resistance levels.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA

– Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 10% off: THANGEA10

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex