In the high-stakes world of Forex trading, slippage is an often-overlooked factor that can significantly impact your trading outcomes. Understanding and mitigating the effects of slippage can be the difference between profit and loss. This article delves into strategies for outsmarting this silent profit killer.

Understanding Slippage in Forex

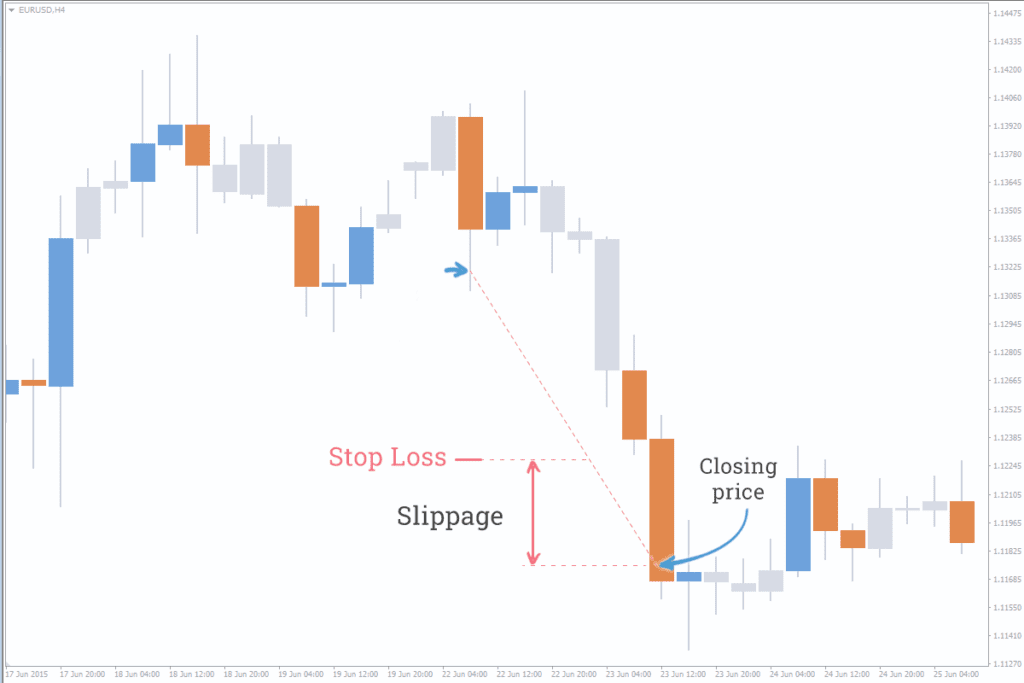

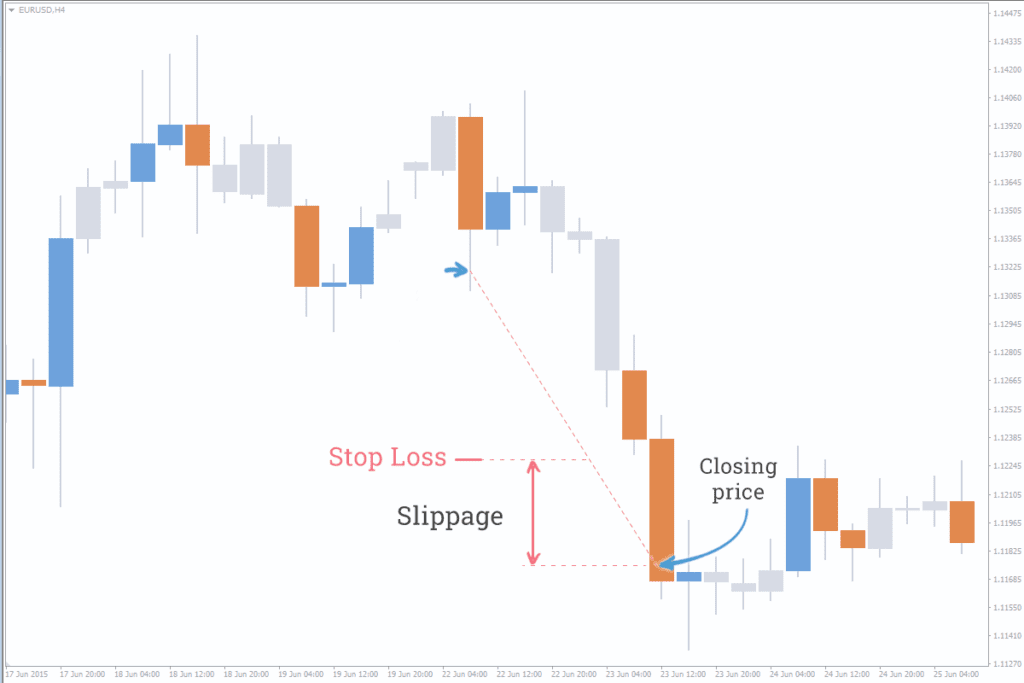

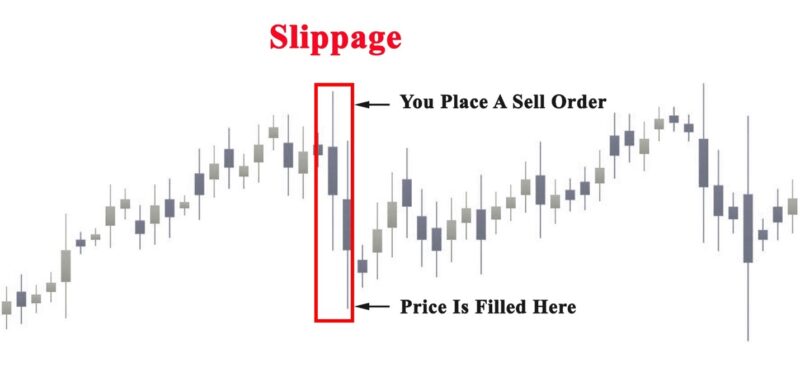

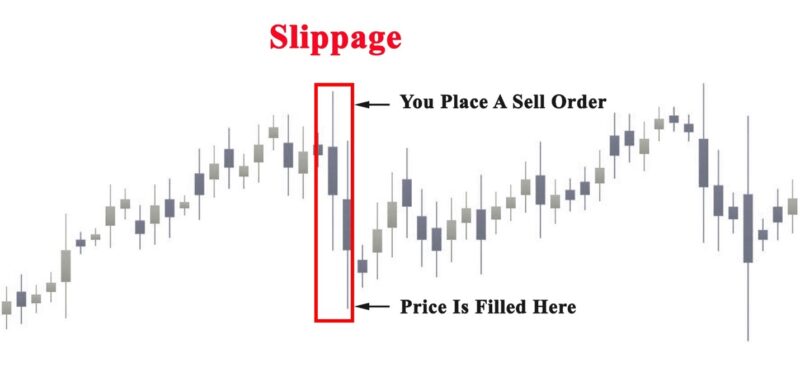

Slippage occurs when there is a difference between the expected price of a trade and the price at which the trade is executed. Market volatility and execution speed are primary contributors to slippage, making it a common occurrence in the Forex market.

The Impact of Slippage

The impact of slippage can vary. While sometimes it may work in your favor, offering a better execution price than anticipated, it often results in a higher entry price or a lower exit price than planned, eroding your profits.

Strategies to Minimize Slippage

In the fast-paced world of forex trading, slippage is an often-encountered and misunderstood phenomenon. It can either work for you or significantly against you, thus affecting your trading outcomes in a substantial way. Understanding what slippage is and implementing strategies to minimize its impact is crucial for any trader aiming for longevity and profitability in the forex market. This article delves into effective strategies to mitigate slippage, ensuring you stay ahead in your trading endeavors.

Understanding Slippage

Slippage occurs when there is a difference between the expected price of a trade and the price at which the trade is actually executed. This discrepancy can be caused by market volatility, high impact news events, or simply the time it takes for an order to be executed. While slippage can sometimes result in a better-than-expected entry price, more often than not, it negatively affects traders by increasing the cost of trades.

Strategic Order Placement

One of the primary strategies to minimize slippage is through the strategic placement of orders. Limit orders, unlike market orders, allow traders to specify the maximum price they are willing to pay for a buy order or the minimum price for a sell order. This control can significantly reduce the risk of slippage, especially in volatile markets.

Trading During Peak Hours

The forex market experiences varying levels of liquidity throughout the trading day. Trading during peak hours, when liquidity is highest, can reduce the chances of slippage. The overlap between the New York and London trading sessions is particularly known for its high liquidity and, consequently, lower slippage risk.

Avoiding High Volatility Periods

Market news and economic events can cause rapid and significant price movements, increasing the risk of slippage. By staying informed about the economic calendar and avoiding trading during major news releases, traders can minimize their exposure to slippage.

Utilizing Slippage Protection Tools

Many forex brokers offer tools and features designed to protect traders from excessive slippage. These can include guaranteed stop-loss orders, which ensure that your trade is executed at the specified price, regardless of market conditions. Familiarizing yourself with and utilizing these tools can be a game-changer in managing slippage.

Choosing the Right Broker

Not all brokers are created equal, especially when it comes to how they handle order execution and manage slippage. Researching and selecting a broker with superior execution technologies and policies on slippage can make a significant difference in your trading experience.

FAQs About Slippage in Forex

- What causes slippage in Forex trading? Market volatility and execution speed are the main causes of slippage.

- Can slippage be entirely eliminated? While it’s difficult to eliminate slippage completely, employing the right strategies can significantly reduce its impact.

- Is slippage always negative? No, slippage can sometimes result in a better execution price than expected.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA

– Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 10% off: THANGEA10

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex