In the dynamic world of foreign exchange trading, the term “pip in forex” is a cornerstone concept every trader encounters. A pip is the smallest price move in exchange rates of currency pairs in the forex market. Understanding what a pip is and how to calculate pips in forex is crucial for managing risk and strategizing your trades effectively. This comprehensive guide will delve into the concept of pip in forex, its significance, and the methodologies to calculate it accurately.

1. Understanding Pip in Forex

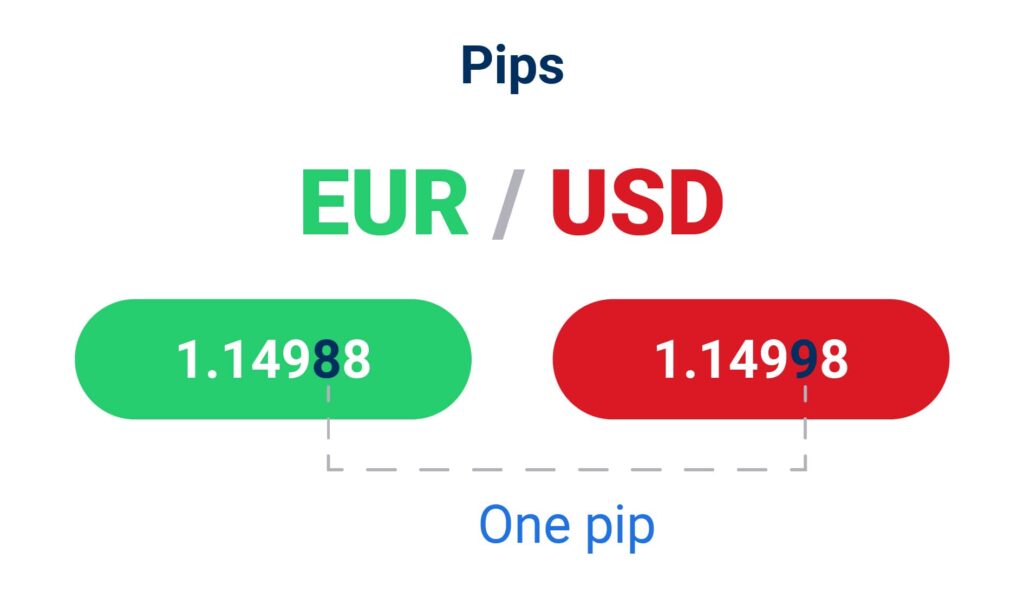

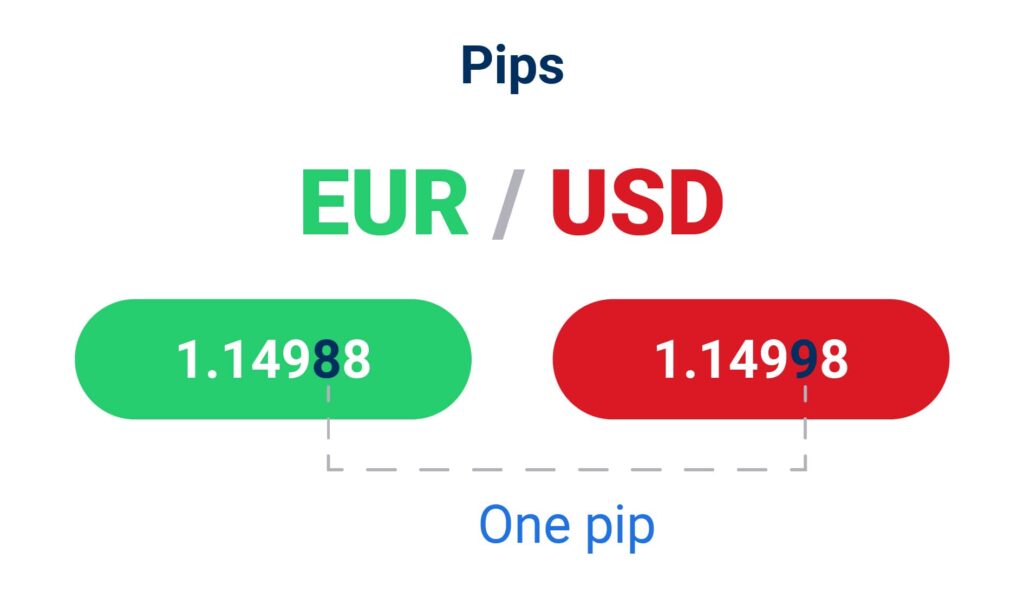

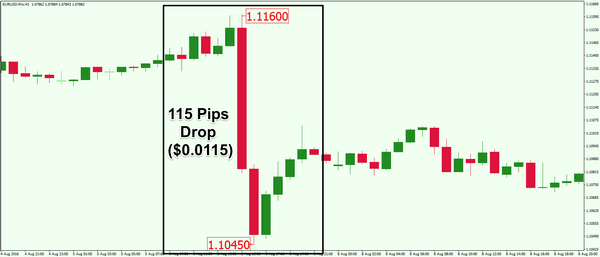

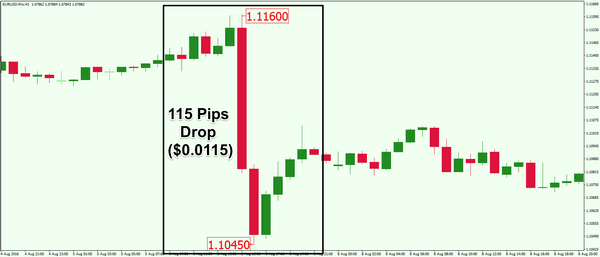

A pip, short for “point in percentage” or “price interest point,” represents the smallest measurable change in the exchange rate for a currency pair in the forex market. Typically, one pip is equal to a one-digit movement in the fourth decimal place of a currency pair. For most currency pairs, this means 0.0001. However, for pairs involving the Japanese Yen, a pip refers to a movement in the second decimal place, or 0.01, due to the Yen’s lower value compared to other currencies.

2. The Significance of Pip in Forex Trading

The concept of pip is integral in forex trading as it signifies the smallest amount by which a currency pair can change. This small change is crucial for traders as it helps them to understand their potential profit or loss from a trade. By accurately calculating the value of a pip, traders can set stop-loss and take-profit orders, manage their risk effectively, and make informed trading decisions.

3. How to Calculate Pips in Forex

Calculating the value of a pip in forex trading involves understanding the size of your trade (in lots) and the currency pair you are trading. Here’s a step-by-step guide:

- Determine the lot size: Forex is typically traded in lots. A standard lot is 100,000 units of the base currency, a mini lot is 10,000 units, and a micro lot is 1,000 units.

- Identify the currency pair: The value of a pip varies depending on the currency pair you are trading. For most pairs, a pip is 0.0001, but for pairs with the JPY, it’s 0.01.

- Calculate the pip value: Multiply the number of units in your trade (lot size) by the size of one pip (0.0001 or 0.01).

Example Calculation:

Assume you’re trading 1 standard lot (100,000 units) of EUR/USD at an exchange rate of 1.1234. If the exchange rate moves to 1.1235, that’s a one-pip increase. For a standard lot, the value of one pip is:

- 100,000 (lot size) * 0.0001 (pip size) = $10 per pip

4. Factors Affecting the Pip Value in Forex

The value of a pip can vary based on the currency pair being traded and the size of the trade. It’s crucial for traders to understand these dynamics:

- Currency Pair: As mentioned, for most currency pairs, a pip is 0.0001 of the quoted price. However, for JPY pairs, it’s 0.01.

- Trade Size: The larger your trade size (lot size), the higher the value of each pip.

5. Utilizing Pip in Forex Trading Strategies

A firm grasp of the concept of pips is essential for developing effective forex trading strategies. Traders use pips to measure price movements, set trade parameters, and manage their risk. Here are some ways pips are used in trading:

- Setting Stop-Loss and Take-Profit Orders: Traders use pips to set specific levels at which they will exit a trade to minimize losses (stop-loss) or take profits.

- Risk Management: Understanding the value of pips helps in determining how much capital can be risked on a trade.

- Performance Measurement: Traders measure their trading performance in terms of pips gained or lost, which helps in maintaining a clear perspective on trading results.

Conclusion

In the intricate dance of forex trading, the pip plays a vital role. A thorough understanding of what a pip is and how to calculate it is indispensable for anyone looking to navigate the forex market successfully. This knowledge empowers traders to make precise and strategic decisions, manage risk effectively, and ultimately, achieve their trading objectives. Whether you’re a seasoned trader or just starting, mastering the concept of pip in forex will undoubtedly add to your trading acumen.

This article has provided a detailed overview of pips in forex, their importance, and how to calculate them. Remember to integrate this knowledge into your trading strategy to enhance your efficiency and success in the forex market!

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA – Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 5% off: THANGEA5

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex