Introduction forex RSI strategy:

In the fast-paced world of forex trading, finding an edge can be the key to success. One such edge is the effective use of technical analysis tools, with the Relative Strength Index (RSI) being a standout. This comprehensive guide dives into the “forex RSI strategy,” offering insights for both novice and seasoned traders to optimize their trading approach using the RSI.

Understanding the RSI

The Relative Strength Index, developed by J. Welles Wilder, is a momentum oscillator that measures the speed and change of price movements. It oscillates between zero and 100 and is typically used to identify overbought or oversold conditions in a trading instrument. The standard period setting for RSI is 14, but this can be adjusted for more sensitivity or smoothing.

Setting Up the RSI for Forex Trading

Incorporating the RSI into your forex trading strategy is straightforward. Most trading platforms come with a built-in RSI indicator. The key lies in configuring the RSI settings to suit your trading style. While the default setting is 14 periods, short-term traders might reduce this to increase sensitivity. Conversely, longer-term traders might prefer a higher period count for more smoothed results.

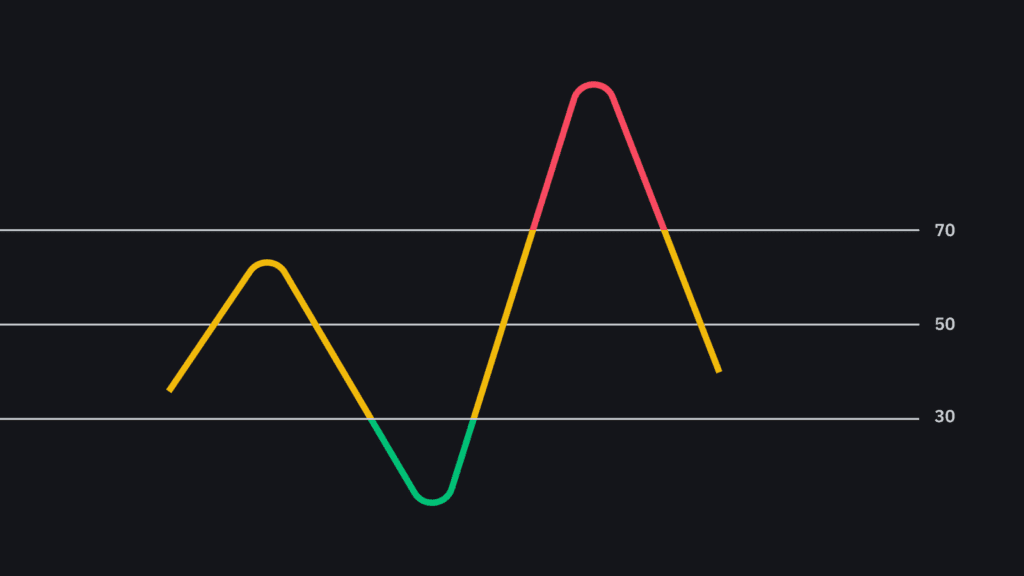

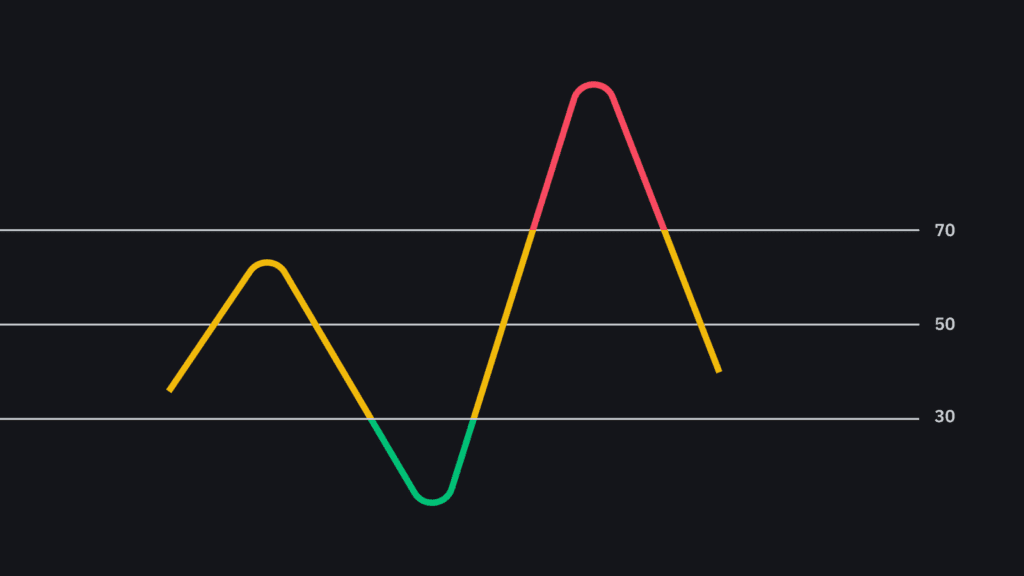

Basic RSI Trading Strategies

The simplest way to use RSI in forex trading is by identifying overbought and oversold conditions. When the RSI crosses above 70, the market is considered overbought; conversely, when it falls below 30, it is deemed oversold. Trades are then taken in anticipation of a reversal. For example, if EUR/USD is overbought on the RSI, a trader might take a short position, anticipating a downward movement.

Divergence: A Key to RSI Strategy

Divergence occurs when the price of a currency pair and the RSI indicator move in opposite directions. This is a powerful concept in the “forex RSI strategy.” For instance, if the price of GBP/JPY is creating new highs, but the RSI is failing to surpass its previous highs, it signals a bearish divergence, suggesting an impending downward movement.

Advanced RSI Strategies for Forex

For a more nuanced approach, traders combine RSI readings with other indicators or chart patterns. A common strategy involves using moving averages in conjunction with the RSI. For instance, if the RSI indicates an oversold condition and the price crosses above a moving average, it can be a strong buy signal.

Another advanced strategy is to use RSI in trending markets. During an uptrend, traders might look for times when the RSI drops below 30 and then moves back above it as a buying opportunity. Similarly, in downtrends, RSI readings above 70 that fall back below can signal selling opportunities.

Risks and Best Practices

While the “forex RSI strategy” is potent, it’s not foolproof. The RSI can remain in overbought or oversold territory for extended periods during strong trends, leading to false signals. To mitigate this, traders should use additional tools like trend lines, support and resistance levels, and price action patterns.

Moreover, a successful RSI strategy in forex trading requires sound risk management. This includes setting appropriate stop-loss orders to protect against market volatility and ensuring each trade does not risk more than a small percentage of the total trading capital.

Conclusion

The RSI is a versatile tool in forex trading, offering valuable insights into market momentum and potential reversals. However, like any trading strategy, the key to success with the “forex RSI strategy” lies in understanding its limitations, combining it with other analytical tools, and applying sound risk management practices. By mastering the RSI, traders can add a powerful tool to their forex trading arsenal, enhancing their ability to make informed decisions in the dynamic forex market.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA – Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 5% off: THANGEA5

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex