Forex leverage is an essential yet often misunderstood tool in currency trading. It can be a powerful ally in maximizing profits but, if misused, a quick route to substantial losses. This guide offers an in-depth understanding of forex leverage and how to use it effectively to maximize your trading potential.

Understanding the Basics of Forex Leverage

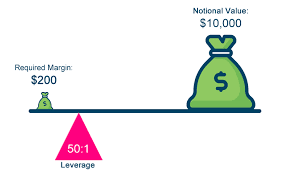

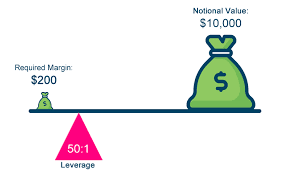

Forex leverage allows traders to control a large position with a relatively small amount of capital. It’s expressed as a ratio, such as 50:1, 1:100, or 1:500. For example, with 1:100 leverage, a trader can control a position of $100,000 with just $1,000 of capital.

Advantages of Using Leverage in Forex

Leverage in forex trading means you can gain a significant exposure to a currency market while only tying up a small portion of your capital. It allows you to make considerable gains from relatively small price movements. However, it’s important to remember that while the potential for profit is amplified, so too is the potential for loss.

Risks and Challenges of Leverage

The primary risk of using leverage in forex trading is that it can magnify your losses in the same way it can amplify your gains. A small adverse move in currency prices can quickly escalate into significant losses, exceeding your initial investment.

Strategies for Effective Leverage Management

Effective leverage management involves understanding market conditions, employing stop-loss orders, and only using leverage when the potential returns justify the risk. It’s crucial to have a clear risk management strategy and to never risk more than you can afford to lose.

Leverage and Market Volatility

Forex markets can be highly volatile. Using high leverage in such conditions can be risky. Traders should be especially cautious and consider reducing their leverage in times of high volatility.

The Role of Leverage in Long-Term Trading vs. Short-Term Trading

Leverage plays different roles in long-term vs. short-term trading. In long-term trading, it’s often used more conservatively due to the prolonged exposure to market fluctuations. Short-term traders might use higher leverage to capitalize on small price movements.

Choosing the Right Leverage Ratio

Choosing the right leverage ratio depends on your trading style, risk tolerance, and experience level. Beginners are advised to start with lower leverage to minimize risk.

The Impact of Regulatory Changes

Regulatory bodies in various jurisdictions have set limits on the amount of leverage offered to retail forex traders. These changes aim to protect traders from the risks associated with excessive leverage.

Leverage in Different Forex Markets

Different currency pairs and forex markets may have different leverage options based on their volatility and market liquidity. Traders should be aware of these differences when planning their trading strategies.

FAQs about Forex Leverage

Q: What is a safe leverage level for beginners in forex trading?

A: Beginners should start with lower leverage levels, such as 1:10 or 1:20, to minimize risk.

Q: Can using leverage lead to owing money to a broker?

A: Yes, if the market moves against your position significantly, you can end up owing more than your initial deposit.

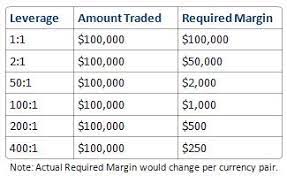

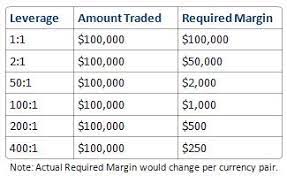

Q: How does leverage affect the required margin in forex trading?

A: Higher leverage reduces the required margin, allowing you to open larger positions with less capital.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA – Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 5% off: THANGEA5

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex