Introduction:

In the fast-paced world of trading, understanding the tools and strategies at your disposal is key to success. Among these tools, ‘buy limit’ and ‘sell limit’ orders stand out as fundamental elements that can shape your trading experience. This guide aims to demystify these concepts, providing you with the knowledge to use them effectively in your trading arsenal.

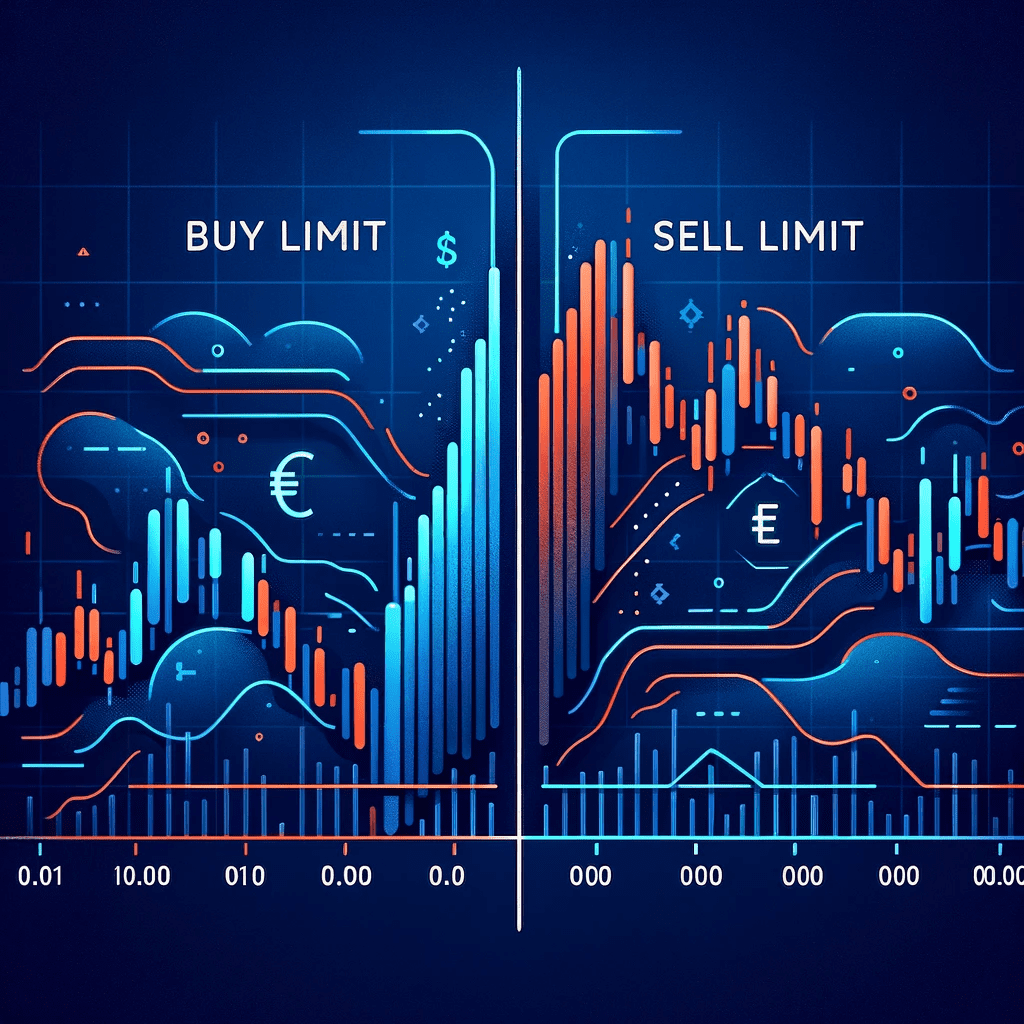

Understanding Buy Limit and Sell Limit Orders:

A ‘buy limit’ order allows traders to purchase an asset at or below a predetermined price, while a ‘sell limit’ order enables selling at or above a set price. These orders are crucial in managing risk and securing profits in volatile markets. By setting these limits, traders can execute trades at favorable prices without constantly monitoring the market.

The Strategic Use of Buy Limit Orders:

Imagine you’re eyeing a stock currently trading at $100, but you believe it’s overvalued at this price. You can place a ‘buy limit’ order at $95. This order will only be executed if the stock’s price drops to $95 or lower, ensuring you don’t overpay. This strategy is particularly useful in markets with frequent price fluctuations, allowing traders to capitalize on short-term dips.

Maximizing Profits with Sell Limit Orders:

Conversely, ‘sell limit’ orders help lock in profits. If you own a stock valued at $100 and expect it to peak around $110, setting a ‘sell limit’ order at $110 ensures the stock is sold at this target price, maximizing your profit. This is especially beneficial in bull markets, where setting a slightly higher sell limit can lead to substantial gains.

Advantages and Risks Associated with Limit Orders:

The primary advantage of ‘buy limit’ and ‘sell limit’ orders is the control they offer. You can set exact entry and exit points, reducing the emotional aspect of trading decisions. However, these orders are not without risks. A major risk is that the order may not be fulfilled if the price doesn’t reach the set limit, potentially missing out on profitable trades.

Practical Tips for New Traders:

- Research Thoroughly: Understand the asset you’re trading. Research its historical performance, market trends, and any factors that might influence its price.

- Set Realistic Limits: Base your ‘buy limit’ and ‘sell limit’ orders on realistic market expectations. Don’t set them too far from the current price unless supported by strong market analysis.

- Monitor the Market: Stay updated with market news and trends. While limit orders reduce the need for constant monitoring, being informed helps in making educated adjustments to your orders.

- Avoid Common Mistakes: New traders often set their limits too rigidly. Be flexible and ready to adjust your strategy based on market movements.

Advanced Strategies Using Buy Limit and Sell Limit Orders:

Experienced traders often combine limit orders with other strategies for enhanced results. For example, using ‘buy limit’ orders in conjunction with stop-loss orders can further minimize losses, while pairing ‘sell limit’ orders with trailing stops can maximize profits in rising markets.

Conclusion: Buy limit and sell limit orders are powerful tools in a trader’s toolkit. They offer precision, control, and a strategic edge in navigating the financial markets. While they come with their own set of risks, the benefits they provide in terms of managed risk and potential profit make them indispensable for both new and experienced traders.

FAQ Section :

- Q: Can ‘buy limit’ and ‘sell limit’ orders be used in all markets? A: Yes, these orders are available in most financial markets, including stocks, forex, and commodities.

- Q: How long can a limit order stay open? A: It depends on the settings you choose. Orders can be set to expire at the end of the trading day or remain open for extended periods.

- Q: Are there fees associated with these orders? A: This depends on your broker’s fee structure. Some brokers may charge for order execution or for orders that remain open for extended periods.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA – Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 5% off: THANGEA5

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex