In the world of Forex trading, understanding the concept of ‘spread’ is essential for every trader aiming to succeed. Spread can significantly influence your trading strategy, affecting both the entry and exit points of your trades. This comprehensive guide is designed to help both novice and experienced traders grasp how to calculate spread in Forex and make informed decisions based on this understanding.

1. Introduction to Forex Spread

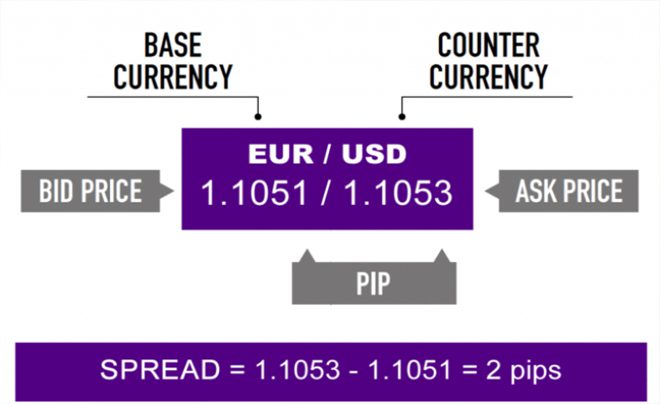

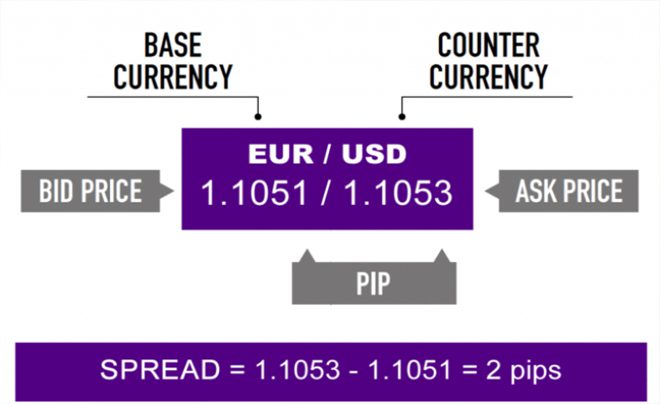

The spread in Forex trading is the difference between the bid price (the price at which you can sell a currency pair) and the ask price (the price at which you can buy a currency pair). This difference represents the cost of trading and is how brokers make money. A lower spread indicates a cheaper cost to trade, making it a crucial factor in Forex trading.

2. Importance of Calculating Forex Spread

Calculating the spread is fundamental for any trader as it directly impacts profitability. By understanding how to calculate spread in Forex, traders can better manage their trading costs, which is especially crucial in strategies that involve frequent trading, such as scalping or day trading. Moreover, awareness of the spread helps in setting more accurate stop-loss and take-profit points.

3. Components Influencing Forex Spread

Several factors influence the spread in Forex trading:

- Liquidity: Major currency pairs like EUR/USD or USD/JPY tend to have lower spreads due to their high liquidity. In contrast, exotic pairs have higher spreads.

- Market Volatility: During times of high volatility, spreads tend to widen as the market conditions are more uncertain.

- Broker Type: Different brokers offer different spreads. While some provide fixed spreads, others offer variable spreads based on market conditions.

4. Step-by-Step Guide to Calculating Spread in Forex

Calculating the spread in Forex involves a few simple steps:

- Identify the Bid and Ask Price: For any currency pair, identify the current bid and ask prices. For instance, if the EUR/USD pair is quoted with a bid of 1.1200 and an ask of 1.1205, these are your two crucial figures.

- Calculate the Difference: The spread is the difference between the ask and bid price. In our example, the calculation would be 1.1205 (ask) – 1.1200 (bid) = 0.0005.

- Convert to Pips: Forex prices are usually quoted to the fourth decimal place, and a pip is one unit of the fourth decimal point. In our example, the spread is 0.0005, or 5 pips.

5. Impact of Spread on Trading Strategies

Different trading strategies have varying sensitivities to the spread:

- Scalping: This strategy involves making a large number of small profits on small price changes. Therefore, a lower spread is crucial as even a slightly higher spread can significantly affect profitability.

- Swing Trading / Position Trading: These strategies are less affected by the spread as they aim for larger market moves and hold positions for a longer period.

6. Tips for Managing Spread in Forex Trading

- Choose the Right Broker: Opt for brokers who offer lower spreads. This is especially crucial if you are engaging in a trading strategy that involves making numerous trades.

- Trade Major Pairs: Major currency pairs usually have the lowest spreads due to their high liquidity.

- Be Mindful of Trading Times: Spreads can widen during times of low liquidity or major economic announcements. Trading during major market hours can ensure more stable spreads.

7. Conclusion

Mastering how to calculate spread in Forex is a fundamental skill that can significantly influence your trading success. By understanding the factors that affect the spread and how it impacts your trading strategy, you can make more informed decisions, manage your trading costs effectively, and enhance your potential for profitability in the Forex market.

In this journey of mastering Forex, always remember that knowledge is your most valuable asset. Keep learning, keep trading, and may the spread always be in your favor.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA – Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 5% off: THANGEA5

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex