The world of forex trading is replete with various technical analysis tools, but few have garnered as much respect and widespread use as the Fibonacci sequence. As a seasoned forex trader with five years of active trading experience, I’ve come to appreciate the profound impact that ‘fibonacci in forex’ strategies have on day-to-day trading decisions. This comprehensive guide aims to demystify Fibonacci tools and strategies, helping traders harness their power for technical analysis success.

Section 1: Unveiling the Fibonacci Sequence in Forex

The Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones, has its roots in ancient mathematics. In the forex world, this sequence translates into several key ratios — 23.6%, 38.2%, 50%, 61.8%, and 100% — which are crucial in identifying potential reversal points in the market. These ratios are derived from mathematical relationships within the sequence and have been found to have a surprising applicability in financial markets, offering insights into potential support and resistance levels.

Section 2: Demystifying Fibonacci Retracement Levels

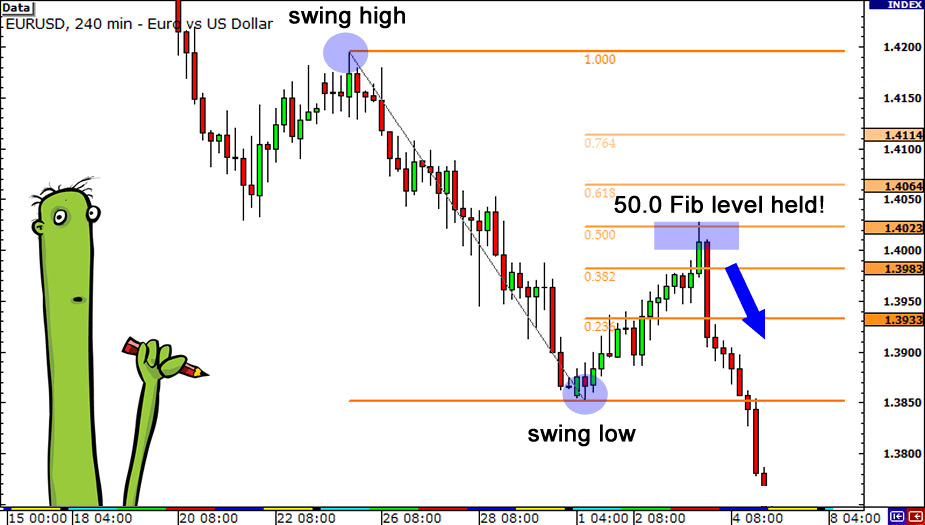

Fibonacci retracement levels are invaluable tools in identifying potential areas of interest (support or resistance) in forex charts. To draw these levels, a trader must identify significant price points (highs and lows) and apply the Fibonacci ratios between these points. The resulting horizontal lines indicate where support and resistance are likely to occur. By using historical forex market data, I’ve observed that these levels often correspond to a pause or reversal in a trend, offering opportunities for entry or exit.

Section 3: Exploring Fibonacci Extension Levels

While retracement levels are used to identify where a pullback could end, Fibonacci extensions are invaluable in determining where the next phase of the price movement after a pullback could potentially go. These are plotted beyond the 100% level and provide traders with targets for their trades. My trading experience has shown that when combined with other indicators, these extension levels can significantly enhance the probability of making a successful trade.

Section 4: Integrating Fibonacci with Other Technical Tools

No tool in forex trading operates in isolation, and this is particularly true for ‘fibonacci in forex.’ When combined with other technical analysis tools like moving averages, Relative Strength Index (RSI), or Moving Average Convergence Divergence (MACD), Fibonacci tools provide a more holistic view of the market. For instance, a Fibonacci retracement level coinciding with a 200-day moving average can provide a strong signal for the potential reversal of a trend.

Section 5: Advanced Fibonacci Trading Techniques

Advanced Fibonacci trading strategies involve looking for areas where different Fibonacci levels converge, known as Fibonacci confluence. These areas are likely to be significant support or resistance zones. Additionally, the use of Fibonacci fan lines can provide dynamic support and resistance levels as they extend diagonally along a chart. Through trial and error in various market conditions, I’ve found these advanced techniques to be particularly effective in trending markets.

Section 6: Risk Management in Fibonacci Forex Trading

An integral aspect of successful forex trading is risk management, especially when utilizing ‘fibonacci in forex’ strategies. It’s crucial to set stop-loss orders based on Fibonacci levels to manage potential losses. For instance, placing a stop-loss just below a Fibonacci retracement level can limit downside risk while still allowing room for normal market fluctuations.

Section 7: Navigating Common Pitfalls

Common mistakes in using Fibonacci tools include relying solely on Fibonacci levels without considering the broader market context or failing to adjust these levels in response to new market information. Another frequent error is the misapplication of Fibonacci levels, which can lead to inaccurate predictions and poor trading decisions.

Section 8: The Journey of Continuous Learning

The journey to mastering ‘fibonacci in forex’ is continuous and evolving. Staying abreast of market changes and adapting one’s strategies accordingly is key to long-term success in forex trading. Regularly reviewing trades and learning from both successes and failures has been instrumental in refining my use of Fibonacci tools over the years.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA – Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 5% off: THANGEA5

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex