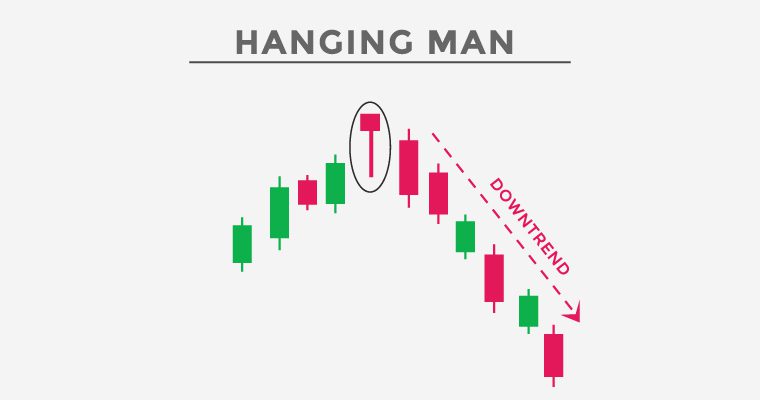

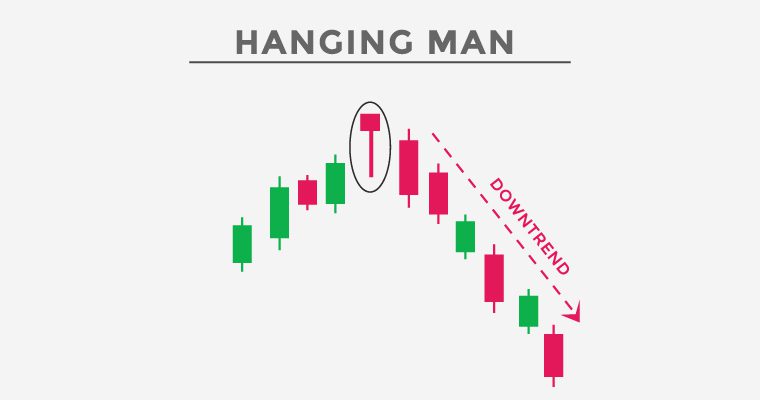

In the realm of financial trading, certain patterns emerge as harbingers of potential market shifts. Among these, the Hanging Man candlestick pattern commands attention for its ominous implication in an otherwise bullish market atmosphere. This detailed exploration sheds light on the Hanging Man candle, guiding traders through its identification, implications, and strategic application.

Decoding the Hanging Man Candle

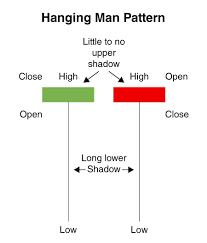

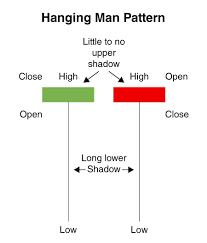

The Hanging Man candle is a candlestick pattern that appears at the end of an uptrend, signaling the possibility of a downward reversal. Its distinctive features include a small upper body, little to no upper shadow, and a long lower shadow. The pattern’s appearance suggests that sellers are beginning to outnumber buyers, despite the prevailing upward trend.

Formation and Interpretation

The Hanging Man candle formation occurs during a period of bullish sentiment when a specific trading session opens near its high but experiences a significant sell-off before closing slightly below or above the open. This activity creates a long lower shadow, indicative of selling pressure, yet the session closes with buyers regaining some ground, hence the small real body.

Psychological Underpinnings

The psychology behind the Hanging Man candle pattern is as critical as its physical appearance. Initially, the long lower shadow represents a period within the trading session where bears have attempted to take control, pushing the price down. The bulls’ partial recovery sends mixed signals to the market, suggesting indecision or weakening bullish momentum.

Strategic Trading Approaches

Upon identifying a Hanging Man candle pattern, traders should consider several strategic responses:

- Confirmation: Before taking action, look for confirmation in subsequent trading sessions. A bearish follow-through, such as a gap down or a large bearish candlestick, can validate the Hanging Man’s reversal signal.

- Volume Analysis: High trading volume during the formation of the Hanging Man reinforces its bearish implication, indicating a significant number of traders participating in the sell-off.

- Stop-Loss Adjustments: Traders might tighten stop-loss levels to protect gains or limit losses, anticipating potential market downturns following the pattern.

- Diversification: In light of the potential for a trend reversal signaled by the Hanging Man, traders could consider diversifying their positions to mitigate risk.

Technical Analysis Complements

While the Hanging Man candle is a powerful tool in isolation, its predictive accuracy increases when used alongside other technical indicators:

- Moving Averages: A Hanging Man pattern that forms near a key moving average, like the 50-day or 200-day, may have more significant implications.

- Relative Strength Index (RSI): An RSI reading in overbought territory (above 70) concurrent with a Hanging Man pattern could further signal a forthcoming reversal.

- Support and Resistance Levels: The pattern’s occurrence near resistance levels can indicate a stronger likelihood of a bearish reversal.

FAQs

Q1: How does the Hanging Man candle differ from similar candlestick patterns?

A1: The Hanging Man is often compared to the Hammer pattern; both have similar shapes but occur in different market contexts. The Hammer appears during downtrends signaling bullish reversals, whereas the Hanging Man appears during uptrends signaling bearish reversals.

Q2: Can the Hanging Man candle predict long-term market trends?

A2: While the Hanging Man can signal a potential reversal, it is primarily a short-term indicator. Its significance should be considered in conjunction with broader market analysis.

Q3: Is the Hanging Man candle reliable in all trading markets?

A3: The Hanging Man can be observed across various markets, including forex, equities, and commodities. However, its reliability may vary based on market volatility and trading volume.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA

– Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 10% off: THANGEA10

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex