In the world of foreign exchange (forex) trading, understanding the concept of a ‘lot’ is crucial for both novice and seasoned traders. A ‘lot’ refers to a standardized unit of currency that traders use to execute their trades in the forex market. This article aims to demystify the term ‘lot in forex’, discuss its importance in trading strategies, and provide insights on optimizing your trading approach for better results.

1. Understanding Lot in Forex

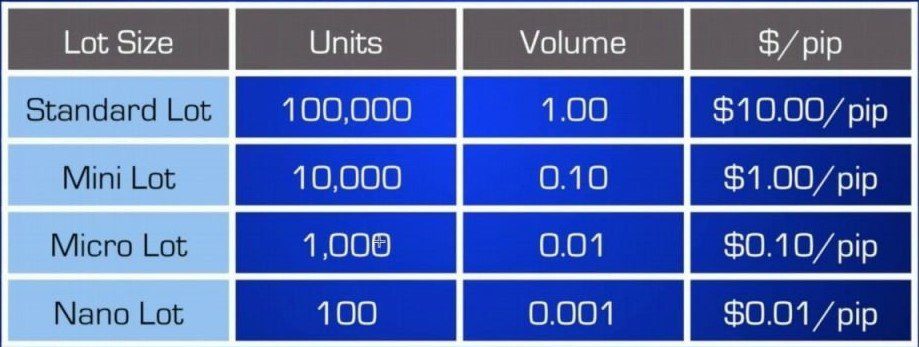

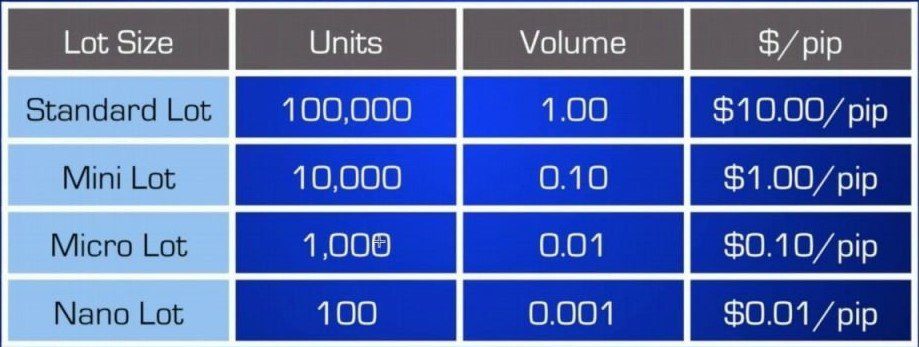

A lot in forex represents a fixed quantity of currency, which standardizes trade sizes and helps traders manage their risk effectively. There are three primary types of lot sizes in forex:

- Standard Lot: This is the most common lot size and equates to 100,000 units of the base currency. For instance, a standard lot in a USD/EUR trade would be $100,000.

- Mini Lot: One mini lot equals 10,000 units of the base currency, which is 1/10th of a standard lot. This smaller lot size allows traders to participate in forex trading with lower capital requirements.

- Micro Lot: The smallest lot size available is the micro lot, which consists of 1,000 units of currency. This lot size is particularly beneficial for new traders who wish to minimize their risk exposure as they hone their trading skills.

Understanding these lot sizes and how they relate to your trading strategy is essential for effective risk management and ensuring that your trading aligns with your financial goals.

2. The Importance of Lot Size in Forex Trading

The size of the lot you choose directly impacts the risk you’re taking. Here’s why understanding and selecting the right lot size is crucial:

- Risk Management: By choosing the appropriate lot size, traders can control the amount of risk they are willing to take. Larger lot sizes magnify profits but also amplify potential losses, making risk management a critical aspect of your trading strategy.

- Capital Allocation: Understanding lot sizes allows traders to allocate their capital effectively, ensuring they can participate in trades without overexposing themselves to the market.

- Strategy Customization: Different trading strategies may require the use of different lot sizes. For instance, a scalping strategy might use smaller lot sizes due to the quick, small trades, whereas a position trading strategy might involve larger lot sizes for long-term trades.

3. Optimizing Your Trading Strategy with Lot Sizes

To optimize your trading strategy, it’s vital to understand how lot sizes can affect your trades and overall trading approach. Here are some tips to consider:

- Understand Your Risk Tolerance: Before entering a trade, know how much of your capital you are willing to risk. Generally, it’s advised not to risk more than 1-2% of your capital on a single trade. Adjust your lot size accordingly to ensure your risk level remains within your comfort zone.

- Utilize Leverage Wisely: Leverage allows traders to control a large position with a relatively small amount of capital. However, it also increases the risk. Ensure you understand the implications of leverage on your lot size and the potential impact on your trades.

- Employ Risk Management Tools: Tools like stop-loss orders can help manage risk by automatically closing a position at a predetermined price. This can prevent substantial losses, especially when using larger lot sizes.

- Keep an Eye on Market Volatility: Market volatility can affect the appropriate lot size for a trade. In times of high volatility, it might be prudent to trade smaller lot sizes to mitigate risk.

- Continuously Educate Yourself: The forex market is dynamic, and strategies may need to evolve. Keep learning and stay informed about market conditions, economic indicators, and news that may affect currency values and, consequently, your trading decisions.

4. Conclusion

Understanding the concept of a ‘lot in forex’ is fundamental for anyone looking to succeed in the forex market. The ability to choose the right lot size for your trades is a significant aspect of managing risk and capital. By carefully considering your risk tolerance, employing effective risk management tools, and continuously educating yourself about the forex market, you can optimize your trading strategy for better performance. Remember, forex trading involves significant risk, and it’s essential to approach it with caution, knowledge, and a well-thought-out strategy.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA – Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 5% off: THANGEA5

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex