Trading Strategies Involving Marubozu Candles

Trading strategies involving Marubozu candles leverage the strong price momentum these patterns suggest. By recognizing and understanding the implications of a Marubozu candle, traders can make more informed decisions. Here are several strategies to consider:

1. Trend Initiation Trades

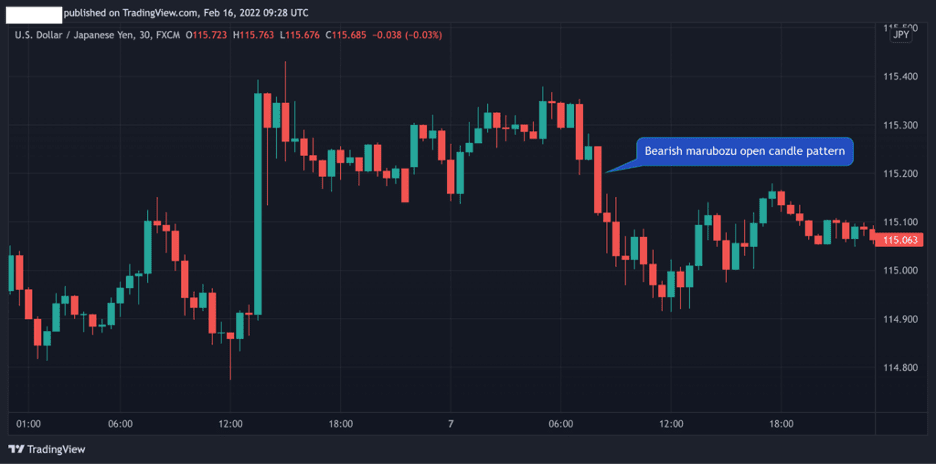

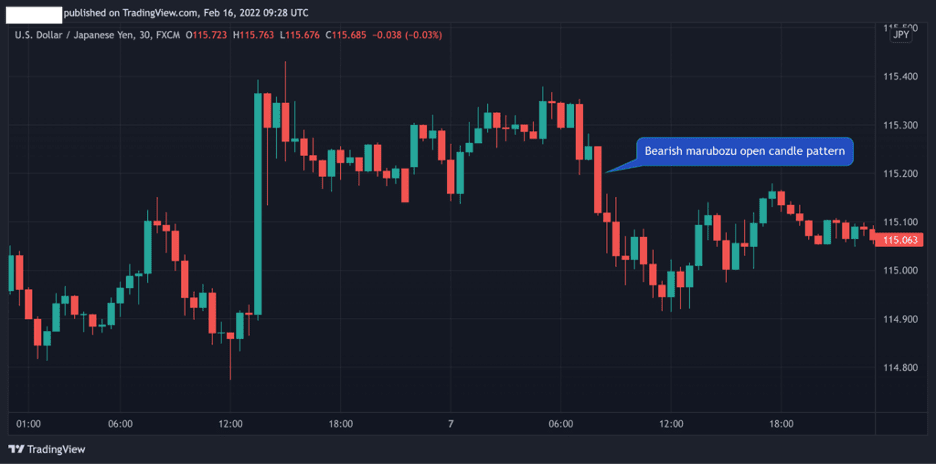

Marubozu candles often indicate the start of a new trend. A bullish Marubozu suggests strong buying pressure, potentially signaling the beginning of an uptrend. Conversely, a bearish Marubozu may signal the start of a downtrend due to strong selling pressure.

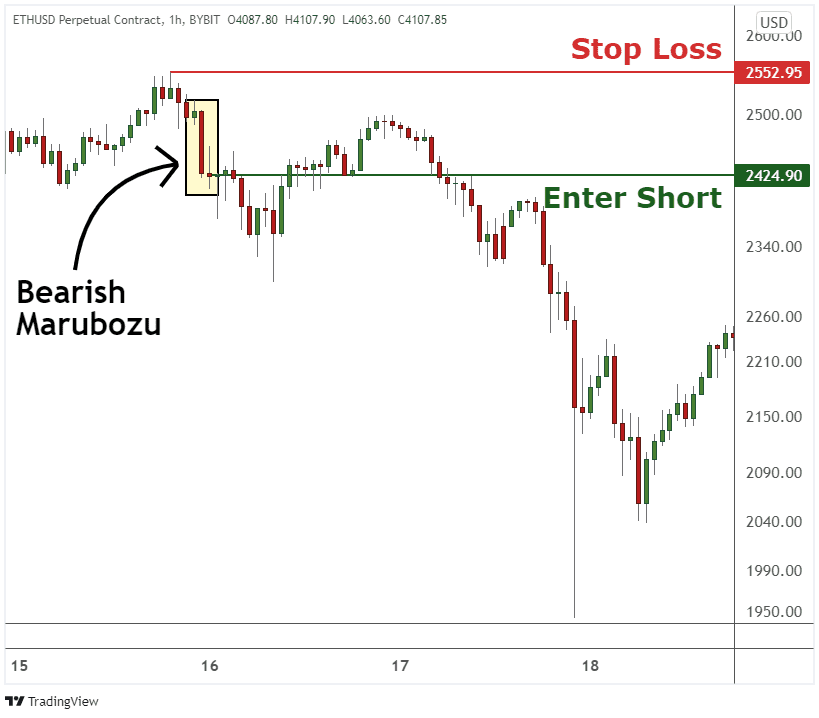

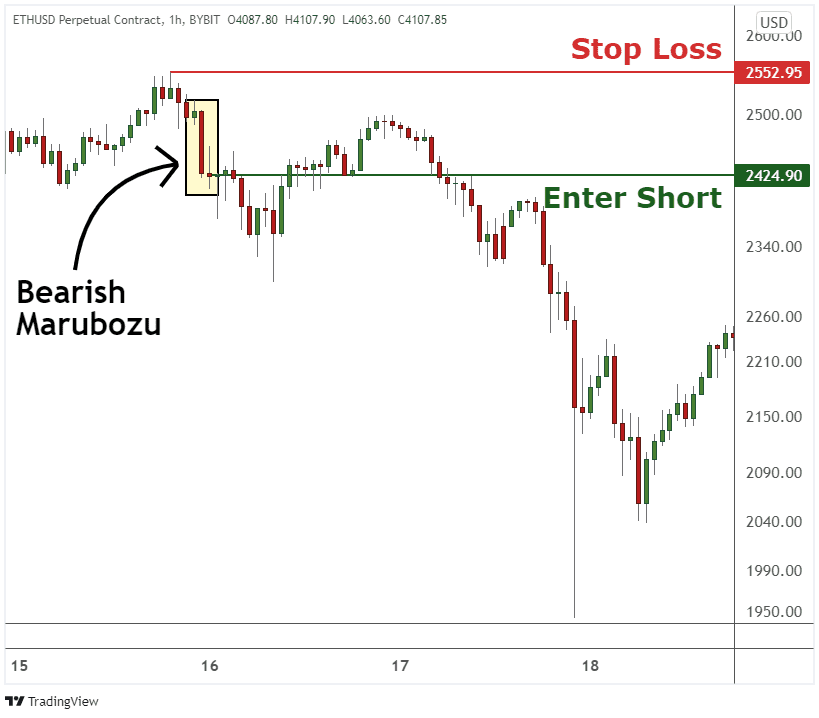

- Strategy: After identifying a Marubozu candle, wait for a slight retracement in the next period as traders take profits. Enter a trade in the direction of the Marubozu candle when the price starts moving back towards the Marubozu’s close. Set a stop-loss just beyond the retracement low for a bullish Marubozu or high for a bearish Marubozu.

2. Breakout Confirmation Trades

In a ranging market, a Marubozu candle breaking through resistance or support can confirm a breakout and the potential start of a new trend.

- Strategy: Upon a Marubozu candle closing above a key resistance or below a key support level, consider entering a trade in the direction of the breakout. The strong momentum indicated by the Marubozu suggests the breakout might continue. Place a stop-loss just inside the broken support or resistance level to manage risk.

3. Momentum Continuation Trades

A Marubozu appearing within a clear trend can signal the continuation of that trend, showing that the prevailing market sentiment remains strong.

- Strategy: When you spot a Marubozu candle in the direction of the existing trend, consider it a potential entry point to join the trend. Ensure the trend’s presence through other indicators like moving averages or trend lines. Set a stop-loss at the opposite end of the Marubozu candle to protect against reversals.

4. Combining with Technical Indicators

Integrating Marubozu candles with technical indicators such as RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), or Fibonacci retracement levels can provide additional confirmation of trading signals.

- Strategy: Look for a bullish Marubozu candle in conjunction with an oversold RSI reading or a bullish MACD crossover as a buy signal. Conversely, a bearish Marubozu with an overbought RSI or bearish MACD crossover can act as a sell signal. Aligning these signals can increase the confidence in the trade.

Risk Management and Marubozu Candle

Risk management is a critical component of any trading strategy, especially when trading based on candlestick patterns like the Marubozu candle. While Marubozu candles can signal strong buying or selling pressure and potential entry points, incorporating sound risk management practices ensures that traders can protect their capital and maximize their chances for long-term success. Here’s how traders can implement risk management strategies when trading with Marubozu candles:

Setting Stop-Loss Orders

One of the most straightforward methods to manage risk is by setting stop-loss orders. A stop-loss order automatically closes a trade at a predetermined price level, limiting potential losses.

- For Bullish Marubozu Trades: Place the stop-loss just below the low of the Marubozu candle. This allows some room for market fluctuations while protecting against significant reversals.

- For Bearish Marubozu Trades: Set the stop-loss just above the high of the Marubozu candle. This placement limits losses if the market moves contrary to the anticipated downtrend.

Position Sizing

Proper position sizing is vital to managing risk effectively. It involves determining the appropriate trade size based on the trader’s capital and the risk level of a particular trade.

- Calculate Risk Per Trade: Decide on a fixed percentage of your trading capital that you are willing to risk on a single trade. A common guideline is to risk no more than 1-2% of your trading capital on any given trade.

- Adjust Trade Size: Based on the distance between your entry point and the stop-loss level, adjust the size of your position to ensure that you do not exceed your predetermined risk level.

Use of Technical Indicators for Additional Confirmation

Integrating technical indicators with Marubozu candle patterns can enhance the robustness of trading signals and help manage risk.

- Confirm Trends: Use moving averages or trendlines to confirm the overall market trend before entering a trade based on a Marubozu candle. Trading in the direction of the prevailing trend can reduce the likelihood of entering a losing trade.

- Volume Analysis: High trading volume accompanying a Marubozu candle can reinforce the strength of the signal. However, unusually high volume might also signal a potential reversal, warranting caution.

Diversification

Diversifying trading strategies and not relying solely on Marubozu candles for making trading decisions can also help manage risk.

- Spread Risk: Use a variety of trading strategies and instruments to spread risk. This way, the impact of a loss on one trade can be mitigated by gains in others.

Regular Review and Adjustment

Effective risk management is not a set-and-forget process. Regularly review and adjust your risk management strategies based on changing market conditions and your trading performance.

- Review Trades: Analyze both successful and unsuccessful trades to understand what worked and what didn’t. Use this information to refine your approach and risk management practices.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA

– Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 10% off: THANGEA10

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex