In the dynamic world of trading, understanding the subtle signals can be the difference between success and failure. Among these signals, the Inside Bar Candle stands out as a powerful indicator of future market movements. This detailed exploration delves into the essence of Inside Bar Candles, offering traders at all levels insights into leveraging this pattern for improved market predictions.

Introduction

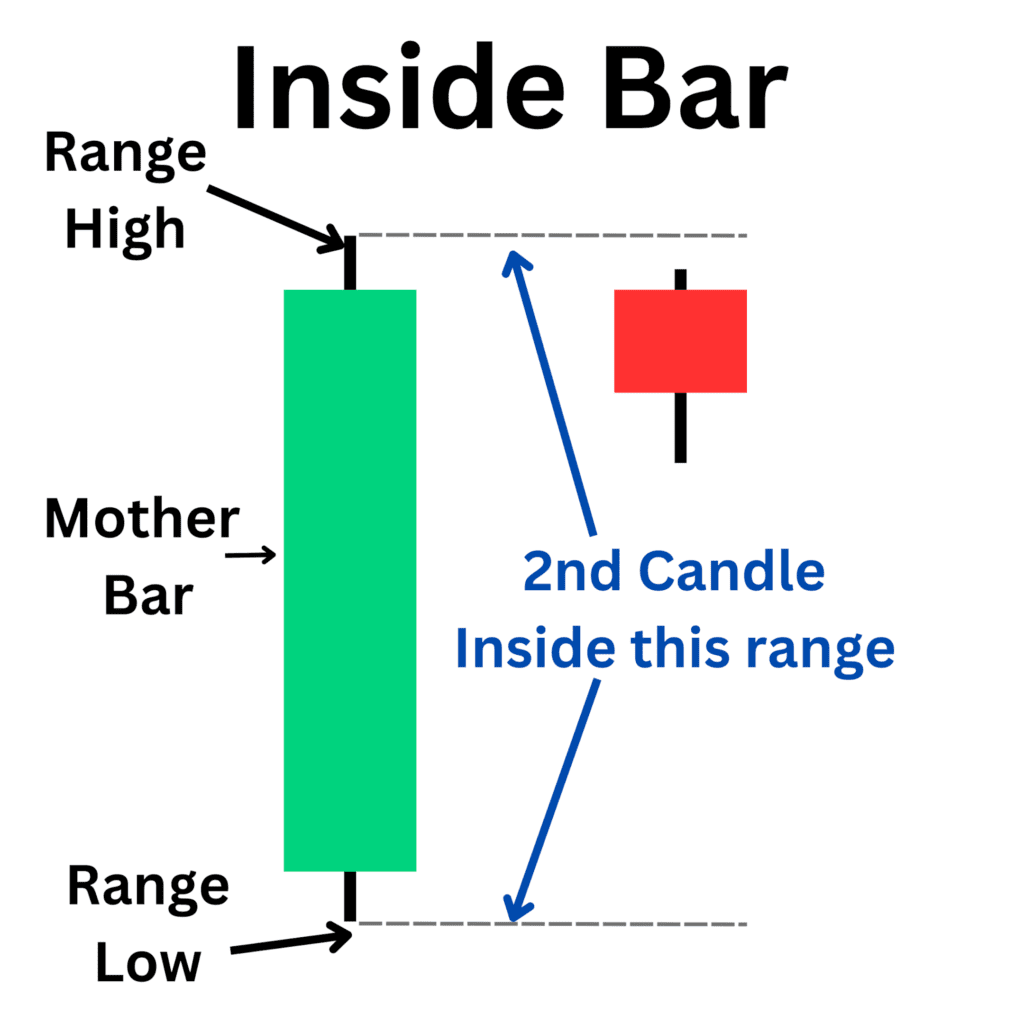

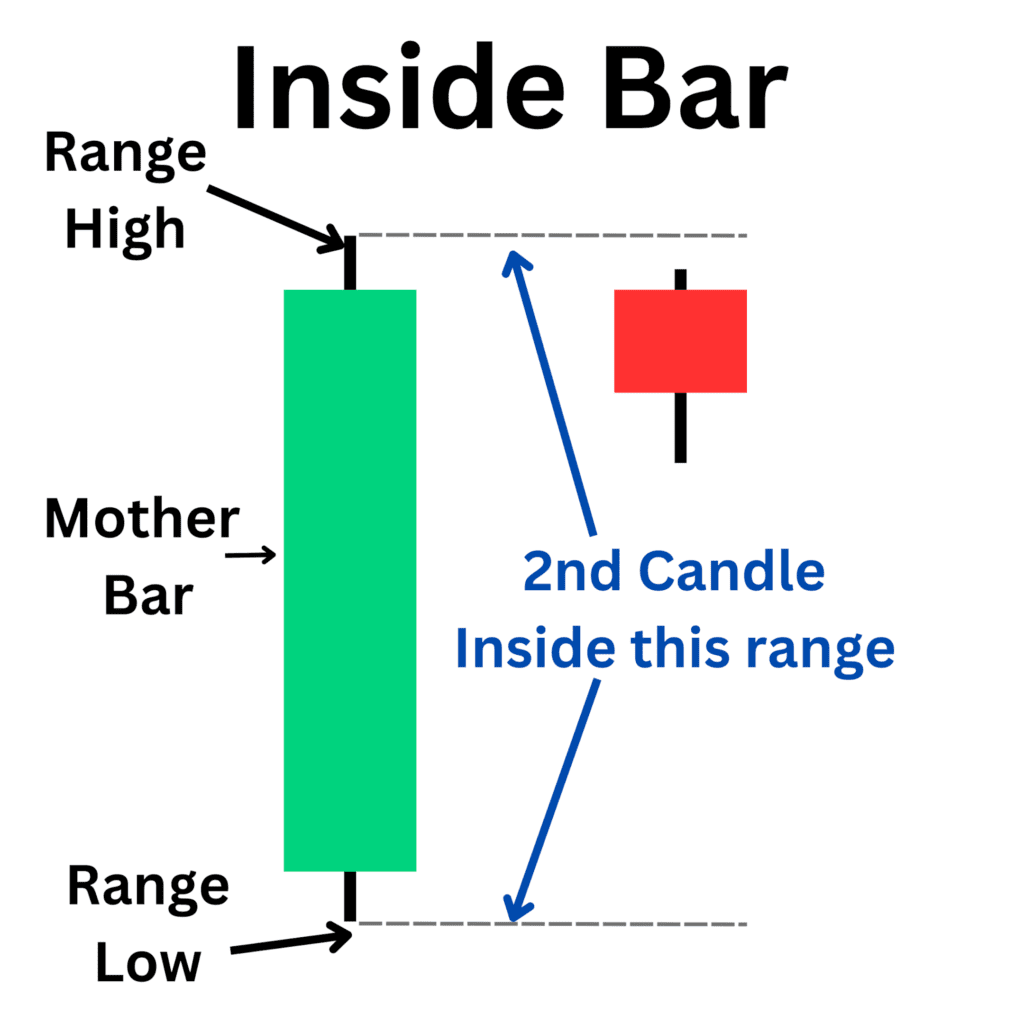

The Inside Bar Candle pattern is a unique and potent market signal that offers a window into upcoming price movements. Characterized by its simplicity, the pattern consists of a two-bar formation where the second bar (the ‘inside bar’) is fully contained within the vertical range of the previous bar (the ‘mother bar’). This pattern is considered a reflection of market consolidation and potential breakout in either direction.

Understanding Inside Bar Candles

- Definition and Structure: An Inside Bar is a candlestick pattern that forms when a candle is completely contained within the range of the previous candle. It signifies a period of consolidation or indecision in the market.

- Significance in Trading: Inside Bars are significant because they indicate a pause in market momentum, often occurring at key decision points in price action, such as resistance or support levels, or before significant news announcements.

The Psychology Behind Inside Bar Candles

- Market Consolidation: The formation of an Inside Bar suggests that neither buyers nor sellers could gain the upper hand, leading to a period of equilibrium where the price moves sideways.

- Anticipation of a Breakout: Traders often see Inside Bars as a precursor to a breakout, as the consolidation phase is typically followed by a sharp move in price once market participants reach a consensus.

Identifying and Trading Inside Bar Candles

- Spotting Inside Bars: Detailed guidelines on how to identify Inside Bar patterns on trading charts, including tips for distinguishing them from other candlestick formations.

- Strategies for Trading Inside Bars: A comprehensive breakdown of strategies for trading Inside Bar patterns, including entry and exit points, stop-loss placement, and considerations for different market conditions.

Inside Bar Candles in Different Time Frames

- Scalping and Day Trading: Discuss how Inside Bar patterns can be used in short-term trading strategies, highlighting the importance of volume and price action analysis.

- Swing Trading and Long-term Investing: Explore the application of Inside Bar patterns in longer time frames, emphasizing the role of broader market trends and fundamental analysis.

Case Studies: Inside Bar Candles in Action

- Real-world Examples: Analyze several case studies where Inside Bar patterns provided clear signals for profitable trades, including both successful trades and missed opportunities for learning.

FAQs

- What does an Inside Bar indicate about market sentiment?

- How can I differentiate a true Inside Bar pattern from market noise?

- Are Inside Bar patterns effective in all market conditions?

- Can Inside Bar patterns be used in conjunction with other technical indicators?

- What are the common mistakes traders make when trading Inside Bars?

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA

– Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 10% off: THANGEA10

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex