In the dynamic world of Forex trading, mastering the art of identifying and utilizing divergence stands as a cornerstone for achieving ultimate trading success. Divergence, a powerful tool in the technical analysis toolkit, offers traders unique insights into market trends and potential reversals. This article dives deep into the concept of divergence in Forex, equipping both novice and seasoned traders with the knowledge to leverage this strategy effectively.

Understanding Divergence in Forex

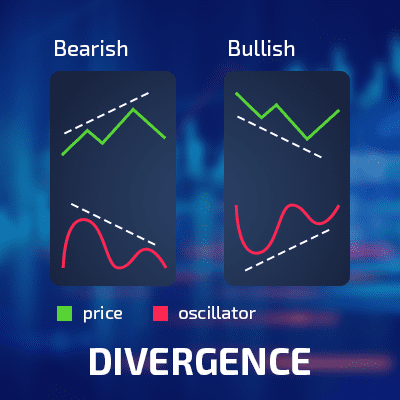

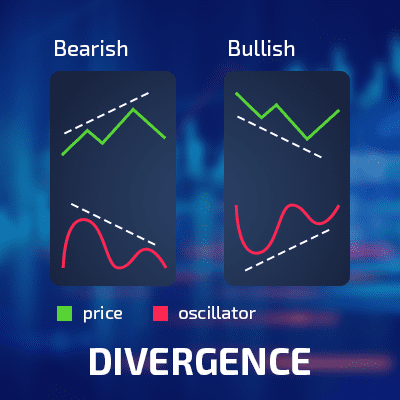

Divergence occurs when the direction of a price trend and the direction of an indicator trend begin to move apart. This discrepancy signals a potential change in price momentum, often heralding a reversal or significant shift in the market. Recognizing divergence patterns can be a game-changer, providing an edge in predicting future market movements.

Types of Divergence

Two primary types of divergence are crucial for traders: bullish and bearish. Bullish divergence forms when prices hit a new low while an indicator starts to climb, suggesting an upcoming upward trend. Conversely, bearish divergence happens when prices peak at new highs but the indicator trends downward, indicating a potential downward trend.

Leveraging Divergence for Trading Decisions

Incorporating divergence into trading strategies requires keen observation and timing. Identifying the early signs of divergence enables traders to position themselves advantageously before a trend reversal. Effective use of stop-loss orders and profit targets based on divergence signals can significantly enhance trading performance.

Key Strategies for Divergence Trading

Divergence trading in the Forex market is a technique used to identify potential reversals in the market by comparing the direction of price action with an indicator. It’s a powerful strategy that, when mastered, can significantly enhance a trader’s ability to make informed trading decisions. Below are key strategies for effectively leveraging divergence in trading.

1. Choose the Right Indicators

The first step in successful divergence trading is selecting appropriate indicators. The Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) are among the most popular and effective indicators for spotting divergence. Each indicator has its strengths, and understanding how to use them can provide valuable signals about potential market reversals.

2. Identify Types of Divergence

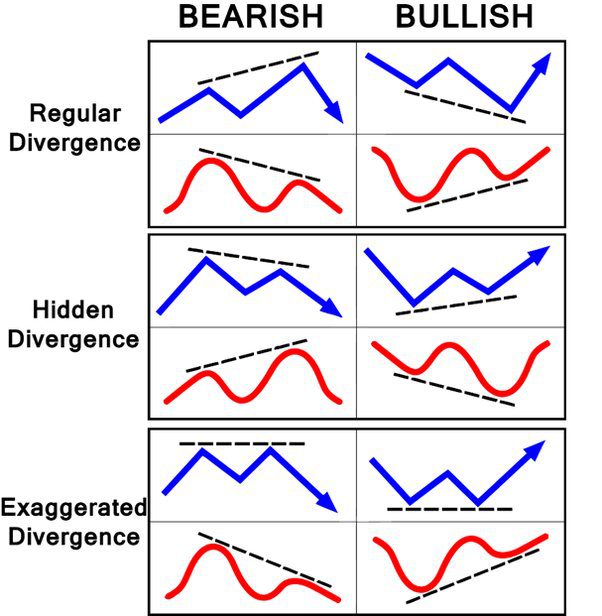

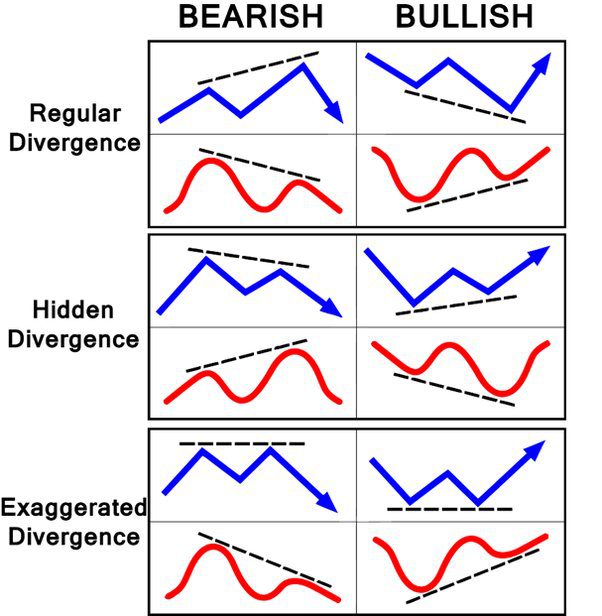

Understanding the types of divergence is crucial for effective trading:

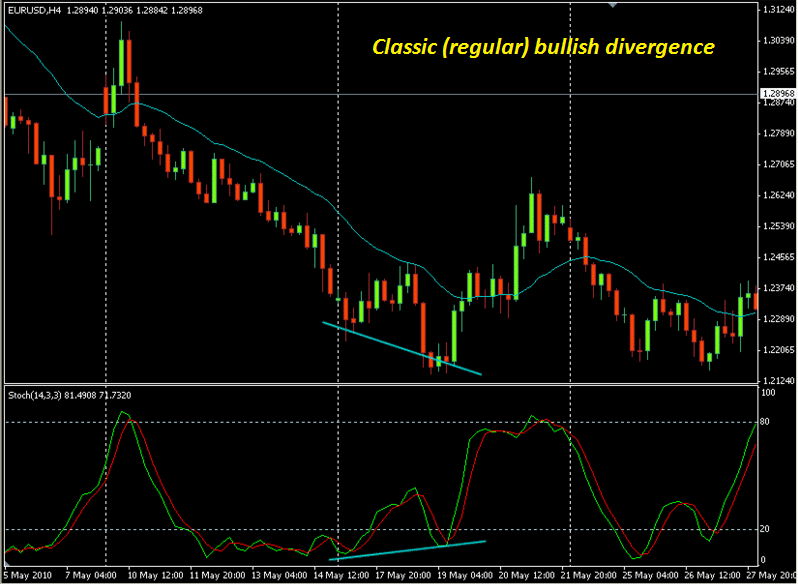

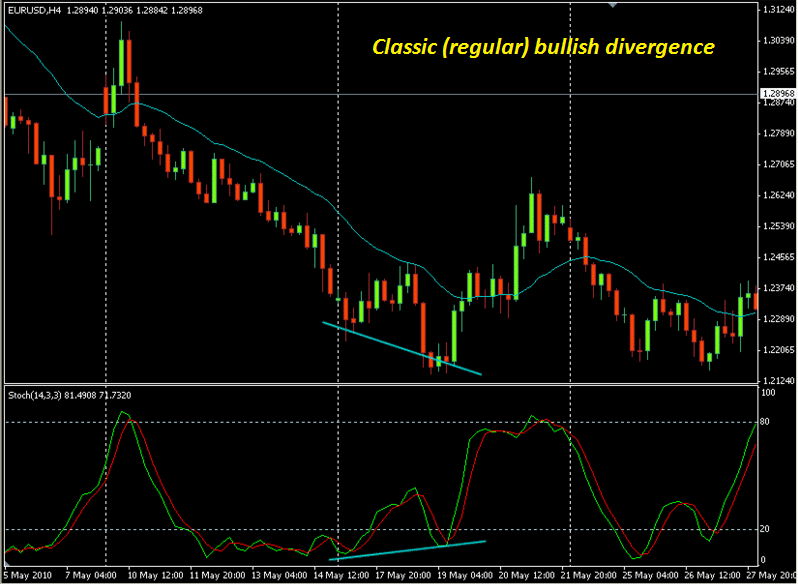

- Regular Divergence: Indicates a potential reversal in the current trend. A bullish divergence occurs when prices create a lower low, but the indicator makes a higher low. Conversely, a bearish divergence happens when prices make a higher high, but the indicator shows a lower high.

- Hidden Divergence: Suggests a continuation of the current trend. In a bullish trend, if the price makes a higher low but the indicator shows a lower low, it indicates the trend will continue upwards. Similarly, in a bearish trend, if the price makes a lower high but the indicator shows a higher high, it suggests the trend will continue downwards.

3. Combine with Other Technical Analysis Tools

Divergence should not be used in isolation. Combining divergence signals with other technical analysis tools, such as trend lines, support and resistance levels, and candlestick patterns, can increase the reliability of the signals and help confirm potential trend reversals or continuations.

4. Wait for Confirmation

One of the critical strategies in divergence in forex is to wait for confirmation before entering a trade. This could be in the form of a candlestick pattern (like a bullish engulfing or bearish shooting star) following the divergence signal or the indicator crossing a significant level. Acting on confirmation reduces the risk of false signals and increases the probability of a successful trade.

5. Set Realistic Stop-Loss and Take-Profit Levels

Proper risk management is essential in divergence in forex. Set stop-loss orders just beyond the recent high or low from where the divergence was spotted to protect against market reversals. Similarly, take-profit levels should be set at realistic points based on the strength of the divergence signal and prevailing market conditions.

6. Practice Patience and Discipline

Divergence trading in forex requires patience and discipline. Not every divergence signal will result in a profitable trade, and it’s crucial to wait for the strongest signals and confirmations before executing trades. Practice on a demo account to refine your divergence trading skills without financial risk.

7. Keep an Eye on Market Conditions

Market conditions can influence the effectiveness of divergence signals. In highly volatile markets, divergence can occur more frequently but with less reliability. Understanding the current market environment and adjusting your trading strategy accordingly can improve the success rate of divergence trading.

Common Pitfalls in Divergence in Forex

While powerful, divergence trading is not without its challenges. False signals can lead to premature entry or exit from trades. Therefore, traders must exercise patience and wait for additional confirmation before acting on divergence signals.

FAQs About Divergence in Forex

- What is divergence in Forex trading?

Divergence refers to the discrepancy between price action and an indicator’s movement, signaling potential market reversals. - How can I identify divergence?

Identifying divergence involves comparing the direction of the price trend with the trend of a chosen indicator, such as the MACD or RSI. - Is divergence trading suitable for beginners?

While it requires practice, beginners can master divergence trading by starting with basic concepts and gradually incorporating more complex strategies.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA

– Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 10% off: THANGEA10

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex