In the dynamic world of trading, mastering the art of chart pattern recognition can significantly elevate your market analysis. Among these patterns, stands out as a powerful indicator of potential market reversals. This article delves into the essence of engulfing candle strategies, equipping traders with the knowledge to anticipate market moves with greater accuracy.

Understanding

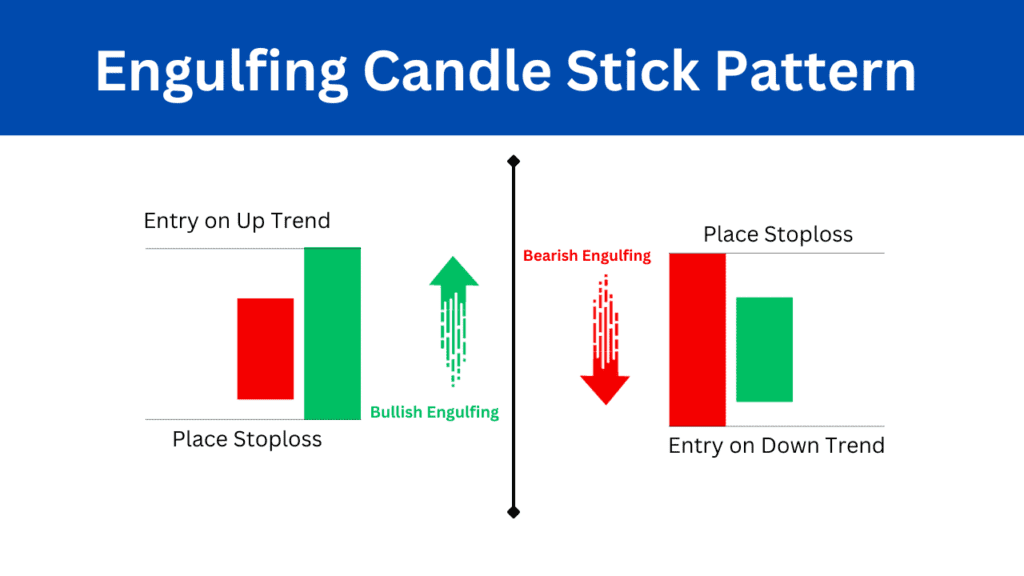

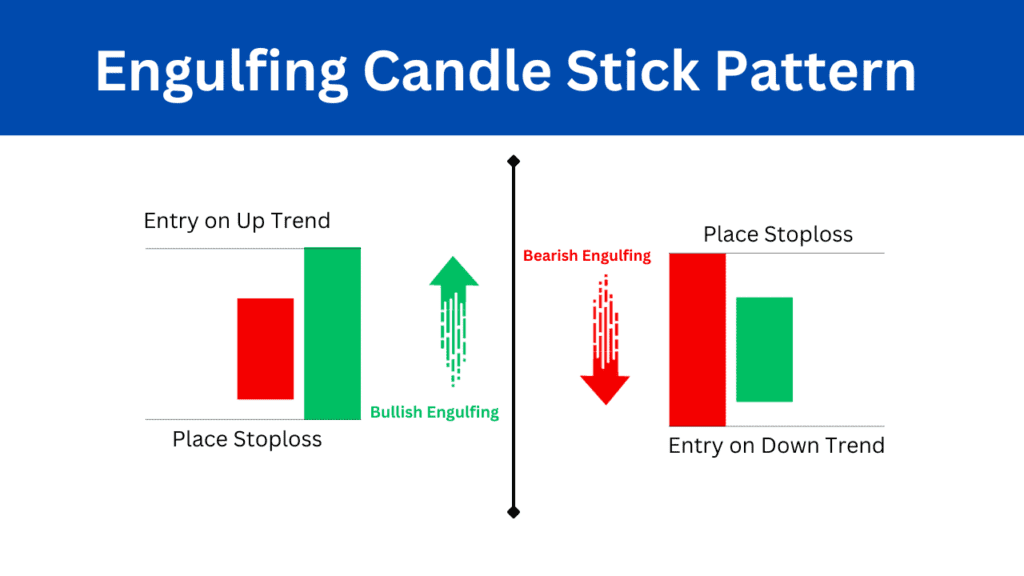

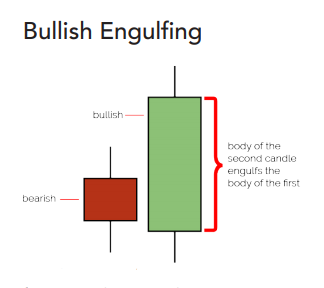

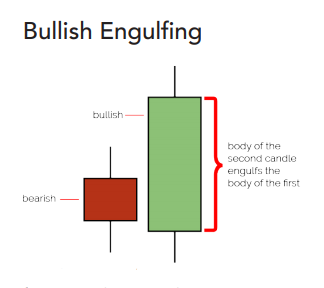

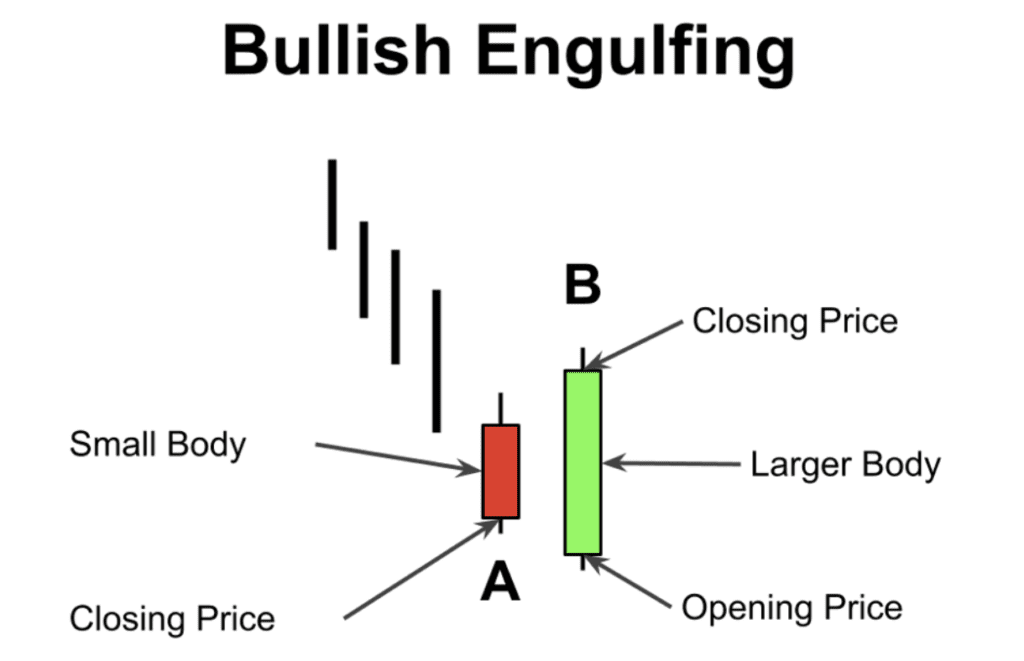

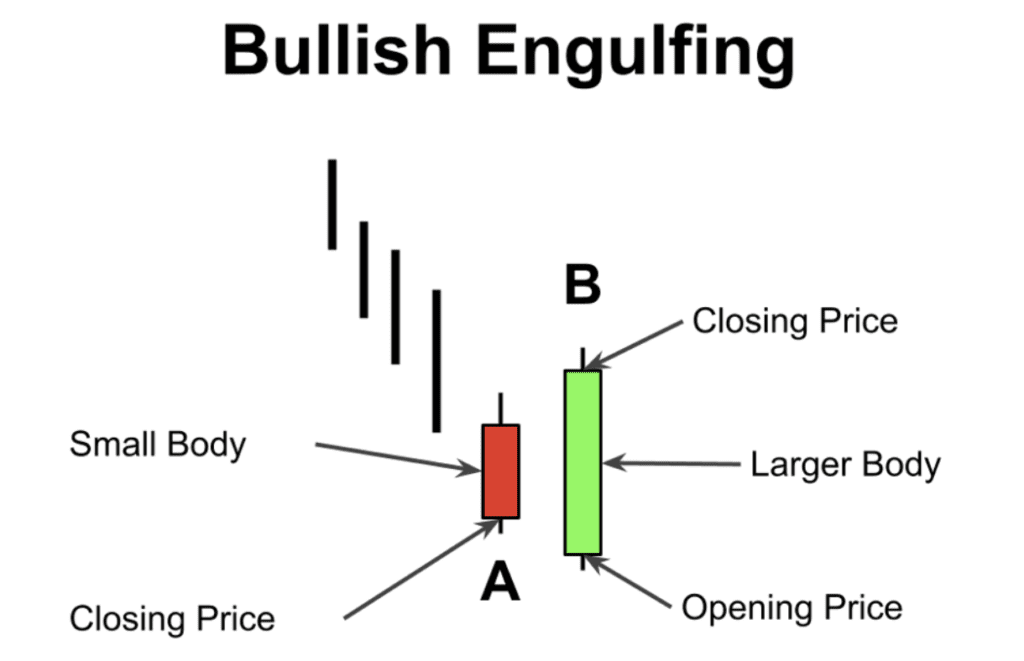

An engulfing candle occurs when a candle on the chart fully envelops the previous candle’s body, indicating a possible shift in market sentiment. This pattern is divided into two main types: the bullish engulfing candle and the bearish engulfing candle. Recognizing these patterns is crucial for traders aiming to capitalize on market momentum shifts.

Bullish Engulfing Candle: A Signal for Buyers

The bullish engulfing candle forms when a large green candle follows a smaller red candle, signaling an upcoming upward movement. This pattern suggests that buyers have overtaken sellers, presenting a potential opportunity for long positions.

Bearish Engulfing Candle: A Warning for Sellers

Conversely, a bearish engulfing candle appears when a large red candle encompasses a smaller green candle, hinting at a forthcoming downward trend. Traders should interpret this as a prompt to consider short positions or exit existing long positions to mitigate risk.

Strategic Application of Engulfing Candles

The strategic application of engulfing candles in trading cannot be overstated. These patterns, when identified correctly, offer a robust framework for making informed decisions in the financial markets. Here’s how traders can effectively apply engulfing candle strategies to enhance their trading outcomes:

1. Recognize the Pattern in the Right Context: The first step is to identify the engulfing candle pattern within the appropriate market context. A bullish engulfing pattern is most significant in a downtrend, indicating potential reversal to an uptrend. Similarly, a bearish engulfing pattern holds more weight during an uptrend, signaling a possible shift to a downtrend. The presence of these patterns at key support or resistance levels can further validate their significance.

2. Combine with Other Technical Indicators: Relying solely on engulfing candles for trading decisions is not advisable. Traders should use other technical indicators to confirm the signal. For instance, the Relative Strength Index (RSI) can indicate whether the asset is overbought or oversold, while moving averages can help identify the overall trend direction. Combining these indicators with engulfing candles increases the reliability of the trading signals.

3. Volume Confirmation: Volume plays a crucial role in confirming the strength of an engulfing candle pattern. An increase in volume during the formation of the engulfing candle compared to the previous candle provides additional confirmation of a potential reversal. High volume suggests strong participation in the price move, increasing the credibility of the pattern.

4. Entry and Exit Points: Once an engulfing candle pattern is confirmed, traders should plan their entry and exit points. For a bullish engulfing pattern, entering a long position at the close of the engulfing candle or at the open of the next candle can be considered. A stop-loss can be placed below the low to limit potential losses. Conversely, for a bearish engulfing pattern, entering a short position with a stop-loss above the high of the engulfing candle is advisable.

5. Risk Management: Effective risk management is essential when trading engulfing candle patterns. Traders should determine their risk tolerance and set stop-loss orders accordingly. It’s important to avoid risking more than a small percentage of the trading capital on a single trade to ensure sustainability in the long term.

6. Patience and Discipline: Patience in waiting for the right patterns to form and discipline in adhering to a predefined trading plan are key to successfully trading engulfing candles. Not every will result in a profitable trade, but by following a disciplined approach, traders can improve their chances of success over time.

FAQs on Engulfing Candle Strategies

- What time frames are best for observing engulfing candles?

Engulfing candles can be identified across various time frames, but they are particularly noteworthy on daily and weekly charts for their reliability in predicting significant market movements. - Can engulfing candles be used in isolation?

While engulfing candles are potent indicators, their predictive accuracy improves when combined with other technical analysis tools, such as moving averages and volume indicators. - How do I differentiate between a true and a false engulfing pattern?

Authentic engulfing patterns are characterized by significant volume increases, suggesting strong market participation. A lack of volume may indicate a weaker signal.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA – Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 5% off: THANGEA5

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex