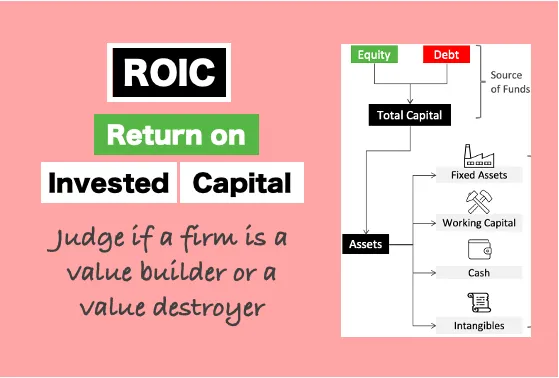

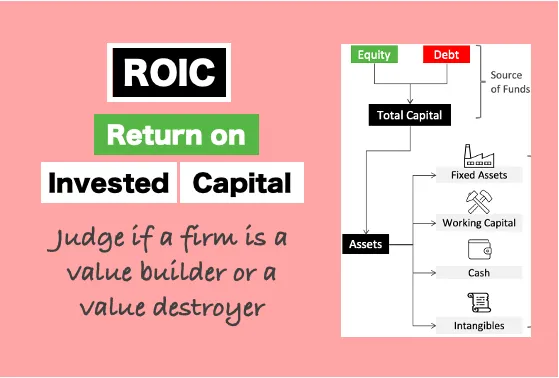

Welcome to the world of savvy investing, where understanding the nuances can significantly impact your financial success. One critical yet often overlooked metric is the Return on Invested Capital (ROIC). This guide will demystify ROIC, showing why it’s a vital tool in assessing a company’s efficiency at allocating the capital under its control to profitable investments.

What is ROIC?

ROIC stands for Return on Invested Capital, a profitability ratio that measures how well a company generates earnings relative to the capital it has invested in its business. It’s a litmus test for the effectiveness of a company’s management in using the funds provided by shareholders and creditors to generate profits.

Why ROIC Matters

Return on Invested Capital (ROIC) is a crucial metric for investors, analysts, and business managers because it offers a clear picture of a company’s efficiency in allocating the capital under its control to profitable projects. Understanding why ROIC matters can illuminate its role as a cornerstone in the assessment of corporate performance and investment potential. Here’s a detailed look at its significance:

Highlights Efficient Capital Use

Measures how well a company generates returns from the capital it has invested in its business operations. A high ROIC indicates that a company is using its capital efficiently to generate profits, while a low ROIC suggests the opposite. This efficiency is paramount in competitive markets where efficient capital allocation can be a significant advantage.

Aids in Investment Decision-Making

For investors, a vital tool in the investment decision-making process. It helps in identifying companies that are good stewards of capital, capable of generating returns above their cost of capital. Investing in companies with a high ROIC can lead to superior returns over time, as these companies are often better positioned to grow and sustain their profit margins.

Facilitates Comparative Analysis

ROIC is especially useful for comparing companies across different industries, where traditional metrics like Net Profit Margin may not provide a fair comparison due to the varying capital intensities of different sectors. Offers a level playing field to assess the profitability and efficiency of companies with diverse business models.

Guides Corporate Strategy and Value Creation

From a managerial perspective, serves as a guide for strategic decision-making regarding investments, acquisitions, and other capital allocation decisions. Companies focusing on projects and acquisitions that yield a high ROIC tend to create more value for shareholders, as they prioritize investments that exceed their cost of capital.

Indicator of Competitive Advantage

A consistently high ROIC can be an indicator of a durable competitive advantage, or moat, around a business. It suggests that the company has a unique product, service, or business model that allows it to generate returns well above its peers. This competitive edge can lead to sustained value creation and is a key factor that long-term investors look for.

Reflects Management Performance

ROIC also serves as a measure of management’s performance in utilizing the company’s capital. It reflects the effectiveness of management’s strategic decisions in terms of investing in growth opportunities, managing debt, and steering the company towards profitable ventures. High ROIC values are often attributed to skilled and prudent management teams.

Drives Shareholder Value

Ultimately, ROIC matters because it is directly linked to shareholder value. Companies that achieve a high ROIC are more likely to generate greater wealth for their shareholders. This is because they can fund their growth from their own earnings without needing to rely heavily on external financing, which can dilute shareholder value or add financial risk.

The Strategic Importance of ROIC

The strategic importance of Return on Invested Capital in the realm of business and investment cannot be overstated. It transcends mere numerical analysis to become a pivotal compass guiding corporate strategy, investment decisions, and ultimately, the creation of shareholder value. Here’s an in-depth look at the strategic significance of ROIC:

Indicator of Efficient Capital Allocation

Effectively measures a company’s proficiency in allocating its capital to projects and investments that yield the highest returns. This efficiency is a cornerstone of strategic planning, as it directly impacts a company’s growth and profitability. Businesses that consistently achieve a high ROIC are seen as adept at identifying and pursuing opportunities that enhance value, making strategic investments that strengthen their market position.

Benchmark for Investment Decisions

From an investor’s perspective, ROIC serves as a critical benchmark for assessing potential investments. It helps in differentiating between companies that are likely to generate sustainable returns above their cost of capital and those that may not. Investing in companies with high ROIC values is often considered a strategy for long-term success, as these firms demonstrate a capability to deploy capital effectively and deliver superior shareholder returns.

Facilitates Value Creation

Directly linked to value creation for shareholders. A business that generates returns on capital that exceed its cost of capital is effectively increasing its intrinsic value. This principle underpins many value investing strategies, where the focus is on identifying companies that not only have high ROIC figures but also have the potential to maintain or improve these levels over time, thereby ensuring ongoing value creation.

Guides Mergers and Acquisitions

In the context of mergers and acquisitions (M&A), ROIC is a vital metric for evaluating the potential success of such endeavors. Companies often pursue acquisitions to boost their overall ROIC, seeking targets that can add value beyond the cost of the acquisition. A disciplined approach to M&A, guided by ROIC considerations, can help companies avoid value-destroying deals and focus on those that are accretive to their financial metrics.

Enhances Competitive Advantage

A high ROIC is often indicative of a sustainable competitive advantage. It suggests that a company has unique strengths—such as superior technology, brand recognition, or customer loyalty—that allow it to earn higher returns on investment than its peers. This competitive moat not only supports long-term profitability but also provides a buffer against market downturns and competitive pressures.

Reflects Management Effectiveness

ROIC also reflects the effectiveness of a company’s management in generating profits from the capital entrusted to them by shareholders and creditors. A high ROIC indicates that management is making wise decisions that contribute to the firm’s success, whereas a declining ROIC could signal poor strategic choices or operational inefficiencies. Thus, ROIC can influence management incentives and compensation, aligning their interests with those of the shareholders.

Drives Strategic Focus

For companies, a focus on improving ROIC can drive strategic decisions, including cost reduction initiatives, pricing strategies, and capital expenditure plans. By targeting improvements in ROIC, companies can prioritize their resources and efforts on the most profitable segments of their operations, leading to better financial discipline and resource allocation.

In essence, the strategic importance of ROIC extends across various dimensions of business operations, from guiding investment decisions to shaping corporate strategies and fostering long-term shareholder value. It’s a multifaceted tool that serves not only as a measure of past performance but also as a roadmap for future growth and profitability.

FAQs

- What makes ROIC different from ROI?

- Is a higher ROIC always better?

- How often should I evaluate a company’s ROIC?

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA

– Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 10% off: THANGEA10

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex