Achieving Mastery Over Your Investments: The Ultimate Guide to Return on Capital Employed (ROCE)

In the dynamic world of finance, mastering the art of Return on Capital Employed (ROCE) stands as a cornerstone for unlocking unparalleled financial freedom. This comprehensive guide delves into the essence of ROCE, offering a strategic blueprint for investors and business owners alike. With expert insights, you’ll discover how to elevate your investment returns and chart a course toward financial independence.

Understanding ROCE: Your Key to Investment Success

In the world of finance and investment, grasping the nuances of key metrics can be the difference between average and exceptional returns. Among these, Return on Capital Employed (ROCE) stands out as a crucial indicator of a company’s profitability and efficiency in using its capital. Here’s why understanding ROCE is vital for anyone looking to enhance their investment portfolio.

ROCE: A Brief Overview

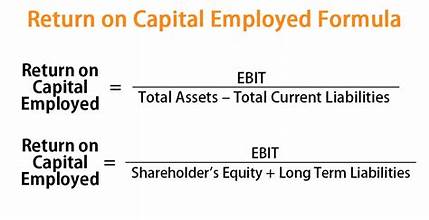

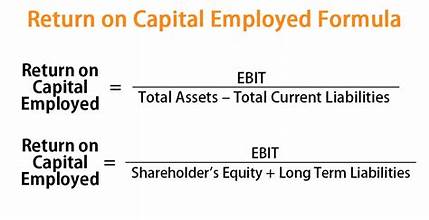

At its core, ROCE measures the returns a company generates from its capital, including both equity and debt. This metric is particularly insightful because it considers not just the equity used by a company (as ROE does) but all the capital employed. The formula to calculate ROCE is:

In essence, ROCE tells investors how effectively a company is turning its capital into profits. A higher ROCE indicates more efficient use of capital, which is a good sign for investors seeking companies with potential for growth and sustainable returns.

Why ROCE Matters

- Investment Decisions: ROCE is a powerful tool for comparing the performance of companies, regardless of their size or industry. By focusing on the efficiency of capital use, investors can identify which companies are truly generating value from their investments.

- Operational Efficiency: A high ROCE suggests that a company is utilizing its resources effectively, leading to better operational efficiency. It’s a sign that the company is managing its assets well and generating significant earnings from its capital base.

- Strategic Planning: For business owners and managers, ROCE is invaluable for strategic planning. It can guide decisions on where to allocate capital for the highest returns, helping to prioritize projects and investments.

Improving Your Investment Strategy

- Portfolio Diversification: Incorporate ROCE into your investment analysis to identify high-performing companies. This can help diversify your portfolio with investments that not only promise high returns but also manage their capital efficiently.

- Risk Assessment: Higher ROCE values can indicate lower financial risk, as these companies are more capable of generating profits from their operations. It allows for a more nuanced risk assessment compared to looking at earnings alone.

- Long-Term Growth: Companies with consistently high ROCE are often well-positioned for sustainable growth. Investing in these companies can be a strategy for long-term wealth accumulation.

Strategies for Elevating ROCE:

Elevating your company’s Return on Capital Employed (ROCE) is essential for enhancing profitability, attracting investors, and achieving competitive advantage. Here are strategic approaches to improve your ROCE, ensuring your business not only grows but thrives in its financial endeavors.

Optimize Capital Allocation

- Invest in High-Return Projects: Prioritize projects and investments with the highest potential returns relative to their risk. Use ROCE as a key metric for project evaluation to ensure capital is directed to the most lucrative opportunities.

- Rationalize Capital Expenditure: Regularly review and rationalize your capital expenditure (CapEx). Cut down on or reallocate funds from underperforming assets to areas with higher return potential. This involves selling off non-core or inefficient assets and reallocating resources to more profitable segments.

Enhance Operational Efficiency

- Reduce Operating Costs: Identify and eliminate inefficiencies in your operations to reduce costs. Streamlining processes, adopting new technologies, and optimizing supply chains can lead to significant cost savings, thus improving ROCE.

- Improve Asset Utilization: Maximize the use of existing assets to increase output without proportionately increasing capital employed. This can involve optimizing production schedules, reducing downtime, and enhancing maintenance practices.

Boost Profit Margins

- Increase Productivity: Focus on productivity enhancements across your operations. Implement lean manufacturing principles, invest in employee training, and adopt automation where feasible to improve efficiency and output.

- Enhance Pricing Strategies: Review pricing strategies to ensure they reflect the value provided to customers. Consider premium pricing for high-value offerings and adjust prices based on market demand and competition to improve margins.

Manage Debt and Equity Efficiently

- Optimize Capital Structure: Find the right balance between debt and equity to finance your business. A more efficient capital structure can reduce costs of capital, thus improving ROCE. Be cautious with leveraging; excessive debt can increase risk.

- Return Excess Capital to Shareholders: If there are no high-return investments available, consider returning excess capital to shareholders through dividends or share buybacks. This can improve ROCE by reducing the capital base while rewarding investors.

Leverage Strategic Partnerships and Acquisitions

- Pursue Strategic Partnerships: Form strategic partnerships to access new markets, technologies, or capabilities without significantly increasing capital employed. This can enhance ROCE by leveraging external resources and expertise.

- Consider Acquisitions: Acquire businesses that can add significant value to your operations and have high ROCE. The right acquisitions can provide instant access to new markets, customers, and technologies, boosting overall ROCE.

FAQs: Mastering ROCE for Financial Freedom

Dive into our expertly curated FAQs, where we unravel the complexities. From beginners to seasoned investors, these insights demystify ROCE, offering clarity and confidence in your financial decisions.

For my contact:

You should first send me a friend request on MQL5, this will make it easier for me to connect and best support you with technical issues: https://www.mql5.com/en/users/tuanthang

– Join our Telegram Channel for new updating: https://t.me/forexeatradingchannel

– Recommended ECN Broker for EA – Tickmill: https://bit.ly/AdvancedTickmill

– Recommended Cent/Micro Account Broker for EA – Roboforex: https://bit.ly/AdvancedRoboforex

– To use an EA you need a VPS. Recommended VPS for EA

– Chocoping: https://bit.ly/AdvancedVPS. When you open the account type in the discount code to get 10% off: THANGEA10

– If you want to ask me any question or join our private group chat for traders. Please contact me through Telegram: https://t.me/thangforex